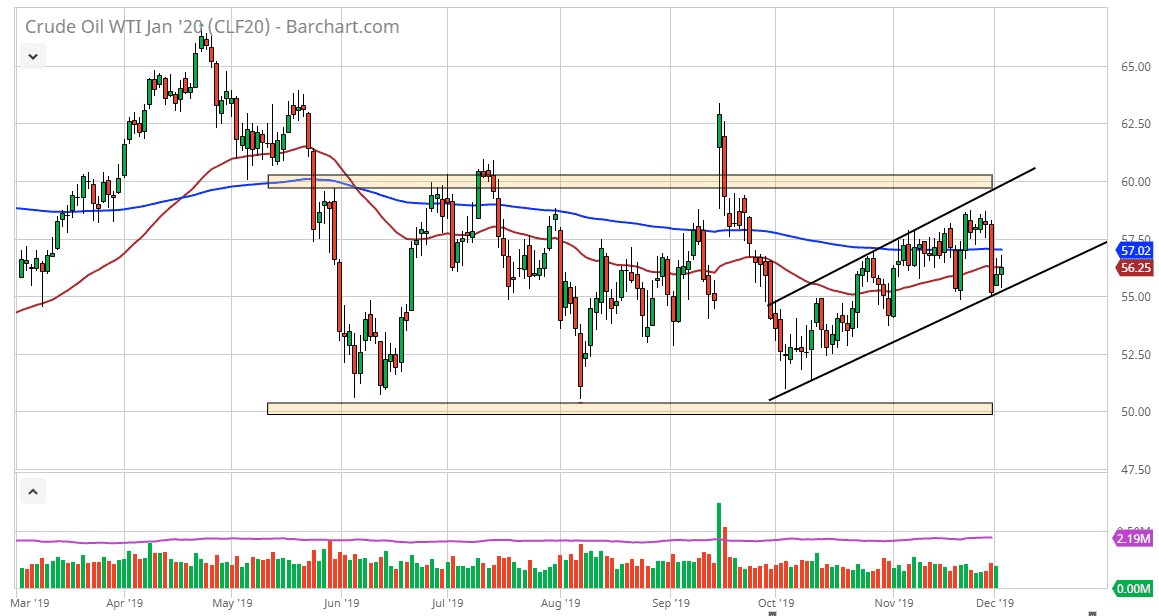

The West Texas Intermediate Crude Oil market went back and forth during the trading session on Tuesday, as we hang around the 50 day EMA. We are also sitting just above the uptrend line of the overall channel, and of course one thing that should be pointed out is that the Friday candlestick that looks so horrific was done on low volume. With that being the case, we should also pay attention to the fact that the OPEC meeting is this week, and headlines will of course continue to move this market based upon rumors, and of course actual announcements.

We are sitting just above the candlestick from the previous session, and it’s very likely that the market will continue to look at this general vicinity as “fair value” in this market. The market continues to see a lot of back-and-forth trading, but quite frankly without knowing what OPEC is going to do, anything that you place as far as a bet right now is going to be simply guessing. The various OPEC oil ministers will suggest whether or not there is going to be a continuation of the overall production cuts, and then perhaps an extension or perhaps even addition of those cards.

At this point, there are conflicting reports as to whether or not they will do anything, so that of course continues to be a problem as far as clarity is concerned. All things being equal, it looks as if we should continue to grind a little bit higher but I recognize that the keyword here is probably going to be “grind”, as beyond the OPEC situation, we have the question as to whether or not global growth will demand more crude oil. With the US/China trade war going on, it will continue to cause a lot of choppiness in this market as well. If we were to break down below the $55 level that would be a very negative sign and could send this market looking towards the $52.50 level. Alternately, if we were to break above the 200 day EMA, it’s likely that the market then goes looking towards the $59 level. Oil continues to be very difficult to trade and it’s very likely that it will continue to be short-term day trading that we are doing more than anything else. Because of this, I would not put too much money in one direction or the other.