January will feature Brexit and usher in the transition period, which is officially ending on December 31st 2020. The British Pound surged after Prime Minister Johnson secured an 80-seat majority in Parliament, but gave back those gains after he announced an amendment to the Brexit bill, making an extension of the transition period illegal. The EUR/GBP quickly accelerated into its resistance zone but was rejected and pressured into a breakdown. More downside in this currency pair is anticipated to follow.

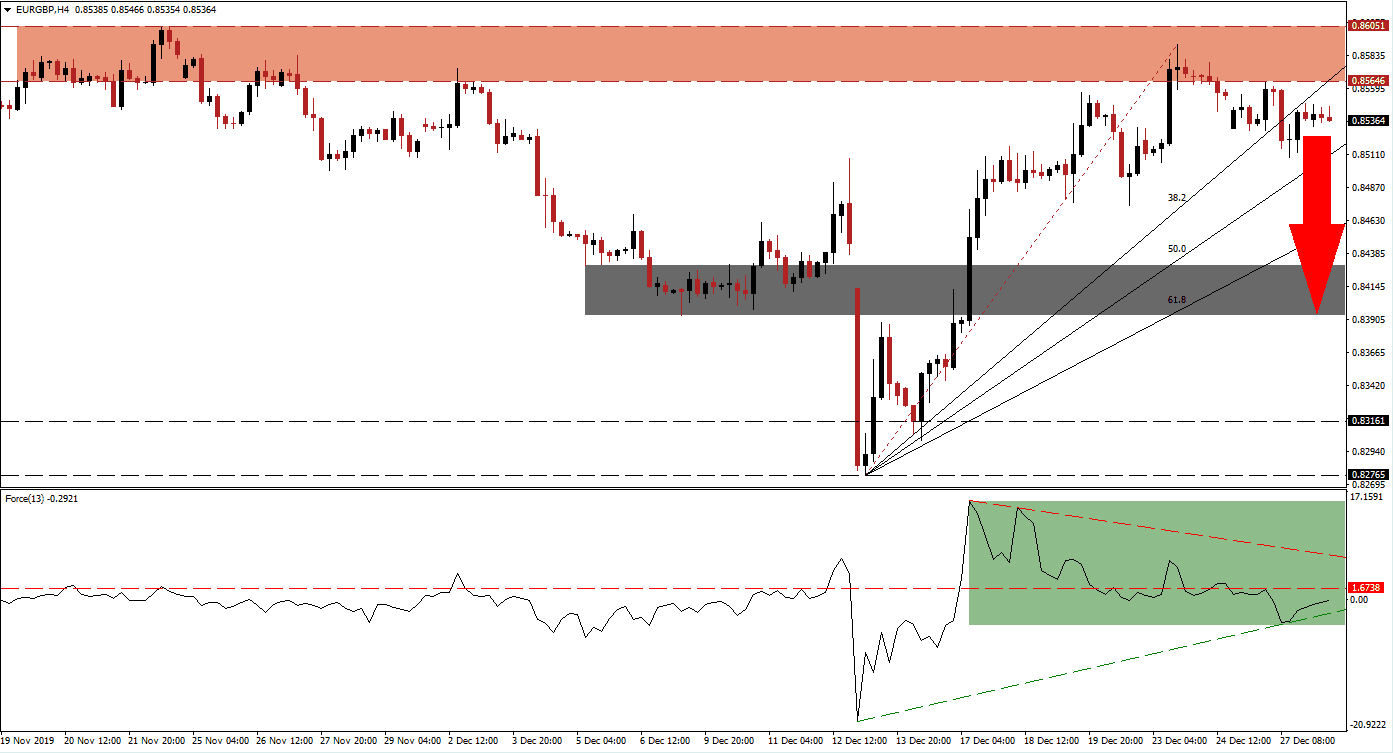

The Force Index, a next-generation technical indicator, spiked with the EUR/GBP as it converted its short-term resistance zone into support. Bullish momentum receded as price action extended its rally and a negative divergence formed. The Force Index descended below its horizontal support level, turning it back into resistance, and its descending resistance level is favored to pressure this technical indicator farther to the downside. After it reached its ascending support level, the Force Index drifter higher, as marked by the green rectangle. A renewed push to the downside is anticipated to keep the breakdown sequence intact.

This currency pair recorded a lower high inside of its resistance zone located between 0.85646 and 0.86051, as marked by the red rectangle. After this bearish development materialized, the EUR/GBP completed a breakdown and bearish momentum additionally converted it’s steep ascending 38.2 Fibonacci Retracement Fan Support Level into resistance. Forex traders are advised to monitor the intra-day low of 0.85090, the low of the current breakdown. A move below this level will take price action below its 50.0 Fibonacci Retracement Fan Support Level and result in the addition of fresh net sell positions, accelerating the sell-off.

An extension of the breakdown sequence should take the EUR/GBP into its short-term support zone located between 0.83932 and 0.84303, as marked by the grey rectangle. This zone additionally includes a previous price gap to the downside. Due to the long-term fundamental outlook, supported by the current technical picture, anther breakdown remains a strong possibility. This may take price action back down into its next long-term support zone between 0.82765 and 0.83161. You can learn more about a breakdown here.

EUR/GBP Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 0.85350

Take Profit @ 0.83950

Stop Loss @ 0.85800

Downside Potential: 140 pips

Upside Risk: 45 pips

Risk/Reward Ratio: 3.11

In the event of a breakout in the Force Index above its descending resistance level, a push higher by the EUR/GBP may follow. A sustained breakout above its resistance zone in the current fundamental environment remains highly unlikely. Forex traders should view any attempt at a rally from current levels as a solid short-selling opportunity. The next resistance zone awaits this currency pair between 0.86948 and 0.87539.

EUR/GBP Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 0.86250

Take Profit @ 0.87200

Stop Loss @ 0.85900

Upside Potential: 95 pips

Downside Risk: 35 pips

Risk/Reward Ratio: 2.71