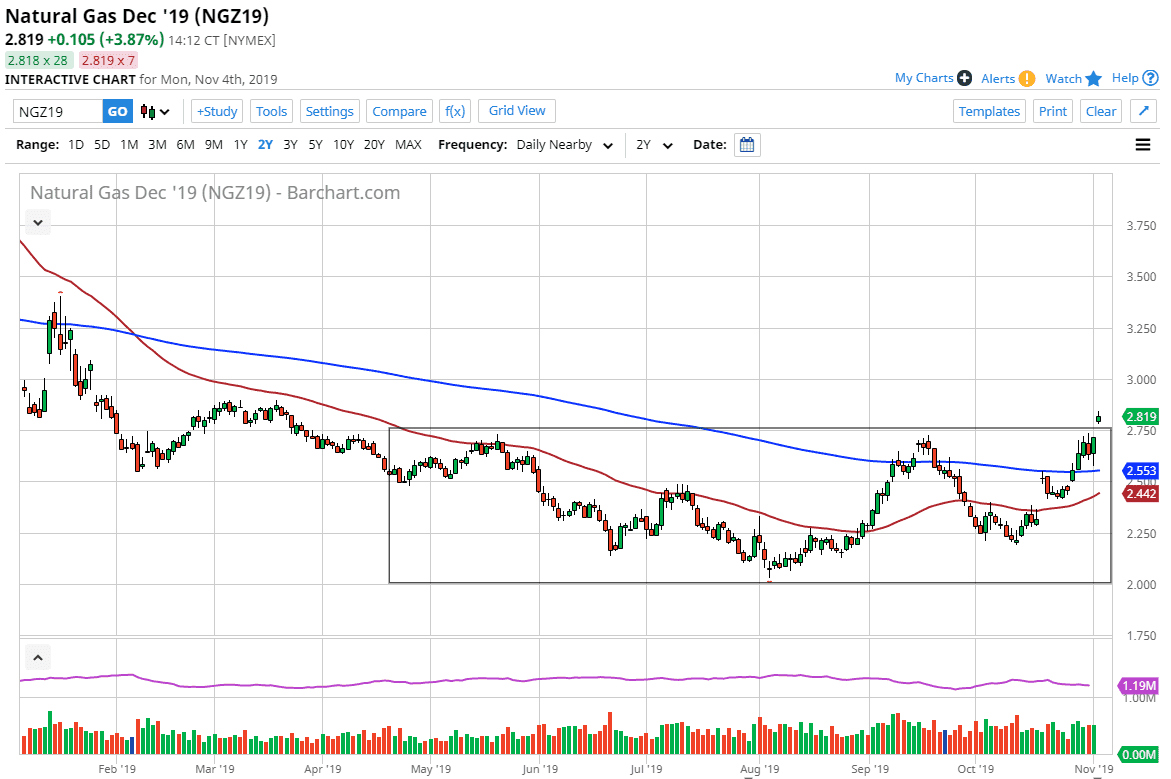

Natural gas markets gapped higher on Monday to break above the top of the overall consolidation area that they had been trading in. It’s very likely that the market should continue to go much higher, reaching towards the $3.00 level. At this point in time, the market looks likely to find buyers on short-term pullbacks based upon that gap, and the fact that the $2.75 level has been leapfrogged tells me that there is plenty of buying pressure underneath.

Looking at this chart, the 200 day EMA underneath should offer plenty of support, but I think it’s likely that we will see a lot of pullbacks it shows signs of bouncing or support, as the colder temperatures will of course drive up demand. Temperatures are plummeting in the United States and that of course makes for the cyclical trade where it goes higher. The market will more than likely break above the $3.00 level initially, looking towards the $3.25 level.

Pullbacks will continue to find plenty of support and therefore that’s how I play this market. I like buying dips, and it is likely that value hunters will continue to flock to this market until the middle of January, as that is typically about how long these traits last. Ultimately, if the market follows the most common pattern, somewhere around 10 January, the markets will absolutely collapse. The market is likely to continue to find plenty of selling pressure as soon as we are starting to talk about trading spring contracts. A break down would make sense as there are plenty of reasons to think that warmer temperatures will be coming as those contracts going to focus, and we will get the collapse as we typically do, simply because the oversupply of natural gas is so strong in the United States, and therefore it’s going to be difficult to imagine a scenario where the longer-term demand outweighs the longer-term supply. Ultimately, it’s likely that the market will offer plenty of buying opportunities over the next couple of months, only before offering selling for most of the year after that. That tends to happen quite a bit, and therefore there’s no need to trying to fight the natural proclivities of the markets. Ultimately, I’m only bullish for the next few months.