The trade agreement between the two largest economies in the world and the end of the British elections in favor of the Conservative victory, were the most supportive factors for investor’s confidence, and consequently, weak demand for safe havens, the most important of which was the gold, therefore, it dropped during last Friday’s session to the $1462 support before returning to the $1478 resistance, and closed trading last week around the $1457 level. Announcing the details of the recent trade agreement between the United States of America and China, along with the clarity of the Conservatives' view to speed up the Brexit process, might cause the yellow metal to lose the momentum to continue its gains, and push it back to the downward correction again.

On the central banks ’policy level for this week, gold will interact with the announcement of both the Bank of England and the Bank of Japan on their monetary policy, along with the announcement of economic growth figures from the US.

And after the recent trade agreement between the two largest economies in the world, there seems to be a sense that conditions for the Chinese economy are stabilizing. This should be reflected in the Industrial Production and Retail Sales reports for November that will be announced today. Industrial output growth slowed year on year to less than 5% for the first time since 2002 in recent months, and reached 4.7% in October. At 7.2% year on year, retail sales for October were at the slowest pace since 2003. A small recovery is expected after a slowdown from 7.8% in September.

On the American side. Thirteen of the 17 Federal Reserve officials expect economic data to be in a condition that the interest rate can be left at 1.50% -1.75% currently for 2020. The other four think the increase is likely to be appropriate in the future, as the US central bank under Jerome Powell’s leadership remains confident of the country's economic performance, inflation is on the rise and that US unemployment will remain around the lowest levels in 50 years, and the bank blames the weakness of US economic issues recently due to the prolonged trade dispute between the United States and China.

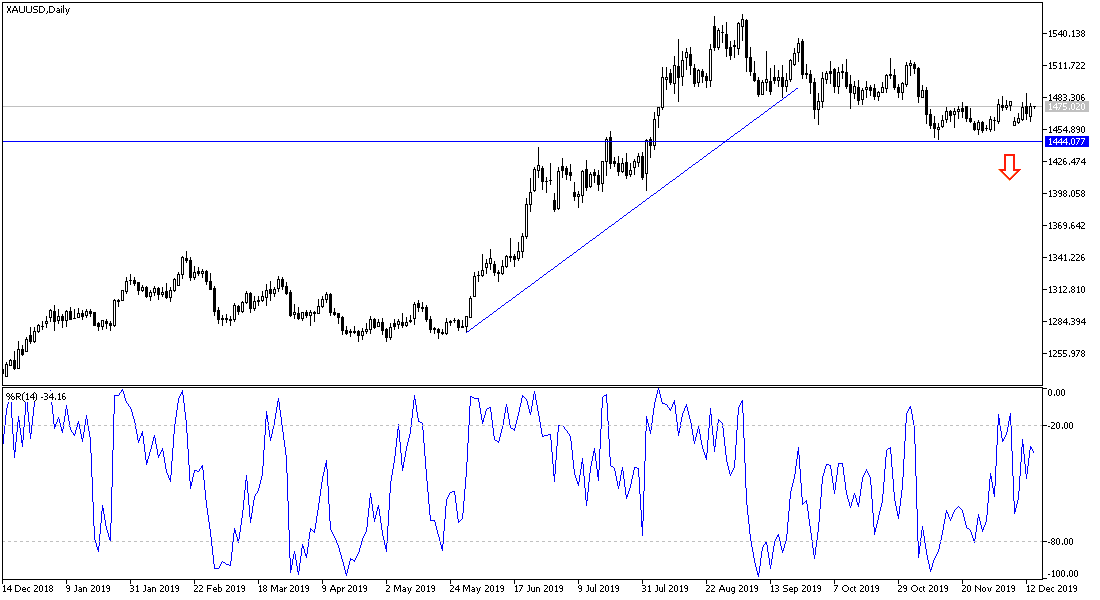

According to the technical analysis of gold: Despite the risk mood, the price of gold advanced for four sessions last week and recorded its highest weekly closing since early November ($1476.3). The increase of 1.1% during the week was the largest since late September. As of now, the technical analysis indicators do not show a strong signal towards the upside. If the price falls towards 1468, 1455, and 1448 levels, the downward correction will be strengthened. Any stability of gold above 1485 resistance will support the move towards psychological resistance at $1500. I expect the correction to be lower in the near term and then start to go higher after that, after the recent optimism evaporates.

The yellow metal will react to the results of Chinese data today, the most prominent of which are industrial production and the announcement of the PMIs for the industrial and services sectors from the Eurozone, Britain and the United States of America.