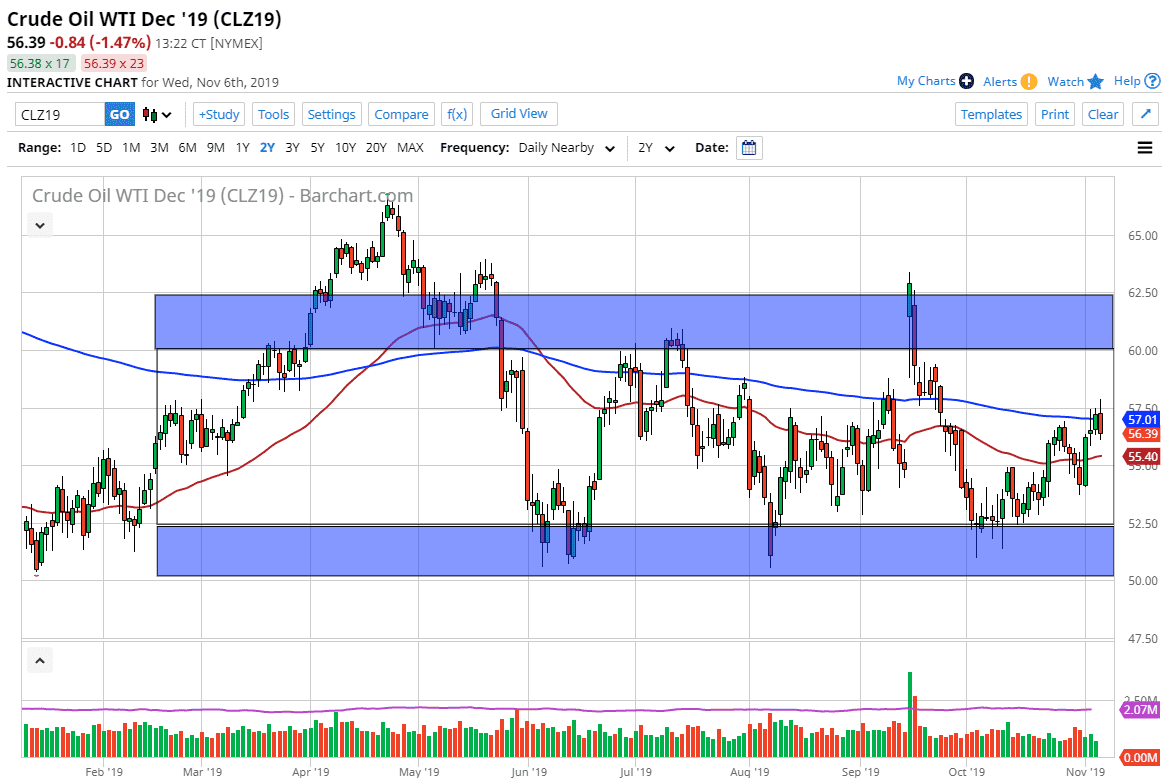

The crude oil markets initially tried to rally during the trading session on Wednesday, as we are generally grinding higher. However, we have seen the market turnaround due to the extraordinarily poor inventory figures. This was the beginning of trouble for the market, as the inventory figure had an addition of 7 million barrels when it was anticipated to be just 800,000. That is a huge miss, and then on top of that it has been reported that the Americans and the Chinese aren’t likely to sign any type of an agreement until at least December. For some reason, the market still likes to pretend that the Americans and the Chinese are going to come to some type of an agreement. They clearly have missed read the entire thing as this is a structural issue that can’t necessarily be fixed.

The idea that the two countries are going to come together for any type of meaningful agreement is far-fetched at this point, and it supposedly would drive up the demand for crude oil. However, there is a lack of demand in general anyway, as the global economy is slowing down. Beyond that, the Americans continue to pump out massive amounts of crude oil and that’s only becoming more every day. At this point, it’s very likely that the market continues to find reasons to go back and forth based upon that and then on the other side of the equation you have the fact that OPEC is possibly going to be cutting production in December, so at this point it looks like we are simply going to go back and forth in the same range that we have been in for some time. All things being equal, it’s likely that the market will drop down towards the 50 day EMA where I anticipate buyers will come back. Just below there, I also see some structural support at the $54 level as well, and that doesn’t even take into account the psychological importance of the $55 handle. With that in mind I think that we should see buyer step in and take advantage of this market if they get the opportunity, as there are several moving pieces at the same time but most notably there is structural support underneath, that has proven itself several times in the past. Although not overly bullish, I do believe in trying to find value.