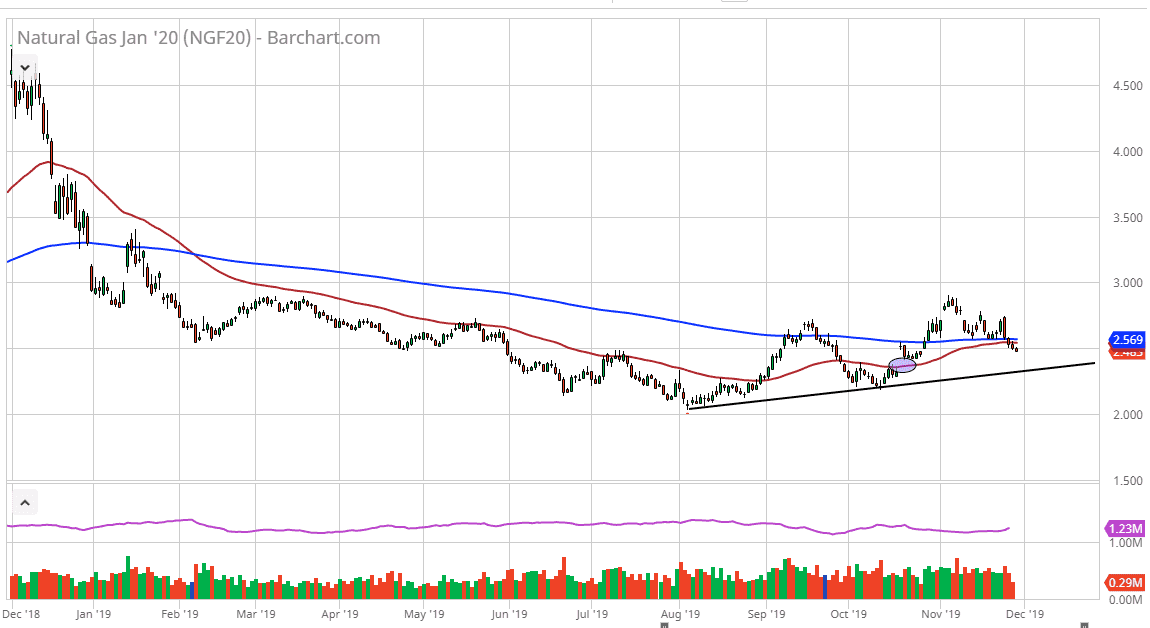

Natural gas markets have fallen a bit during the trading session on Thursday and what would have been very thin electronic trading. At this point, the market looks likely to go looking towards the gap underneath at the $2.40 level, and perhaps even more importantly the uptrend line that sits underneath. That uptrend line should continue to hold the overall consolidation of the uptrend and channel. Remember, this is the time of year that is typically bullish for this market, so there is still a bit of a proclivity to the upside.

Keep in mind that the markets will continue to pay attention to whether, so that obviously is going to cause a bit of issues. At this point, the markets continue to see a bit of oversupply though, so that of course is going to continue to be a problem. However, cold weather is coming and will certainly dwindle the supply. The most recent inventory number was a bit more bullish than anticipated, so if we get a couple more of those this market will rip to the upside.

Looking at this chart, the moving averages are relatively flat, and a bit confused. That being said, we have been grinding higher cents August, as we had gotten quite oversold. At this point, the market should continue to see plenty of buyers on these dips and given enough time it looks as if the uptrend line and the $2.40 area coincide quite nicely. That gap should continue to offer support and the market finding buyers there would not be a huge surprise. Having said that, it’s also not a huge surprise that the market tries to fill that gap, as it typically will. With that being the case, as colder temperatures arrive in places like Chicago, Columbus, Cleveland, Buffalo, and New York City, you will start to see natural gas being used more.

If we were to break down below the $2.30 level, that shows just how negative this market has gotten, and would be a bit surprising. This time a year would almost be unheard of, so it’s the least likely of scenarios. I think at this point we are very likely to see this market go looking towards the $3.00 level after a bounce from that gap. Either way, this is a grind and not necessarily an explosive move yet. Sooner or later though, it will take off.