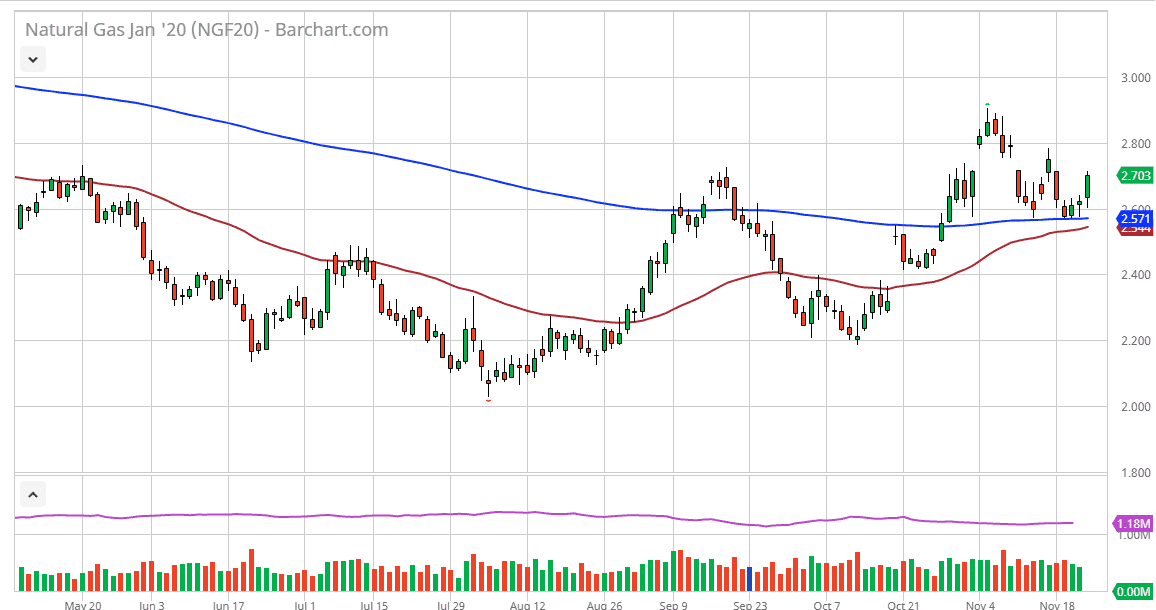

The natural gas markets gapped higher to kick the Friday session off, but then pulled back a bit to the test the $2.60 level, before rallying yet again. In fact, the market is starting to close very strong, towards the top of the range. Natural gas markets have gotten a boost due to the inventory figures coming out the United States much more bullish than anticipated. Because of this, demand seems to be picking up and it should be noted that we are starting to break out above the top of a falling wedge, which is also a bullish sign.

The 200 day EMA underneath at the $2.57 level, it’s likely that the market will continue to offer a significant amount of support. By the fact that the 200 day EMA has been broken above, and now has offered quite a bit of support more than once, it’s likely that we could continue to go higher. The $2.80 level above would be a target, and if it could be broken above there, the market is likely to go looking towards the $2.90 level above, and then the $3.00 level. That is a large, round, psychologically significant figure, and therefore it’s likely that the market continues to find pullbacks as buying opportunities.

To the downside, if we were to break down below the moving averages on the chart, it’s more than likely going to go looking towards the $2.40 level where we had had a gap previously. That being said, I don’t think it’s can happen anytime soon as we are going to continue to show signs of buying due to the fact that the temperatures have dropped so much in the United States already, and it is relatively early in the season for that. Longer-term, I believe that we are probably looking towards the $3.00 level, followed by the $3.10 level and eventually the $3.25 handle after that. All things being equal, this is a market that seems to be trying to change its overall trend, and until roughly January 10 or so it’s normally very bullish market. In fact, longer-term trader simply by and hang on to it for a couple of months. Keep in mind that every week the inventory number comes out to cause havoc in this market, but the general upside is maintained and should be thought of as an opportunity to take advantage of a yearly trade.