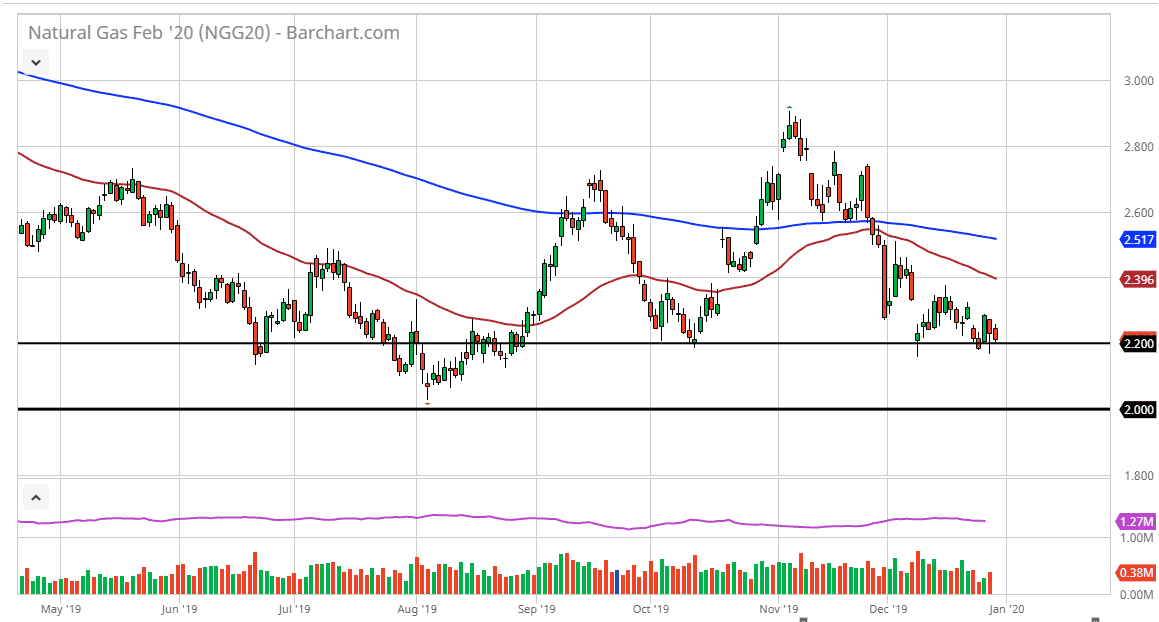

Natural gas markets fell a bit during the trading session on Monday, to test the psychologically and structurally important $2.20 level, which is offered massive support more than once. I think that this begins a significant support “zone” extending down to the $2.00 level, which obviously has a lot of psychological importance attached to it. I don’t necessarily think that we break down below there, because if we do it will put a lot of natural gas drillers out of business, and at this point I think many of them are looking at cutting back production given enough time

This is a market that I think continues to see a lot of volatility in it, but at this point we are getting towards extreme lows, and this is the time year that you will typically see more buyers come in. If we get some type of cold snap in the United States that could be the main driver of prices to the upside, but it will more than likely be short-lived as we continue to see a major problem when it comes to oversupply in the markets. The Americans drilled 17% more this year than they did last year, and so far, winter hasn’t exactly been freezing cold in the United States, causing a bit of a “double whammy” for the industry.

All things being equal, I believe that a bounce could be seen and send this market towards the $2.40 level at the first sign of extraordinarily cold temperatures, where it will run into a certain amount of technical resistance. If we can break above the 50 day EMA then it’s likely that the 200 day EMA at the $2.50 level would be a major resistance barrier as well. The one thing that this winter has shown us is that the rallies are yet to be proven and therefore fading those short-term bursts is probably the way going forward. I think there is a ton of support all the way from $2.20 down to the $2.00 level, so any down at this point is probably going to be sluggish to say the least. Ultimately, the next couple of days will be very thin as far as volume is concerned, so the next couple of days will probably be difficult to trade to begin with. We are at extreme lows of the range, so a bounce is an out of the question.