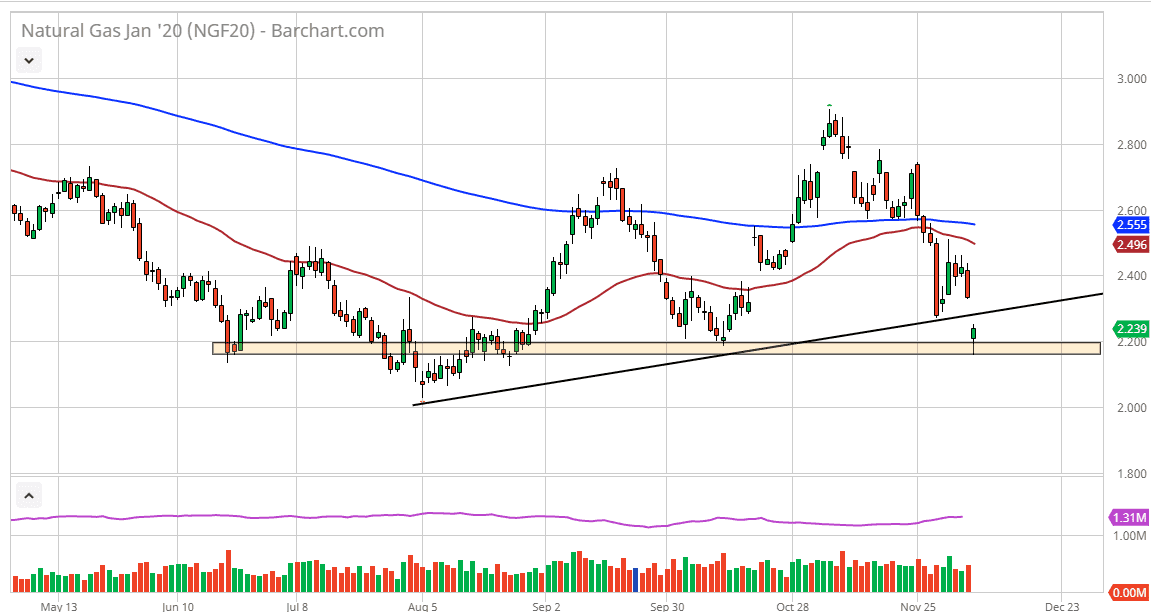

Natural gas markets gapped lowered to kick off this session on Monday as some whether reports are calling for warmer temperatures in the month of December. This of course is kryptonite when it comes to pricing natural gas and has caused a rush of selling at the beginning. At this point in time, the looks very likely that we are going to try to bounce and fill that gap, but this has been a huge blow to the buyers when it comes to natural gas.

The candlestick has turned around to form a bit of a hammer and that of course is a bullish sign. It looks as if the $2.20 level did attract some buying pressure, which makes sense considering that when you look to the left it’s likely that there will continue to be a lot of buyers in that region. If we were to break down below the bottom of the candlestick for the trading session on Monday, that could send this market down to the $2.00 level which is a large, round, psychologically significant figure. That’s an area that will attract a lot of attention as well, meaning that if we were to break down below the $2.00 level it will attract a lot of headlines in the financial markets.

In the short term, I anticipate that we will probably fill the gap above, perhaps looking towards the $2.32 level. If we can break that, then it would be a very bullish sign. That being said though, we need cold weather make that happen and as whether reports are starting to swing the other way, that will continue to cause major issues for this market. Remember, the Americans drilled 17% more this past year than they did the one before, meaning that we desperately need cold weather to drive pricing higher. With all of that being said, this is the time a year you will get that eventually, and it could send this market well above the $3.00 level. This typically happens at least once during the winter, and I think because of that you simply need to see an impulsive candlestick to get involved. That being said, it’s been very difficult for this winter so far, but that could change rather rapidly on the right whether report that comes out. Ultimately, this is a market that continues to be very reactive, so it’s best to play natural gas with small positions.