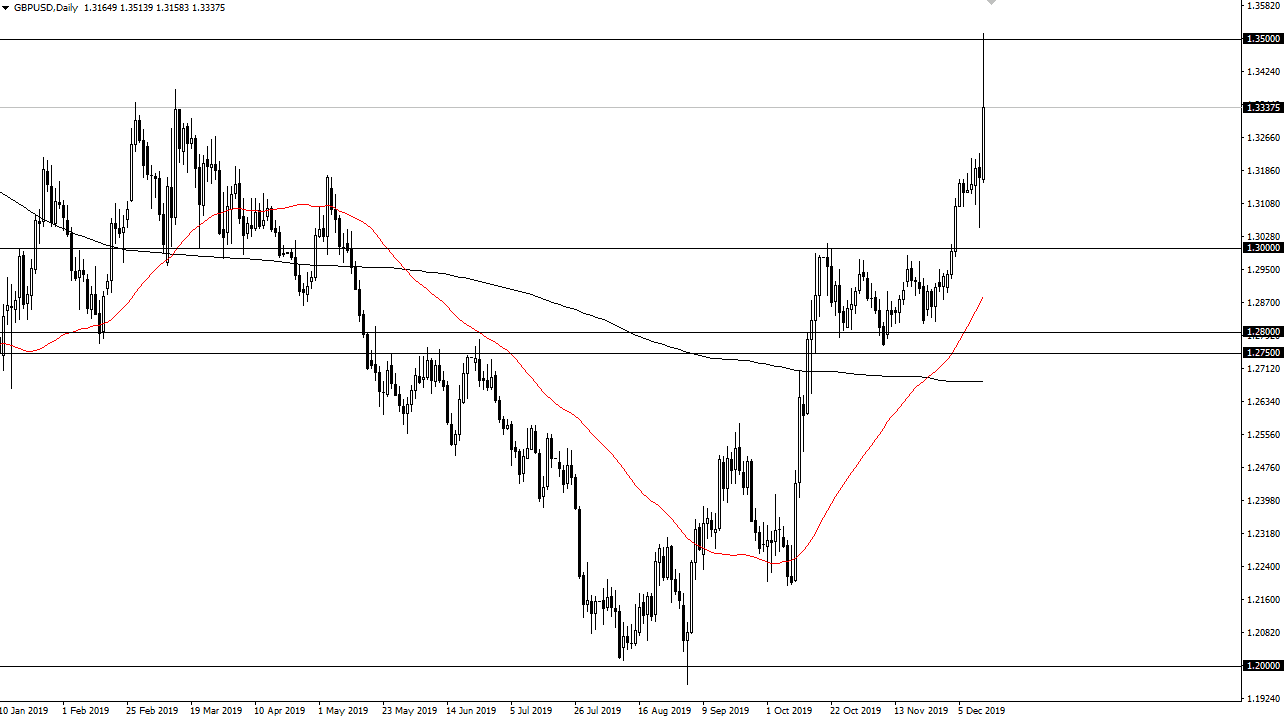

The British pound rallied significantly during the trading session on Friday, reaching towards the 1.35 level after we had election results in hand. This was a strong reaction to a conservative victory, smashing through all expectations and handing Boris Johnson a major majority in parliament, all but ensuring that we are going to have Brexit finally. Ultimately, the market had already priced in most of the move are ready, so the fact that we failed at a large figure such as 1.35 does not surprise me.

At this point, short-term pullback should be buying opportunities as we have clearly changed the overall attitude of the market. The hammer from the Thursday session was very good support just waiting to happen so I think between here and the 1.30 level will find plenty of buyers. After a move like this, I like to see a pullback because you need to find value before chasing after this type of move. The bullish flag below should continue to offer support based on the noise that will be generated there, so at this point I do not expect to get below there unless of course something catastrophic happens with Brexit.

The bullish flag measures for a potential move to the 1.38 handle, and that is an important level on longer-term charts anyway. Looking at this chart, short-term pullbacks should continue to be thought of as buying opportunities as we have been so bullish, and clearly after the last couple of years of traders being short, there is still a lot of short covering that needs to be done. Looking at the chart, if we break above the 1.35 level then we have the ability to go to the 1.38 handle given enough time.

There are multiple areas that we could find buyers underneath, especially the 1.32 level, which has seen a lot of action on the short-term charts. At this point, there is the likelihood that those who have missed that sudden move will be looking to get involved as well. After all, this happened at the bank rollover, meaning that it was when liquidity was almost all gone, and the move was almost instantaneous. That being said, the next day or two should offer a pullback that we should take advantage of. I have no interest in shorting regardless, and do think that eventually we will find the 1.38 handle longer term.