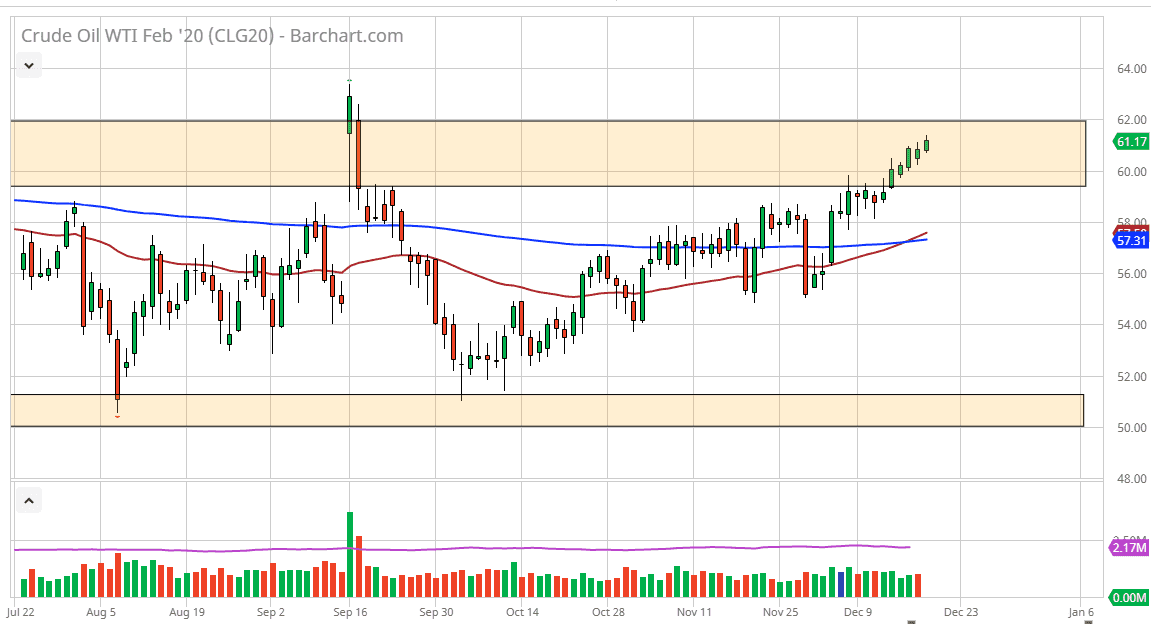

The West Texas Intermediate Crude Oil market has rallied again during the trading session on Thursday, as we continue to see the market grinding higher. The $62 level is the next little level that we will need to overcome, but I believe that it’s very likely to see the $62.50 level be important as well, if not the short term final destination.

Over the last several days we have seen green candlesticks, and that shows that we are likely to continue going higher, but obviously there is a significant amount of resistance based upon the most recent high. Beyond that we will also have inventory numbers to think about, as well as the OPEC production cuts. The production cuts will of course continue to put a bit of bullish pressure in this market, but the market has gotten a bit ahead of itself. Beyond that we have to worry about global demand and that of course is an issue in general. The $60 level underneath will continue to be important as well, as it was significant resistance. It should now be an area where buyers will come back in trying to pick up a bit of value, as the market has changed its tune.

The 50 day EMA has broken above the 200 day EMA, forming the so-called “golden cross”, which of course is a very bullish sign. At this point, it’s very likely that the market will continue to see noisy momentum, but I think pullbacks will be the best way to approach this market. Having said all of that, if we were to break down below the $58 level then we are likely to return to the bottom of the larger consolidation area, opening up the possibility of a move to the $52 level. Keep in mind that this time year markets do tend to be a little bit thin, as the majority of market participants will be looking for an opportunity to enjoy their holidays instead of putting money to work. That being said, it can make moves rather violent and erratic all of the sudden. Because of this, it’s very important to keep your position size somewhat small this time of year, as the volatility can be an absolute killer if you aren’t careful. In fact, most professional traders are on the sidelines until after the first of the year, but there are opportunities.