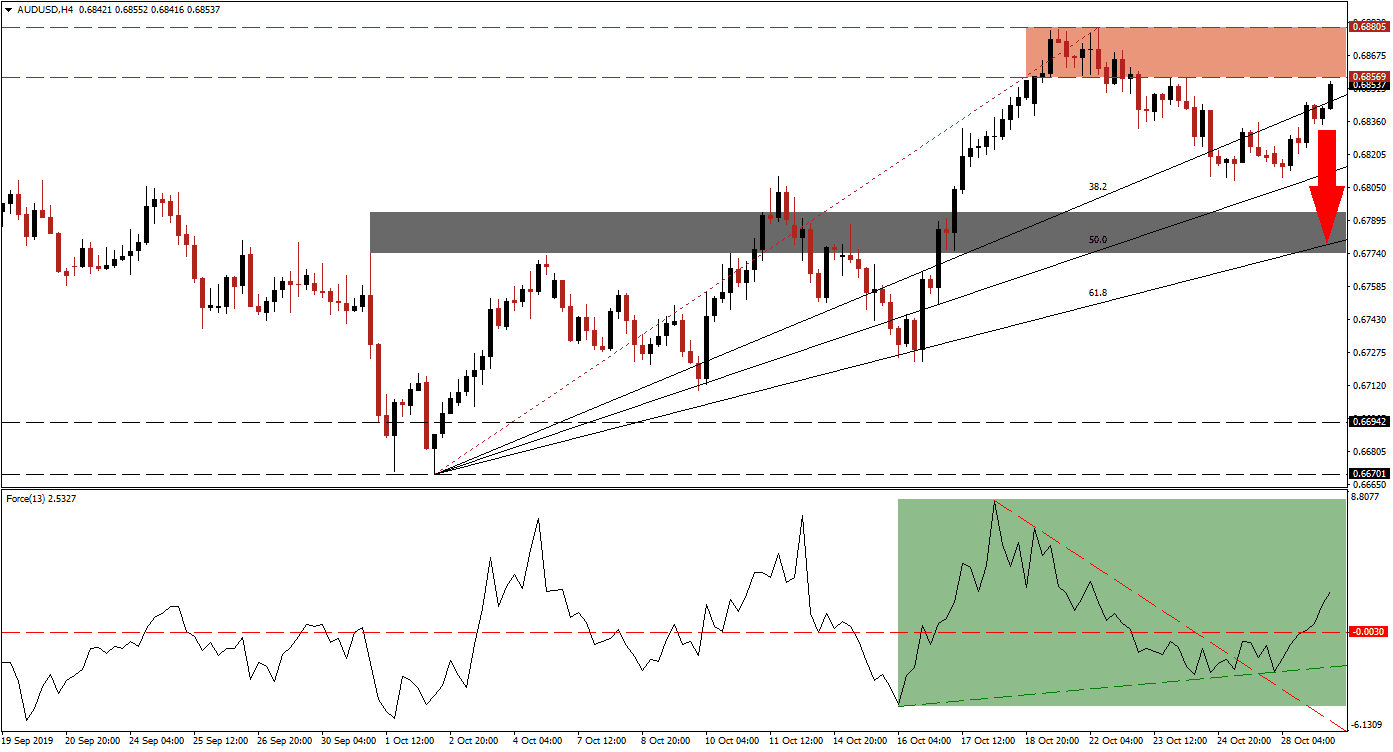

After the breakdown below its resistance zone, the AUD/USD approached its 50.0 Fibonacci Retracement Fan Support Level before reversing. Weekly consumer confidence decrease in Australia, but economic data out of the US printed bigger disappointments; this supports more long-term gains for this currency pair. Price action has confirmed a bullish trend with a series of higher highs and higher lows, but a short-term correction appears likely as a new report shows that wage growth in Australia has contracted below 2.0% annualized. A chart showing this development went viral and embarrassed economists at the RBA as they failed to expect it and forecasted a slow increase in wage pressures.

The Force Index, a next generation technical indicator, indicates a bullish burst after the AUD/USD closed in on its 50.0 Fibonacci Retracement Fan Support Level. Price action quickly advanced and is now approaching the lower band of its resistance zone which previously rejected a continuation of the uptrend. The Force Index was able to use its ascending support level and accelerate past its horizontal resistance level, turning it into support as marked by the green rectangle. Additionally, this technical indicator eclipsed its steep, descending resistance level; but as this currency pair is near its most recent intra-day high, the Force Index remains well below its own high and suggests much weaker bullish momentum. You can learn more about the Force Index here.

As the 38.2 Fibonacci Retracement Fan Support Level is closing the gap to the resistance zone, which is located between 0.68569 and 0.68805 as marked by the red rectangle, pressures for either a breakout or breakdown are on the rise. Given the weakening bullish momentum, the AUD/USD may be pressured to the downside on the back of a profit-taking sell-off before attempting a breakout and extending its long-term uptrend. Short-term upside is exhausted and forex traders should pay close attention to the Force Index as a reversal below its horizontal support level is expected to lead price action lower.

Any reversal is likely to be limited to its next short-term support zone which is located between 0.67739 and 0.67932 as marked by the grey rectangle. The 61.8 Fibonacci Retracement Fan Support Level is moving through this zone and further enforcing support. A correction of this magnitude will not violate the long-term uptrend and could provide the necessary conditions for a subsequent rally which can lead to a breakout and extension of the trend. Developments out of the US-China phase one trade deal are expected to keep volatility elevated. You can learn more about a breakout here.

AUD/USD Technical Trading Set-Up - Price Action Reversal Scenario

Short Entry @ 0.68550

Take Profit @ 0.67800

Stop Loss @ 0.68750

Downside Potential: 75 pips

Upside Risk: 20 pips

Risk/Reward Ratio: 3.75

In case the Force Index advances as price action attempts to pressure for a breakout, the AUD/USD could push higher without a short-term correction; this may reduce the longevity of the uptrend and make it vulnerable to collapse. The next resistance zone is located between 0.69104 and 0.69416. This was a previous support zone which pushed the AUD/USD above the key psychological 0.70000 mark from where the sharp sell-off in this currency pair materialized.

AUD/USD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 0.68950

Take Profit @ 0.69400

Stop Loss @ 0.68750

Upside Potential: 45 pips

Downside Risk: 20 pips

Risk/Reward Ratio: 2.25