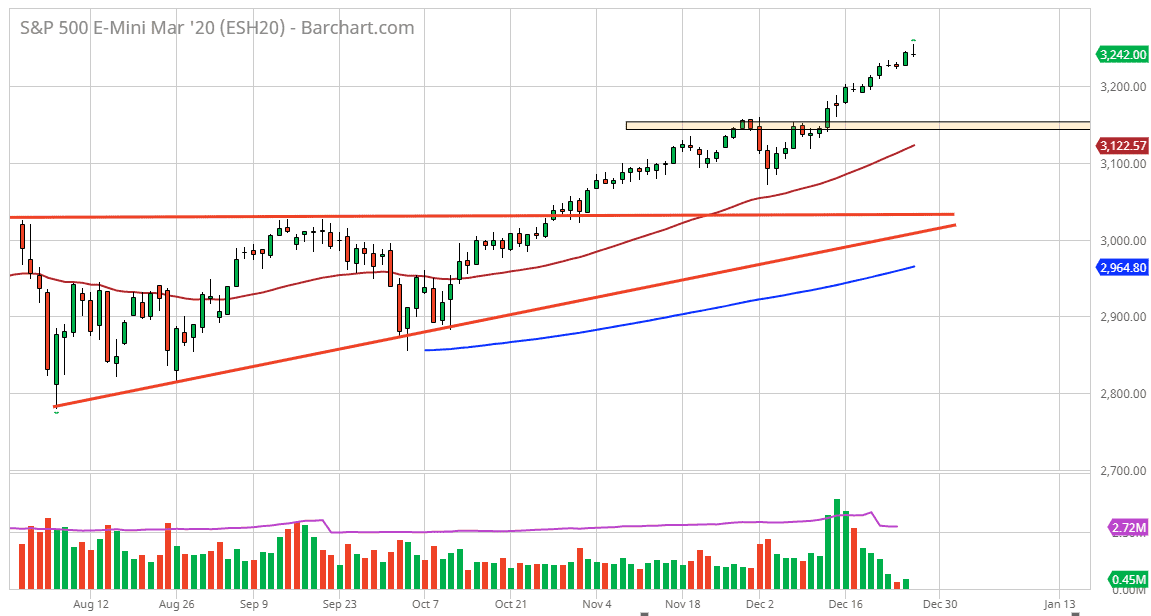

The S&P 500 rallied a bit during the trading session on Friday, but then gave back the gains as we have gotten a bit of an overextension. By forming a shooting star, it shows that the market is starting to run out of momentum and it’s likely that we will continue to see a bit of a pullback. The 3200 level is an area that I think we should be looking at as potential support due to the fact that it is a psychologically important figure. Beyond that, the market has broken above the 3150 level which was previous resistance and as we head towards the New Year’s Day celebrations, a lot of money managers will be looking to take advantage of the ability to close out positions for profit, showing clients solid gains for the year. Ultimately though, think that short-term pullback will be a nice buying opportunity if we get low enough. Ultimately, the market looks very likely that we will continue to see a lot of bullish pressure longer-term, but we need to get through a lot of profit-taking first.

The 50 day EMA underneath should be a massive support level, and I think that market participants will be looking for selling opportunities anytime soon, unless of course we get some type of major breakdown between the US and China, which lately has been relatively strong. All things being equal, I like the idea of finding plenty of value underneath but will probably have to wait a couple of weeks to finally get through a lot of noise. Keep in mind that January 6 is probably when the full volume comes back, because we have not only the New Year’s Day celebrations, but we also have the employment number shortly after that. With that being the case it’s very likely that a lot of people will be on the sidelines, waiting to see where we go longer term. Ultimately, I do believe that eventually the buyers will come into play, so look for signs of a bounce in order to take advantage of. Although I recognize that we are more likely to drop than not over the next couple of days, I have no interest in trying to short this market as it is so strong. Value is the thing you should be looking for, as most professional traders will be doing the same thing.