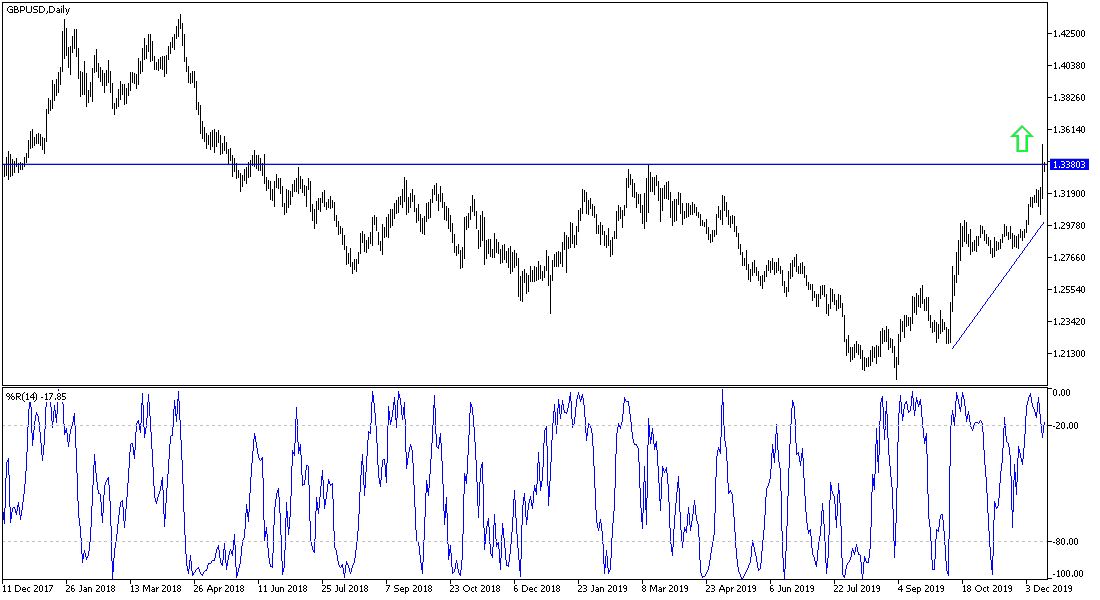

At the end of last week’s trading, and with the announcement of a major victory for the Conservatives in the general elections that took place in the United Kingdom last Thursday, the best opportunity was for an upward price gap for the GBP/USD to start from 1.3160 support to reach the 1.3514 resistance, the highest level since May 2018. However, with the market price ending its gains after winning, the pair quickly reverted to the 1.3305 level, before closing the week's trading around the 1.3333 resistance. Prime Minister Boris Johnson is scheduled to start work "before Christmas" on obtaining parliamentary approval for a Brexit deal.

Driven by its landslide victory, the Conservative government, led by Johnson, plans to move quickly to fulfill their campaign promise to "end Britain's exit from the European Union." This means ensuring that the legislation known as the Brexit Bill is passed in time for its historic departure from the European Union by the current deadline of January 31, 2020.

The Conservatives won 365 of the 650 seats in the House of Commons. The Labor Party won 203 seats, its worst number since 1935. With a majority of 80 seats in favor of the Conservatives, the tormented wrangling that has been the hallmark of the Brexit discussions since Britain’s 2016 referendum on its status in the European Union must be subject to history.

Once the Brexit law is passed, negotiations will begin between London and Brussels over a new deal covering its economic and strategic relationship. A transition period incorporated into Johnson's Brexit deal means that trade between Britain and the bloc will remain smooth until the end of 2020. But if there is no ready-made deal then, the UK may face an economically destructive departure from the European Union.

This week we will be on a date with the results of the Bank of England meeting to determine monetary policy after the Conservative victory and the approach of the Brexit date. Any change in the bank’s tone regarding the future of its monetary policy in the coming period will have a strong impact on the performance of the pound against other major currencies.

According to the technical analysis of the pair: The reversal of the GBP/USD general trend towards the rise is still valid and the return of the movement towards the 1.3500 resistance will open the way for the pair to test new record resistance levels. On the downside, the closest support levels for the pair are currently at 1.3300, 1.3230 and 1.3140, respectively. We prefer to buy the pair from every low level.

As for the economic calendar data today: From Britain, the PMI for the industrial and services sectors will be announced. Subsequently, the results of the stress tests of the British banks, the financial stability report and the minutes of the Bank of England's fiscal policy meeting. From the United States, we have the announcement of the Manufacturing and Services Purchasing Managers Index.