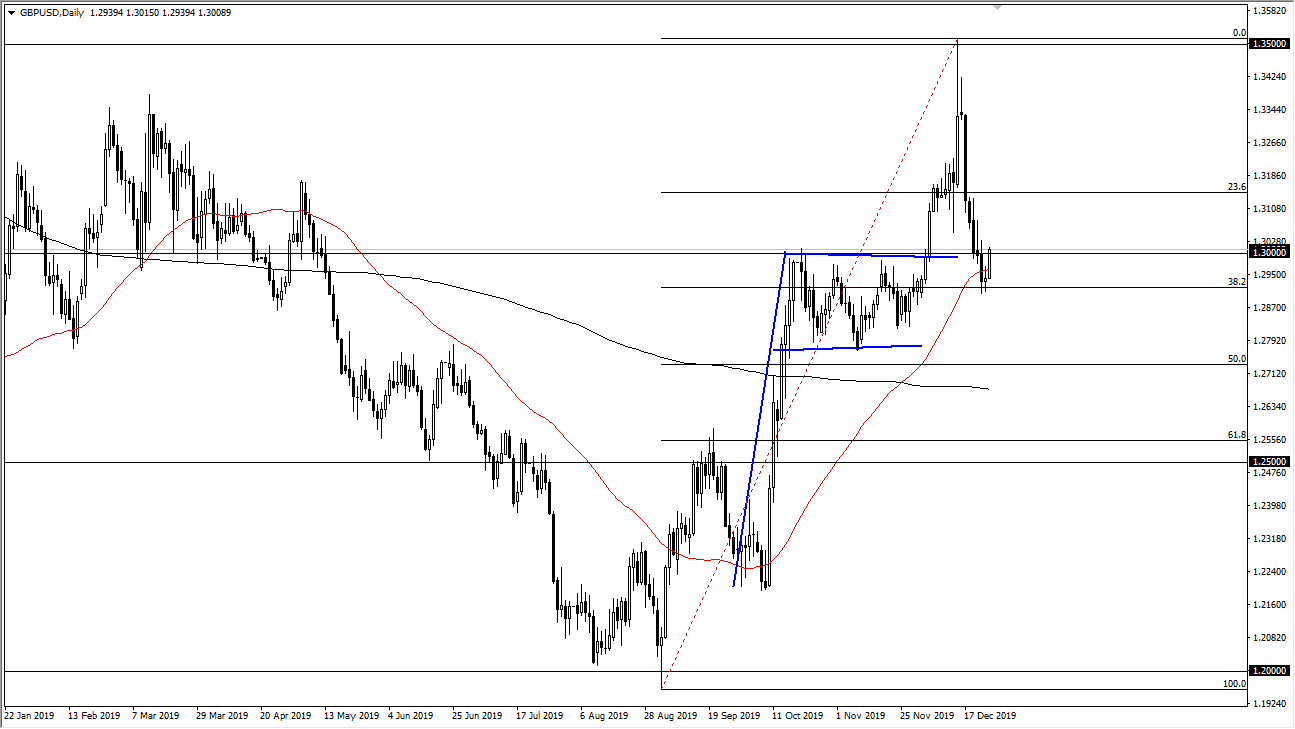

The British pound rallied significantly during the trading session on Thursday, breaking above the 1.30 level during the US session. This of course is a very significant move, and the fact that we are trying to recapture that major psychologically significant figure. If we can break above this area for any significant amount of time, it’s very likely that we could then go looking towards the 1.3250 level, and then eventually the 1.35 handle. Remember, the market had been extraordinarily bullish for some time but then sold off drastically to reach into this general vicinity.

We have bounced from the middle of the bullish flag that sent the market to the highs to begin with, so it makes quite a bit of sense that we should see continued pressure to the upside but it won’t be as explosive as we have seen recently, because quite frankly we don’t have the drive after that explosive move. At this point, it’s very obvious that the market will continue to find a lot of volatility overall, but I think the “easy gains” have been had at this point. Ultimately, keep in mind that the 38.2% Fibonacci retracement level has offered support, and it is in the middle of the bullish flag. That should continue to offer a lot of noise and therefore support for this marketplace.

We have sold off rather drastically due to the idea of a “hard Brexit”, but at this point it’s only a matter of time before the market corrects some of the overselling that it had done recently. I think at this point we are likely to go much higher and therefore I don’t have any interest in selling. Remember, the 1.30 level is still rather cheap from historical standpoint, and the bullish flag measures for a move to the 1.38 handle above. At this point, the market will completely break out but quite frankly I don’t think it’s hard to imagine a scenario where we are most certainly trying to move much higher over the next several years. I have no interest in shorting this market, at least not until we slice through the 200 day EMA which is currently near the 1.27 level or so. If we break down below there, then it would be something to do with the British situation collapsing. I don’t think that happens, and I believe that every time it pulls back you should be looking for signs of buying to get involved.