Despite the decline of the US dollar against most other major currencies during the past week's trading, the USD/JPY pair has maintained its upward momentum and the decline has been slight to the 109.38 level after the gains reaching the 109.68 resistance, and the pair was trading in a limited range in light of the holidays and lack of liquidity, as investors refrain from taking new positions until the financial markets return to their full momentum work. In general, easing fears of the US-China trade dispute after the two countries agreed on the Phase 1 of a trade deal, reduced the attractiveness of safe assets, including the Japanese yen.

After the two countries reached an agreement in principle, a Phase 1 of the trade agreement was scheduled to be signed sometime in January 2020. Investors were optimistic that China had been in close contact with the United States regarding the signing of the initial trade agreement. This came after US President Donald Trump pointed to coordination of a signing ceremony with Chinese leader Xi Jinping on the Phase 1 commercial deal.

On the economic front, the Ministry of Economy, Trade and Industry said in a preliminary reading that industrial production in Japan decreased - 0.9 percent on a monthly basis in November. This exceeded expectations by a decrease of - 1.1 percent after a decline - 4.5 percent in October. Japan's unemployment rate was 2.2% in November, below expectations of 2.4%, which is unchanged from the October reading.

Japan's retail sales increased to seasonally adjusted 4.5 percent in November, below expectations of an increase of 5.0% after falling by -14.2% in October. The data results also showed that overall consumer prices in Tokyo increased by 0.9 percent year on year in December. It was in line with expectations and had risen from 0.8% in November.

The core CPI, which excludes volatile food prices, rose by 0.8 percent annually - exceeding expectations for 0.6 percent increase, which was unchanged from the previous month.

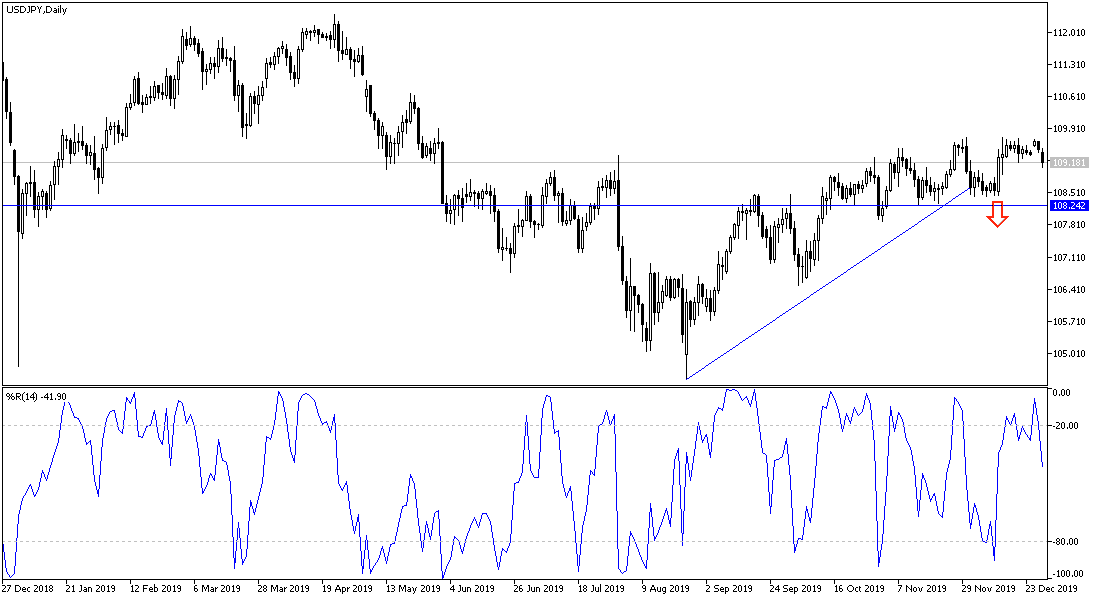

According to the technical analysis of the pair: There is no significant change in my technical view of the USD/JPY pair, as bulls are trying to breach the 110.00 psychological resistance of to confirm the reversal of the trend to the upside. On the other hand, stability below 109.00 support is a strong threat to these expectations. In general I still prefer buying the pair from every downtrend.

For today's economic notebook data: Focus will be on US data with the Chicago PMI and Pending Home Sales datd.