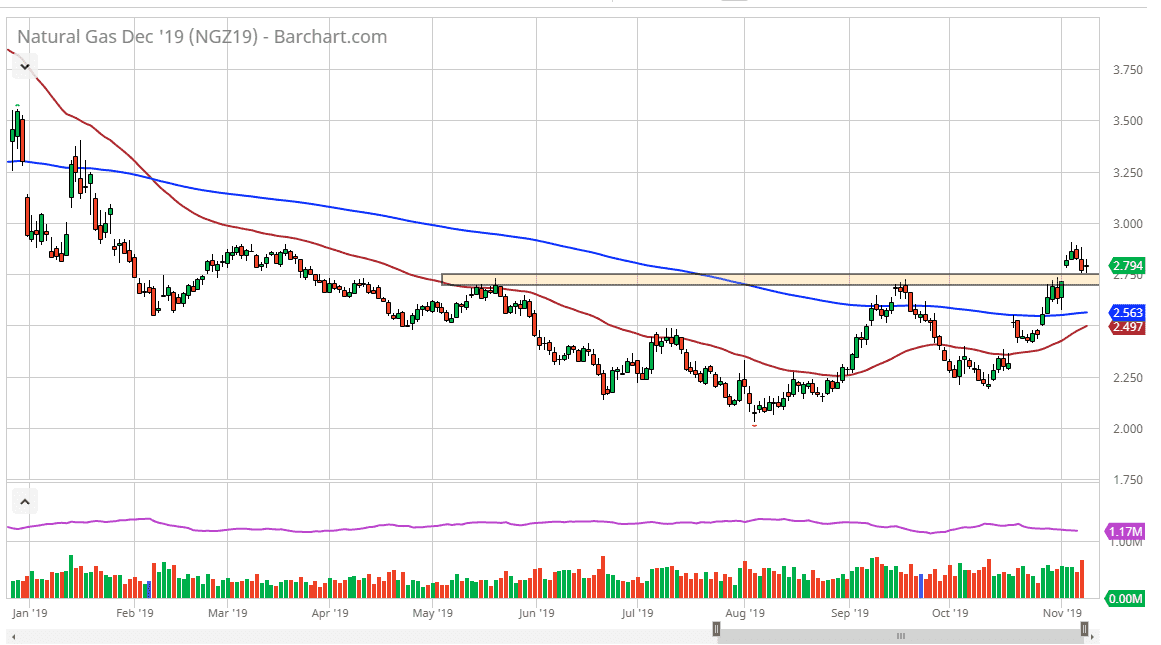

Natural gas markets have gone back and forth during trading on Friday as we continue to see a lot of volatility. The market is sitting just on top of a gap from earlier in the week, and at this point it’s likely that the market will find plenty of buyers in this general vicinity. It’s likely that the market will continue to go higher, so therefore once this gap gets filled, it’s likely that we continue to rally and reach towards the $3.00 level.

At this point, we are reaching into the colder part of the year in the northeastern part the United States and of course the European Union, as this will drive a significant amount of demand. Ultimately, it’s likely that the market will continue to see buyers based upon the higher rate of natural gas burned over the next couple of months. Keep in mind that the futures markets trade into the future, meaning that somewhere near the beginning of January traders will start focusing on spring, and that of course means warmer temperatures and less demand. This sets up the seasonal pop that we see every year.

At this point in time, short-term pullbacks should continue to offer plenty of buying opportunities but if you are a longer-term trader you will probably simply hold onto a long position. As far as shorting is concerned, it’s all but impossible at this point as the temperatures alone in the north will continue to drive demand higher. This is only temporary though, but certainly something that traders can take advantage of to pad their accounts every year. Pullbacks at this point will be supported by not only the gap, but the 200 day EMA which is painted blue on the chart. Beyond that, the 50 day EMA is starting to reach towards the 200 day EMA, setting up the so-called “golden cross.” This is a very bullish sign for longer-term traders and has them jumping into the market as well. Overall, it’s very likely that this market continues to go much higher but will be influenced by weekly weather reports so keep in mind that volatility won’t necessarily disappear. Either way though, selling is all but impossible at this point of the year, but once we do run out of steam in early January, this market will rollover and sell off rather drastically.