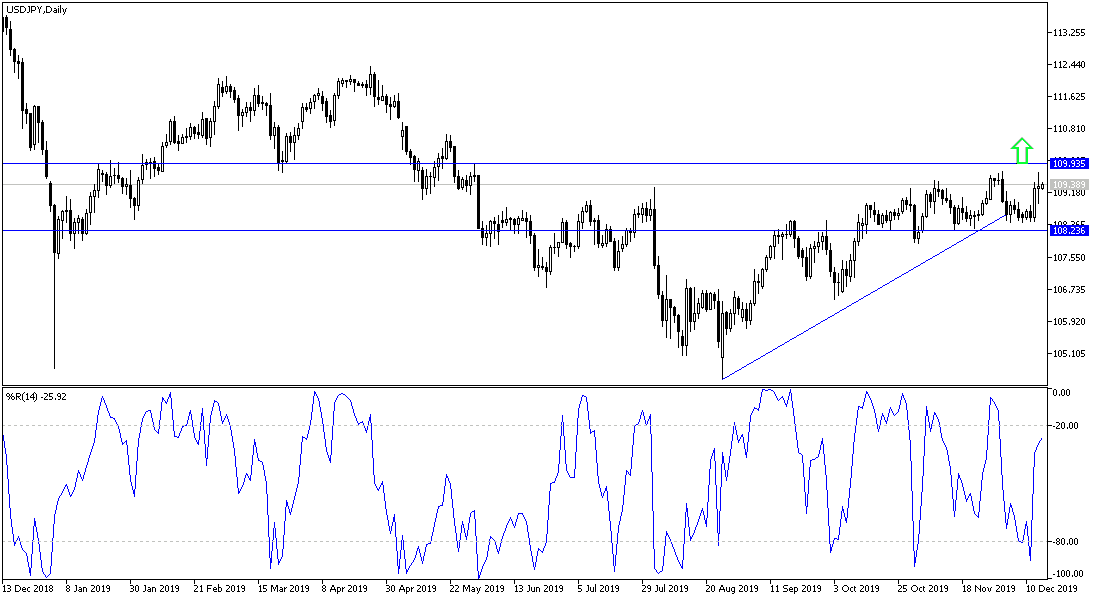

Investor confidence increased after the announcement of a trade agreement between the United States and China, which will avoid imposing more American tariffs on Chinese imports, which was scheduled for December 15. Thus, the risk appetite increased and, accordingly, the price of the USD/JPY pair surged to the 109.70 resistance level before closing last week's trading around the 109.35 level. We expect bulls to push the pair to the 110.00 psychological resistance to confirm the strength of the last correction.

US Trade Representative Robert Lightizer said that under Friday's agreement, China has pledged to purchase $40 billion in US agricultural products over the next two years. He said China also promised to end its old practice of pressuring companies to deliver their technology as a condition for accessing Chinese markets.

For its part, China has expressed cautious optimism about the Phase 1 trade agreement, which calls for a temporary halt to a trade war that they blame the United States blames for. Chinese experts and media have joined government officials in saying the deal will reduce corporate uncertainty, at least in the short term. They remained cautious, saying that the two sides must be willing to make concessions to resolve the fundamental differences between them and end the trade war that threatens the global economy as a whole.

The two countries announced the "Phase 1" agreement last Friday, according to which, the United States will reduce tariffs, and China will buy more American agricultural products. Chinese officials said the nine-chapter text, which includes intellectual property, technology transfer, financial services and dispute settlement, should be subject to legal review and translation before it is formally signed.

At a press conference in Beijing, officials said that the United States will start phasing out tariffs on Chinese imports, rather than continuing to raise them. Officials said the deal was announced just two days before new US tariffs were imposed. China will make similar tariff cuts, but they did not give any details.

Investors will be watching reactions from both sides this week, as well as receiving many important economic issues from all over the world ahead of the closing of financial centers for the year-end and New Year holidays.

According to the technical analysis of the pair: On the daily chart, there is a return of the USD/JPY pair in the range of a bullish channel, and the bullish reversal will be strengthened if the pair breaks the 110.00 psychological resistance. On the downside, the 108.00 support will remain the key to the downside force's return again. We still prefer to buy the pair from every low level.

As for the economic calendar data: The yen will react to the release of the Chinese economic data, then the US data; the purchasing managers’ index for the industrial and services sectors. The return of global trade and geopolitical tensions will again be in favor of the Japanese yen's gains.