West Texas Intermediate Crude traded in light volume during the Thanksgiving Day holiday, drifting a little bit lower. That being said, this was probably more or less a reaction to the trade situation taken a turn for the worse. That being said, Donald Trump has signed a bill that sides with the Hong Kong protesters against the Chinese. That being said though, at the end of the day it really doesn’t matter and nobody truly cares.

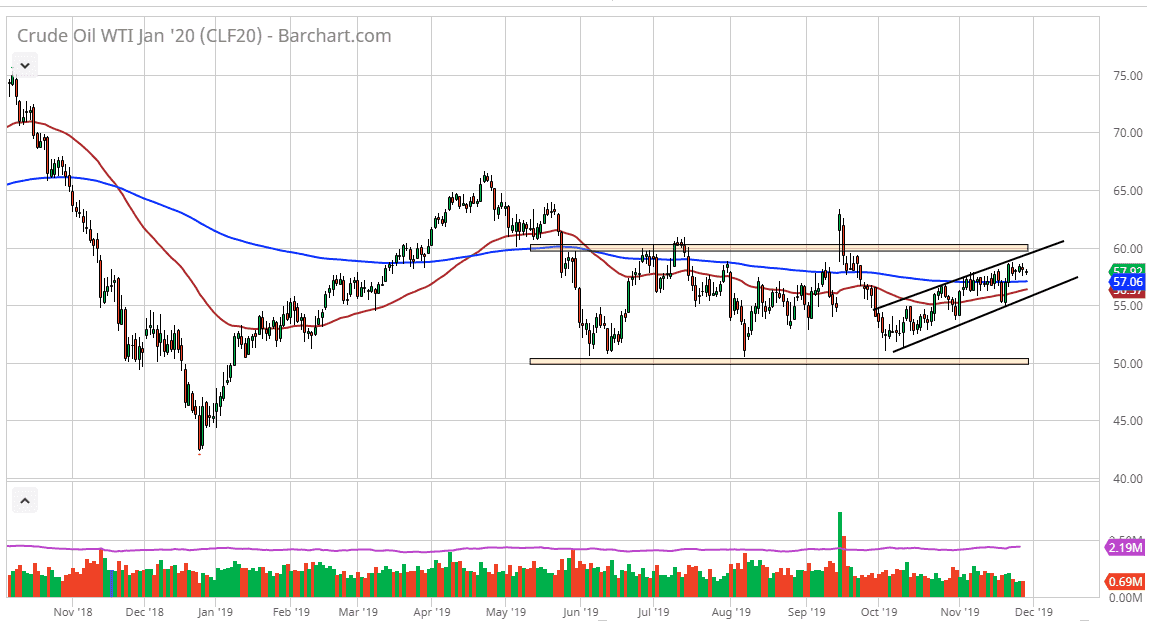

The Chinese of course were furious about a but have yet to react so it’s likely that the trade situation won’t be a huge factor. The reality at this point is that we are getting close to the top of the overall consolidation range, so I think it’s only a matter of time before we drift a bit lower. At this point, the market could drift towards the $55 level, but at this point the $60 level above is going to be difficult to break through, but if it does the market probably goes looking towards the $62.50 level.

With OPEC meeting in December, a lot of people will be looking to see whether or not the members decide to continue the overall production cuts. While it has pretty much been ruled out that they will increase cuts, keeping them going forward that are already in place makes a bit of sense. That being said, the market looks like it wants to go back and forth between the $50 level and the $60 level longer-term, and as we are closer to the top of it it’s likely that we will find sellers. However, if we get some type of surprise economic announcement, then we could see a bit of volatility. That being said though, we have so much in the way of issues when it comes to US/China, global growth or perhaps lack of it, and the uneven economic outlook. With that, I think that it makes sense that we continue to drift back and forth. As we are closer to the top of the range drifting lower makes more sense than anything else. Keep your position size small, because quite frankly the volatility in the choppiness will get you into trouble if you are over levered. Until we get some type of clarity, we will probably continue more of the same noisy and choppy movement.