The US dollar has rallied significantly during the trading session on Thursday as some traders will have come back from the Christmas holiday to start placing orders again. This is a market that should show plenty of bullish pressure over the longer term, but in the end it’s a matter of whether or not we can break above the significant ¥110 level. That being the case, the market is likely to see a break above there as a gateway to reach towards the ¥111 level next.

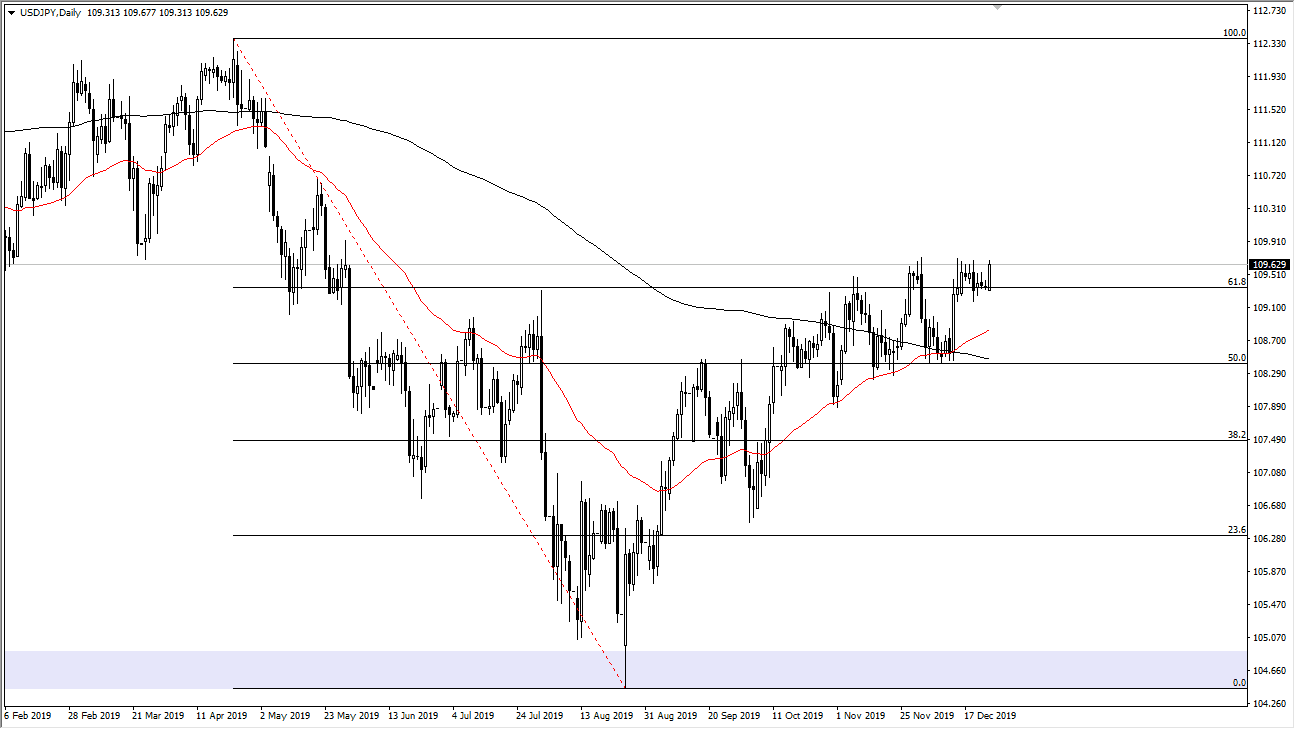

Short-term pullback should be buying opportunities as I believe the ¥109 level underneath as massive support and as we recently had the “golden cross” form, when the 50 day EMA has broken above the 200 day EMA. Ultimately, this is a market that has quite a bit of movement underneath that that should continue to push to the upside. At this point, it’s not until we break down below the 200 day EMA which is pictured in black on the chart that I would consider selling this market. At this point, the market breaking above the ¥110 level could probably reach towards the gap above at the ¥111 level, where I think that is an area where we could see some issues. Otherwise, if we can break through there then it’s a move towards the 100% Fibonacci retracement level next, the ¥112.50 level.

At this point, you should keep in mind that the market is highly sensitive to risk appetite, so overall as markets go higher, so should this pair. Once we break above the ¥110 level, it should be more or less like a beach ball being released from underneath water, meaning that it will pop higher rather quickly once this massive resistance barrier gets busted through. Alternately, if we break down below the 50 day EMA, it will then test the 200 day EMA, which giving way would show that the complete move higher has been wiped out and we are going to go much lower. At that point I would anticipate that this market drops rather significantly. All things being equal though, I definitely prefer the upside as we have been so tenacious as far as this buying pressure is concerned. I don’t know when we break out, but I suspect by this time next month we will have done it, but in the meantime the holiday will keep markets somewhat thin.