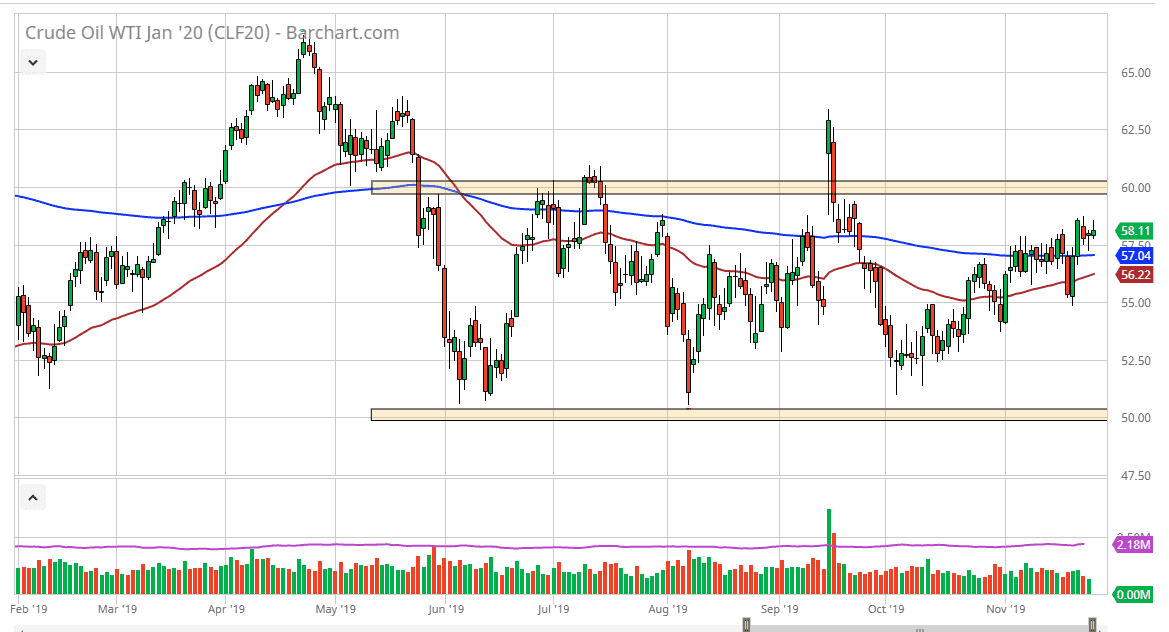

The West Texas Intermediate Crude Oil market rallied initially during the trading session on Tuesday but gave back some of the gains to form a less than impressive candlestick. That being said, the market still has plenty of buyers underneath, and I think this cannot be ignored. The 200 day EMA is sitting underneath at the $57 region, and I think at this point it’s very likely that pullbacks will be thought of as buying opportunities, as we continue to try to reach towards the top of the overall consolidation area. That would mean the $60 level, but obviously we have quite a bit of effort needed to try to get above there.

To the downside, even if we were to break down below the 200 day EMA I think that the 50 day EMA and the $55 level both could come in and offer support, and still be well within the tolerance of the bullish channel that we have been forming. With that, the market continues to grind towards the highs, but I wouldn’t get too excited about crude oil breaking out simply because there are far too many moving pieces right now affecting the markets.

There are a lot of concerns when it comes to the US/China trade situation, and the latest headline of course has an influence on what the market does. The headlines come fast and furious, so quite frankly it’s difficult to guess what’s next other than simply watching price. Algorithms trade based upon headlines as well, so it will throw a lot of volatility into the market that doesn’t necessarily mean anything more than at the moment. Because of this, we will continue to see a lot of choppy behavior, but I think longer-term trader simply look at it as trading in a range between $50 on the bottom and $60 on the top.

Looking at this chart, I think we can expect a lot of difficult trading for anything more than a quick scalped, I think day trading still continues to work but I would favor more on the upside than the down, and therefore I will be looking for value on dips. It wouldn’t necessarily be an easy trade to take to the downside anyway, so when we break down, I like the idea of looking for value at lower levels as the ones mentioned previously.