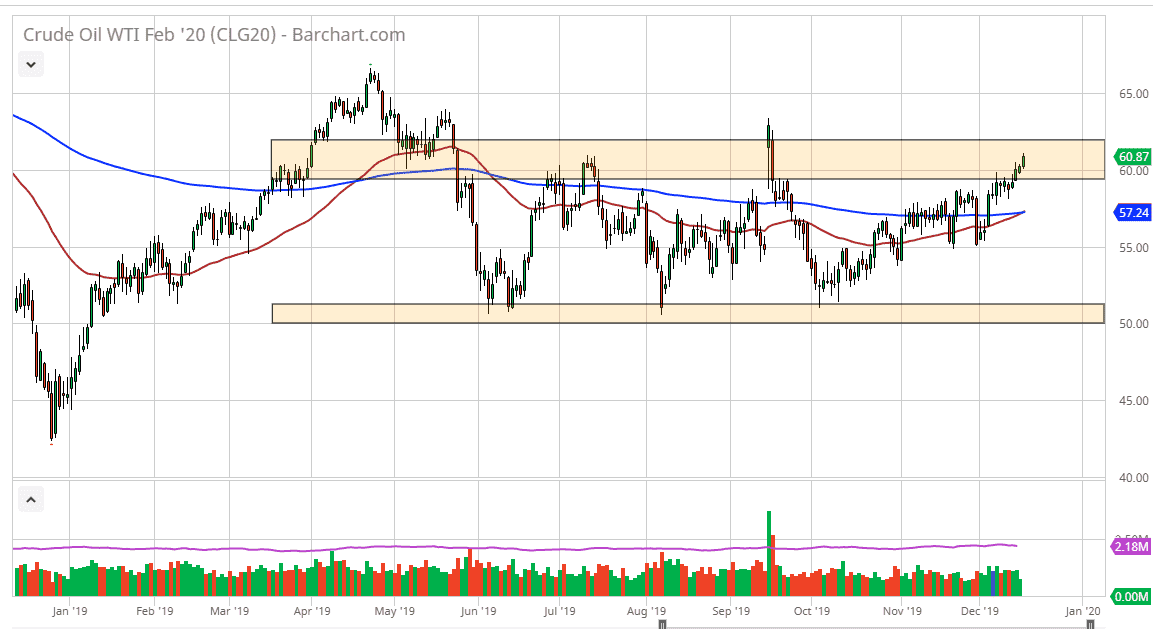

The West Texas Intermediate Crude Oil market has rallied again during the trading session on Tuesday, as we are above the $60 level. Now it looks as if we will make a move towards the $62.50 level which I see as the top of an overall “range of resistance” that will be difficult to break through. I think at this point it’s only a matter of time before we pull back in order find a bit of value, and if we can pull back from here it’s likely that value hunters will continue to come into this market and push to the upside.

The West Texas Intermediate Crude Oil market continues to look bullish, but at this point the 50 day EMA is likely to break above the 200 day EMA forming the “golden cross” which of course has a lot of influence on longer-term traders at times. The OPEC production cuts of course will come into play here, but I think ultimately, we have to worry about demand globally as well, so I think there will be a lot of back and forth here. Beyond that, there is a little bit of a push higher due to the US/China “Phase 1 deal” that is in theory agreed to between the Americans and the Chinese. It in theory, that should push this market higher due to more demand coming online. That being said, I do think that we are bit overextended at this point and I’m looking for a bit of value to take advantage of.

Underneath at the $59 level I see a ton of support, and therefore I would love to see a little bit of a pullback towards that area that I can take advantage of. Ultimately, if we were to break above the $62.50 level, then the market is likely to go looking towards the $65 level after that. Crude oil of course is highly sensitive to the economic conditions around the world, and therefore people start to think about the fact that things have slowed down and it is weighing upon this market a bit. Inventory figures come out in a couple of days, and that could give us the slight pullback that were looking forward to taking advantage of value. Ultimately, we are stretching to the top of a range, and if we can break above the $62.50 level, the market likely continue to go much higher.