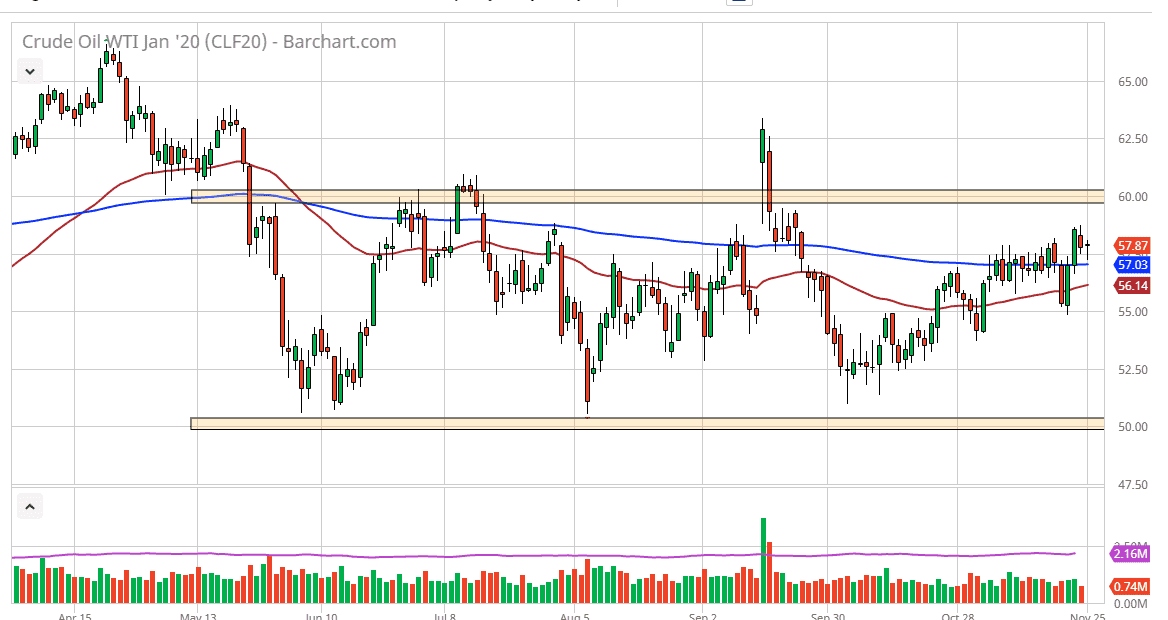

West Texas Intermediate Crude Oil has pulled back quite a bit during the trading session on Monday but has also found a significant amount of support near the 200 day EMA. By doing so, the market ended up rolling back to the upside and forming a bit of a hammer. This tells me that there is quite a bit of buying pressure, and I suspect at this point we are probably going to be looking towards the top of the overall consolidation range. This means that we will probably go looking towards the $60 level, which has been the top of the overall range for some time.

I do not think that this market is going to break through there easily, so it’s likely that this is a short-term buying opportunity more than anything else. However, if we were to break above the $60 level, then the market could go to the $62.50 level. Looking at this market, if we were to pullback from here, there is a ton of support underneath based upon several attempts to break down but yet the buyers continue to come back. Looking at this chart, I would also argue that there is support in the 200 day EMA, and of course the 50 day EMA. If we do get the 50 day EMA jumping above the 200 day EMA, then it’s the so-called “golden cross”, which is a longer-term buy-and-hold signal. At this point I think short-term buyers continue to come into this market and supportive, so if you are a short-term trader, this is a good market for you. Otherwise, if you are a longer-term trader you are going to continue to see this market chop around.

If we were to break above the resistance, then the market could really start to take off but right now I think there is far too little in the way of demand to pick up crude oil pricing beyond that region. It is because of this that I feel buyers will return, but probably be out by the end of the day. This is not the type of market that you get involved in for a longer-term move. With that, take a look at the market as a “value proposition”, but get out rather quickly as well. If we were to break down below the $55 level, then the market could go down to the $52.50 level. Underneath there, I think the “floor” in the market is closer to the $50 handle.