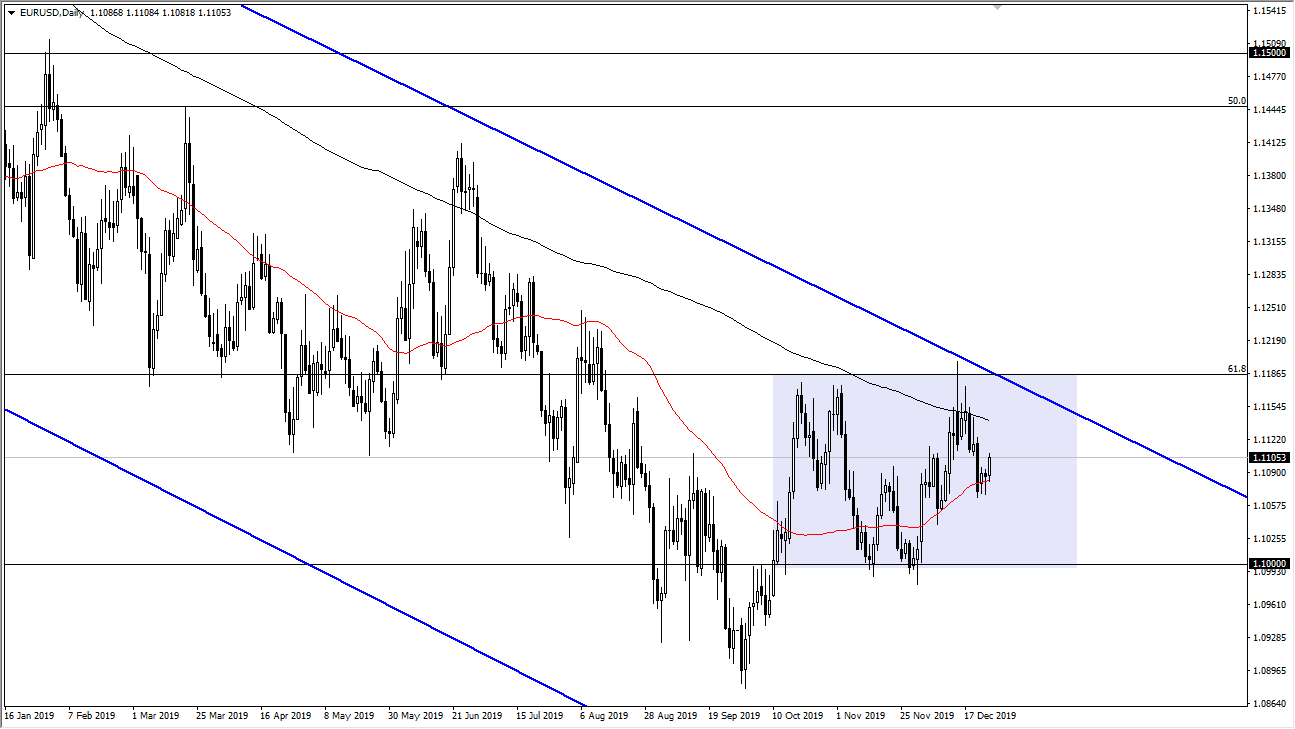

The Euro has rallied a bit during the trading session on Thursday as we came back from the Christmas break. Ultimately, the past couple of days have formed a hammer, so that of course is a bullish sign sitting at the 50 day EMA. All things being equal though, this should be a significant amount of resistance in the form of the 200 day EMA above, and several other levels. The downtrend line of course will offer significant resistance as it is the top of the descending channel, but beyond that there is resistance in the form of the 1.12 handle as it is the top of an overall consolidation area.

That being said, there is a significant amount of support at the 1.10 level underneath. This is a market that is bouncing around in a 200 point range, with the 1.11 level being “fair value”, as it seems to be where the market is attracted to. If we can break above the 1.12 level though, that would change the overall trend and could have the Euro going much higher over the longer term. To the downside, if we were to turn around a break down below the 1.10 level, then it’s likely that we go down to the 1.09 level.

Ultimately, this is a market that is in a downtrend, so therefore I do prefer to short the markets on signs of exhaustion but the next couple of days might be a bit difficult as we are testing between the 50 day EMA on the bottom and the 200 day EMA on the top. Ultimately, this is a market that I think continues to see a lot of noise, but I think that by the time we get back to the heavy volume trading in January, it’s likely that we will continue to see plenty of sellers. Quite frankly, the European Central Bank is going to be very loose with monetary policy, and therefore it makes quite a bit of sense of the Euro continues to drift lower. All things being equal I think it will be very difficult to trade this market, but I think that sellers will still have the upper hand when we get back to work in January. Between now and then you are probably looking at micro moves more than anything else. Be cautious, but quite frankly you would be forgiven to stay on the sidelines for a couple of weeks.