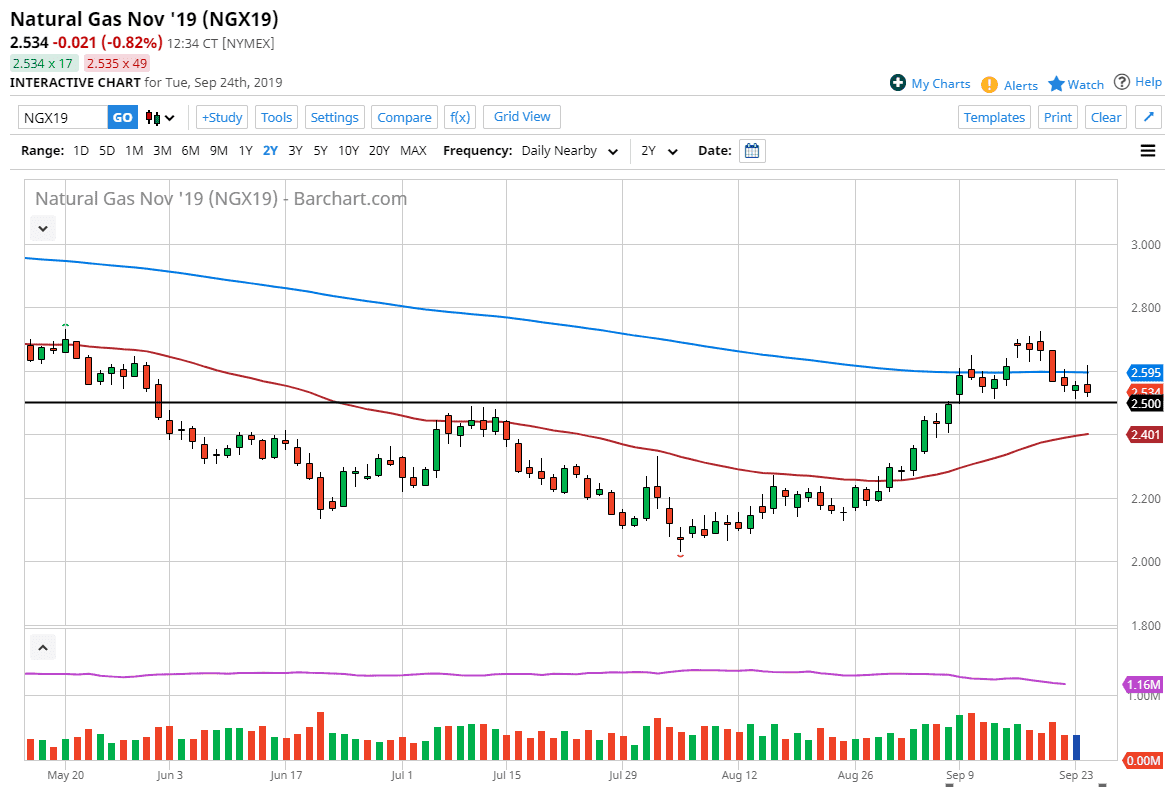

Natural gas markets initially rallied during the trading session on Tuesday but found enough resistance above the turn things back around near the $2.60 level. By pulling back the way it did, it suggests that natural gas isn’t quite ready to take off to the upside but certainly seems to be building a bit of pressure. Of particular note underneath is going to be the $2.50 level, an area that of course is a large, round, psychologically significant figure and has previously been both support and resistance in the past. Below there, the $2.40 level has the 50 day EMA sitting there, and that of course should attract quite a bit of attention anyway.

While the candle stick for the trading session on Tuesday looks very poor, the reality is that the natural gas markets may struggle to go higher in the short term, but longer-term we are looking at the wintertime pop that comes every year just ready to happen. We have recently broken above the 200 day EMA, so therefore it’s likely that we will make that attempt again. If we were to break above the highs from the Tuesday session that’s obviously a very bullish turn of events and will send all of the sellers from the session on Wednesday running for cover. That could be a huge push to the upside, reaching towards the highs again and beyond.

However, if we do break below the $2.50 level is very likely that we are going to see the $2.40 level, or at least the 50 day EMA right by offer a bit of support as well. We had recently seen a huge move to the upside so it makes sense that we will continue to see quite a bit of volatility but more importantly, upward mobility as we are trading the November front month contract. As demand in the United States and Europe starts to pick up for heating, the natural gas market should continue to go higher as they do every year. Based upon the recent run, the measured move is suggested to be to the $3.00 level in the short term, and ultimately as high as $3.50, but that probably won’t be seen until late December or even early January, just before the market rolls over and start selling off again when we start to focus on the Spring.