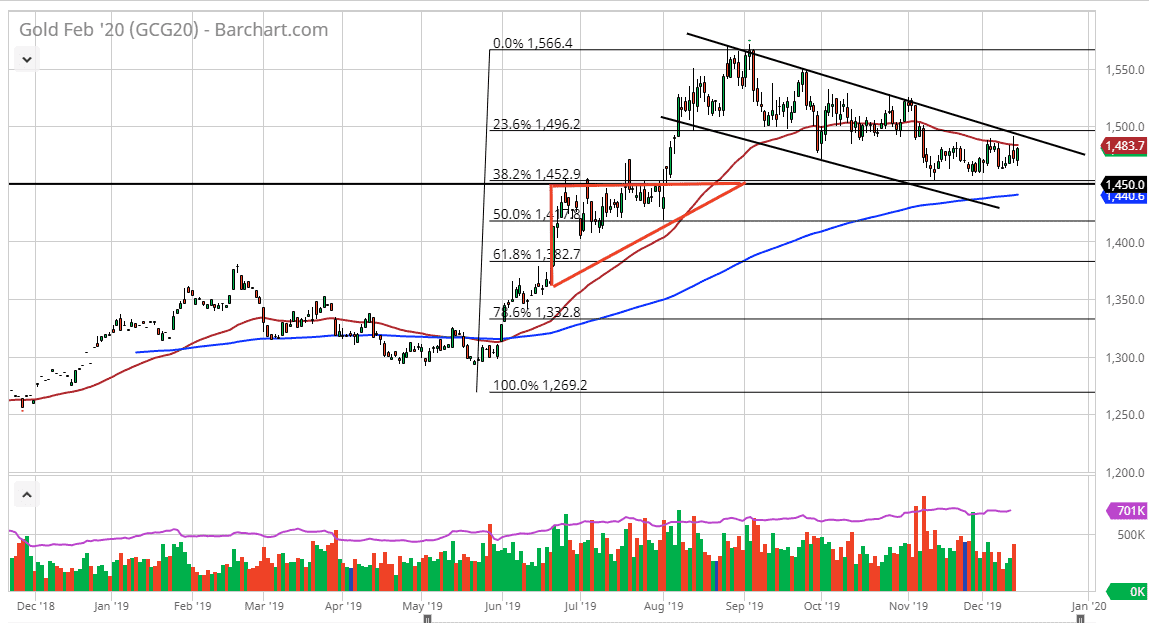

The gold markets rallied during the trading session after the Americans and the Chinese agreed in principle to the idea of a “phase 1 deal” but left a lot of confusion as to exactly what was agreed to. Because of this, the market continues to go back and forth and this action is a bit concerning. Ultimately, the $1450 level continues offer a lot of support and if we were to break down below there it would be very negative. Having said that, if the market did in fact break down below there, we could go much lower but in the short term one would have to pay attention to the fact that the 200 day EMA is just below. With that in mind it’s can be very difficult to break down below there.

However, there is a massive downtrend line that slices through the $1500 level, and therefore that is something that should be paid attention to. Beyond that, the 50 day EMA is sitting right at the top of the candlestick for the trading day, so it makes a lot of sense that we simply go back and forth and try to figure out where to go next. If we can break out above that $1500 level though, then gold has a chance of shooting much higher and continue in an uptrend. That would probably be due to some type of “risk off” type of scenario, something that could happen if the trade deal isn’t actually a deal at all. By all accounts at this point though, it looks as if the Americans and Chinese believe that we are going to see some type of signing process, but we have seen them get this close previously, but this is the first time that we have seen both governments admit the likelihood of it.

If the signing does not happen, or if there are signs that it won’t, then it’s likely that the gold market will skyrocket. Ultimately, if we get some type of bigger move to the downside, it will probably be due to the deal not only being signed, but perhaps more hope of further negotiations and gains in the trade war towards some type of an agreement. Gold is typically a risk appetite barometer, and right now there is just so much confusion that one would have to think a lot of back and forth will probably continue to be the case.