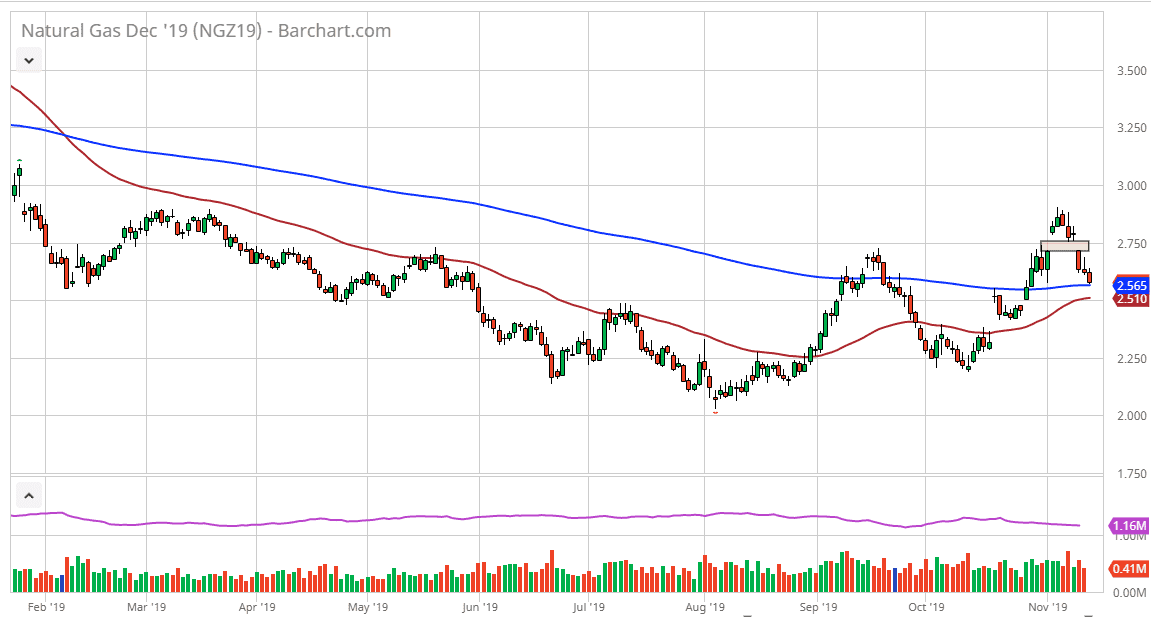

The natural gas markets initially tried to rally during the trading session on Wednesday but have given back the gains to reach down towards the crucial 200 day EMA as a huge oversupply of natural gas continues to be a major issue. The United States has been pumping out natural gas drastically for some time, and as a result it makes sense that prices fall. That being said though, there is plenty of support underneath that should continue to drive this market.

Looking at this chart, the 200 day EMA sits just above the 50 day EMA, and those should both continue to offer support. If we were to break down below the 50 day EMA, then the market could go higher. I like the idea of buying some type of support of candle as we have made a “higher high” recently, but we clearly have a lot of work to do. The gap below at the $2.30 level or so is what should be the “floor” in the market.

That being said there is also a gap at the $2.75 level, so it shows complete chaos and confusion in this market, like so many of the other ones that I follow at this point. Expect a lot of volatility and choppiness but short-term back-and-forth trading is probably about as good as this is going to get right now. If we do break above that gap at the $2.75 level then it opens up the door to the $3.00 level, but quite frankly it’s difficult to imagine a scenario where it can be easily done. We need to see some type of massive drop in inventory for natural gas to finally break out to the upside. If we can break out to the upside the target initially would be the $3.00 level, and then possibly higher than that. A move above there probably has the market looking for $3.25 but that’s probably more of a December story than right now. Expect a lot of back-and-forth trading but I would still have a bit of an upward bias as long as we don’t breakdown through that gap underneath. I like natural gas is time year but quite frankly it has not been acting well, as production had increased so much earlier in the year that it is taking longer than normal to burn through supply.