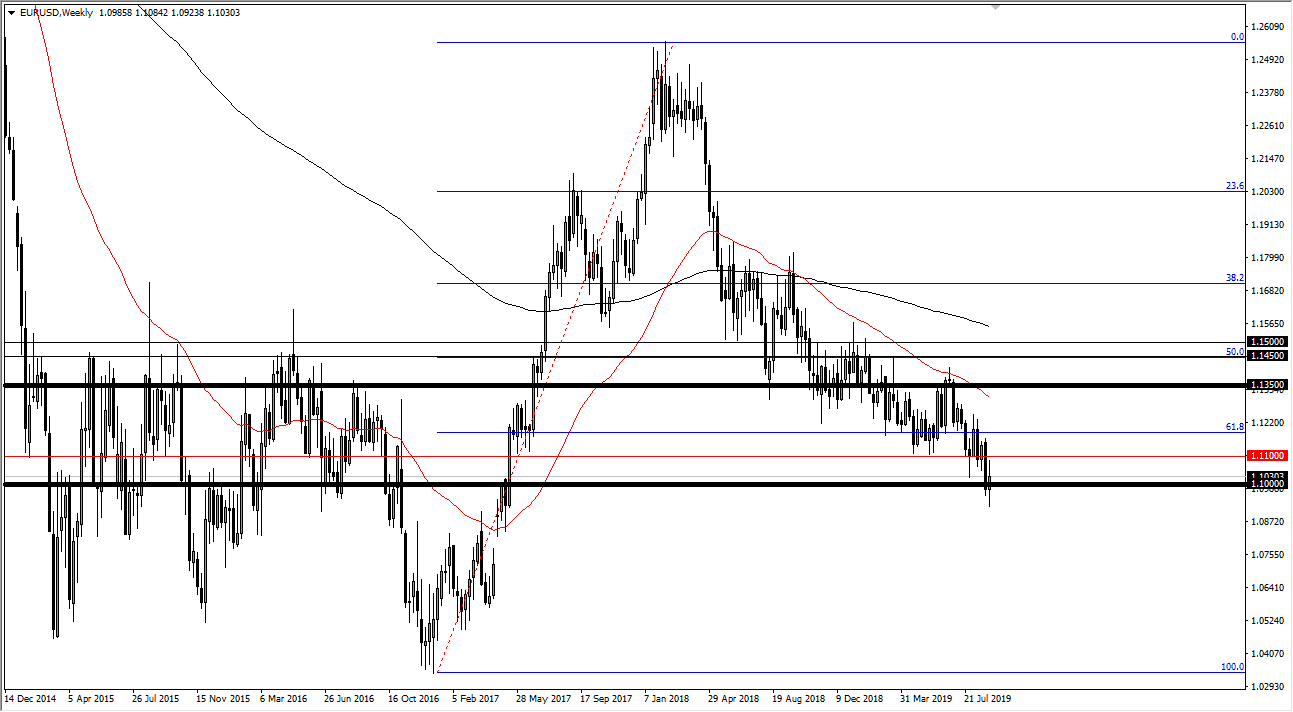

EUR/USD

The Euro has been all over the place during the past week, as we got below the 1.10 level. At this point though, it’s very likely that we will continue to see negative pressure but a short-term bounce could occur. The 1.11 level offer significant resistance that extends to the 1.12 handle. A move towards that level should be sold on the first signs of exhaustion, as negative yields in the bond markets of the European Union continue to throw money toward the Americans. If we break down below the bottom of the candle stick, then it’s likely that we continue our move lower. Longer-term I think we’re going after the 100% Fibonacci retracement level, which is closer to the 1.04 level.

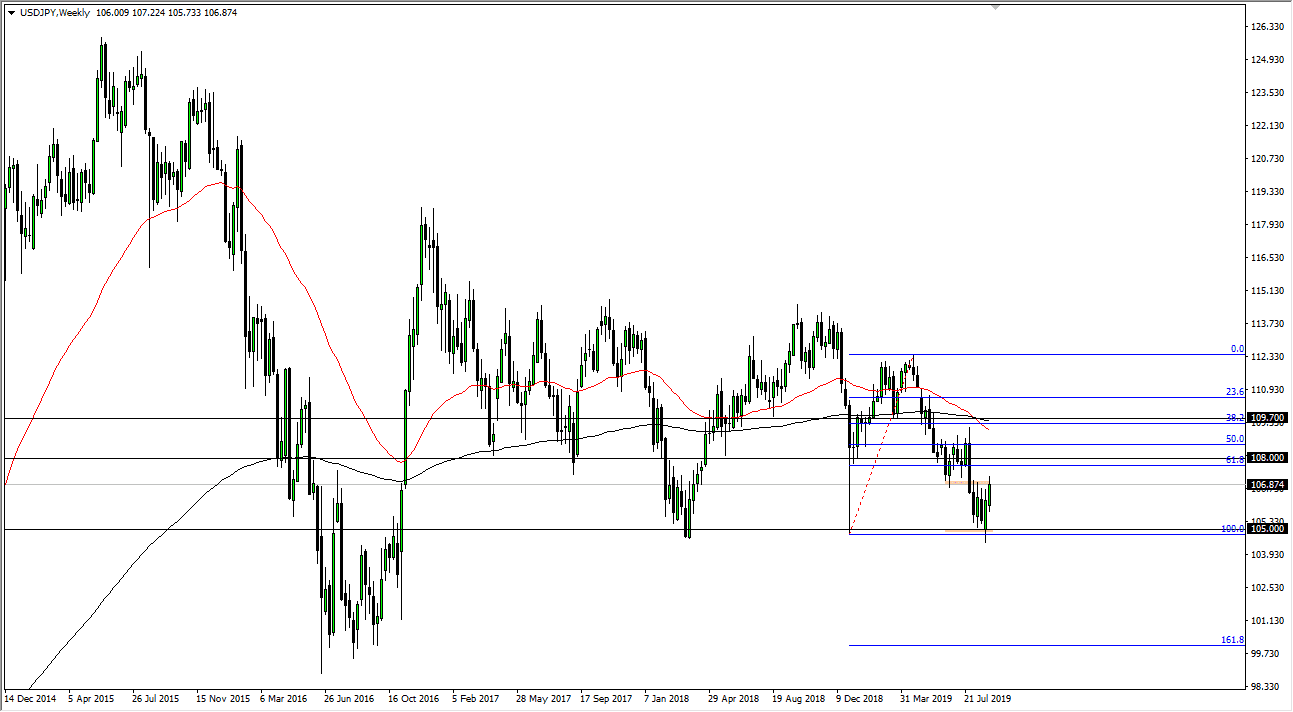

USD/JPY

The USD/JPY pair has had a slightly positive candle stick for the week, and now it looks like we could perhaps try to break above the ¥107 level. If we can get above there, then it’s likely that we could go towards the top of the breakdown candle from several weeks ago, meaning a move towards the ¥108.50 level. Signs of exhaustion will be sold though. Beyond that, it’s very likely that the market would consolidate between here and the ¥105 level. Either way, I have no interest in buying in I’m simply looking for exhaustion to take advantage of.

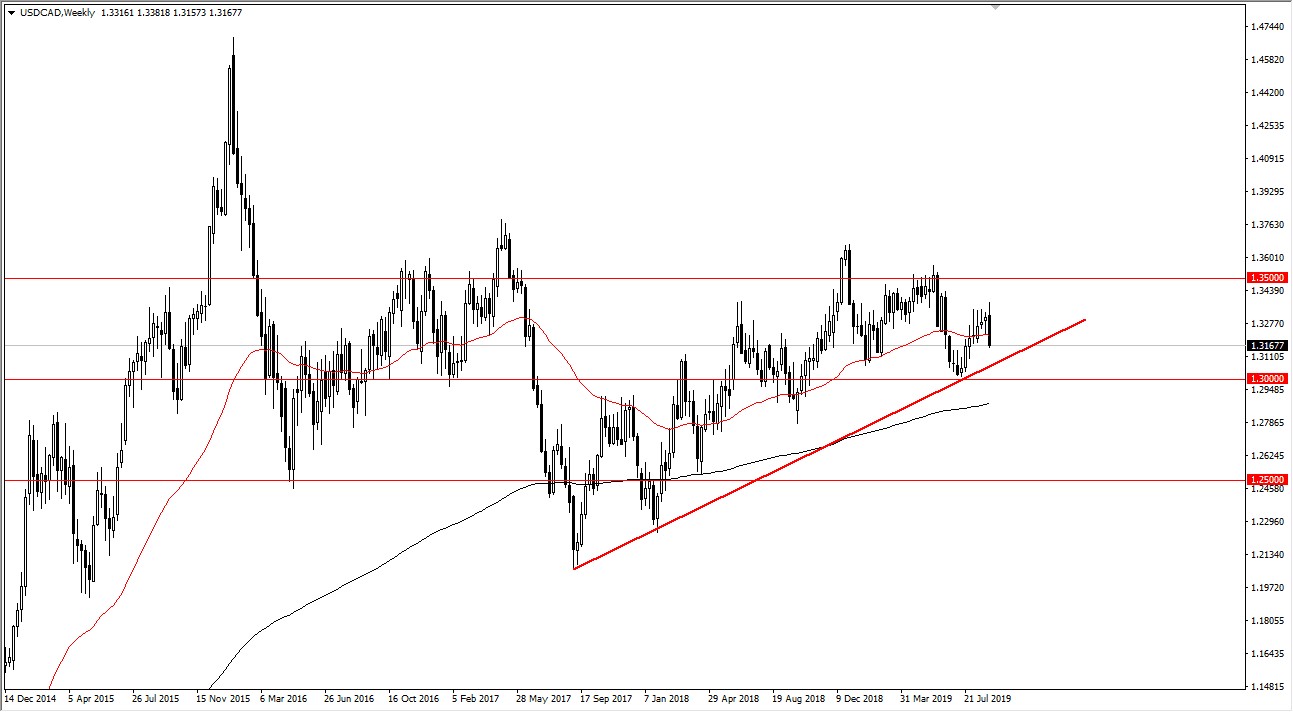

USD/CAD

The US dollar initially tried to rally during the week but has now broken distinctly down from there, as we have broken through quite a few of the previous week’s candles. With that being the case it looks as if we are going to run towards the uptrend line underneath. I think this will move right along with oil, meaning that of oil breaks out to the upside we will not only break down from here but we could very well break below the 1.30 level. All things been equal though, I would anticipate a slightly negative bias for the week.

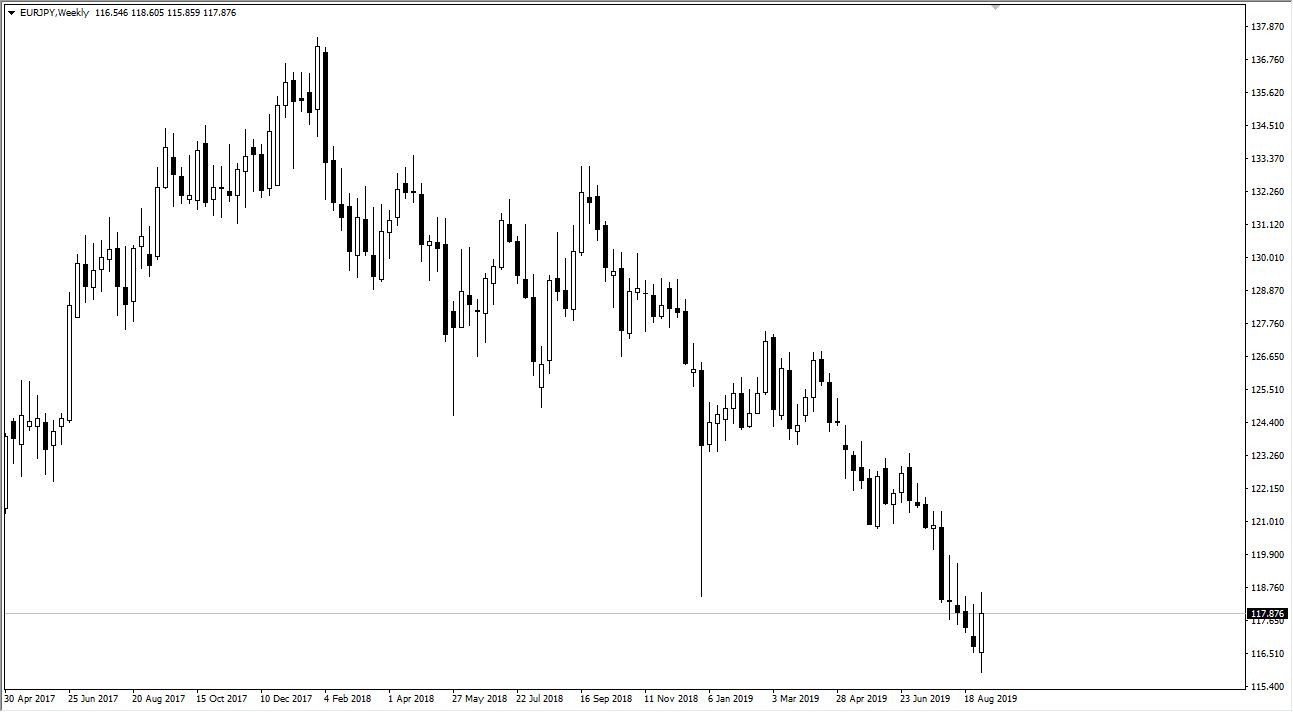

EUR/JPY

The Euro initially fell during the week against the Japanese yen but bounce significantly from there to break above the ¥118 level at one point. We did give back some of the gains, and I would be the first to point out that we have several long wicks just above the area that we are at right now. In other words, there are plenty of things to point at resistance above and therefore I’m looking to fade rallies although I am the first to admit that this was a rather impressive move.