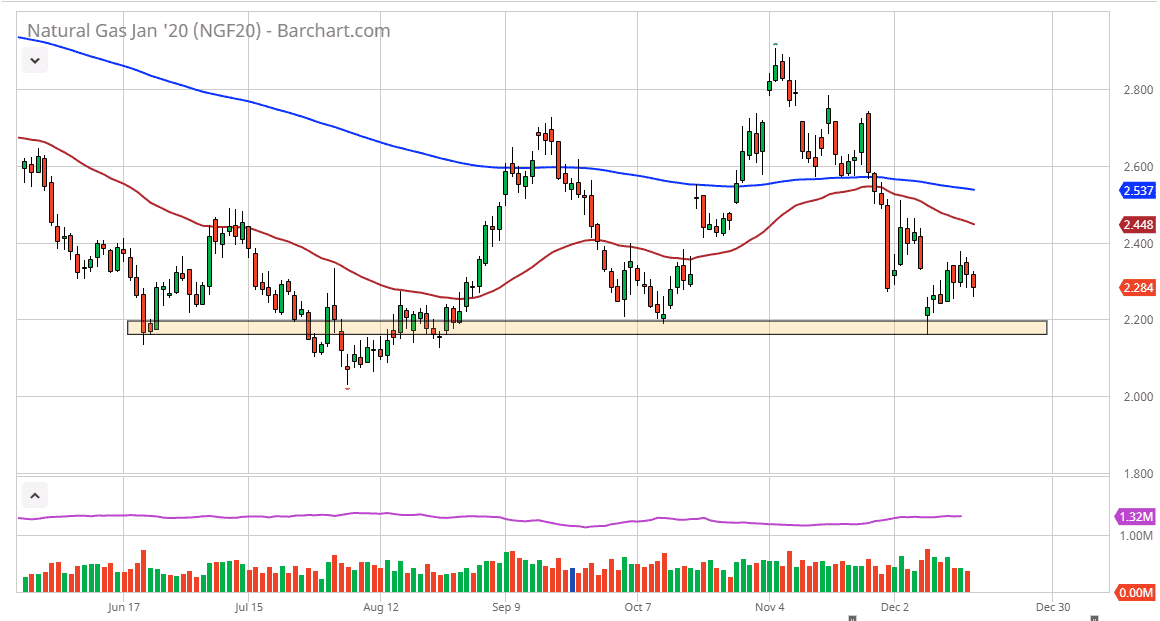

Natural gas markets fell a bit during the trading session again during the day on Wednesday, but as you can see, we simply have no momentum to the upside. To the downside, the $2.20 level is offering support, and therefore I believe that it is the short term bottom in the market. The closer we get to that area, the more likely a.m. to try to buy some type of bounce. Having said that, natural gas has been a complete disaster this winter as the suppliers will tell you. Ultimately, this is a market that continues to see a massive oversupply as Americans drilled 17% more this past year than they did the previous year.

Looking at this chart, if we can break above the $2.40 level, then it’s likely that the market will continue to go higher and $0.10 increments. I believe this point this is a market that should continue to see a lot of back-and-forth trading, but we are so low when it comes to the pricing of natural gas it’s difficult to get overly bearish at this point. Overall, this is a market that I think does need to find some type of bottom relatively soon, as this has been such a disaster for the natural gas industry. If we can break above the $2.40 level, then it’s likely that we continue to go higher but given enough time it’s likely that it could open up the door to the $3.00 level but overall, it’s a difficult market right now.

The cold snaps that tend to come during the wintertime in the United States will drive massive spike higher, but we just have not had enough destruction of the supply to get there. If we don’t in the next few weeks, 2020 will be a horrible year for this market as well, because quite frankly if we can’t choose through supply during high demand season, it will be absolutely horrific when warmer temperatures come into the United States. Quite frankly, this market desperately needs to see some type of spike to get back to equilibrium. Right now, it doesn’t look very likely that we have that coming, but I don’t necessarily want to short this market either because I recognize that the $2.20 level is massive support. If we were to break down below there, then it could open up the door to the $2.00 level.