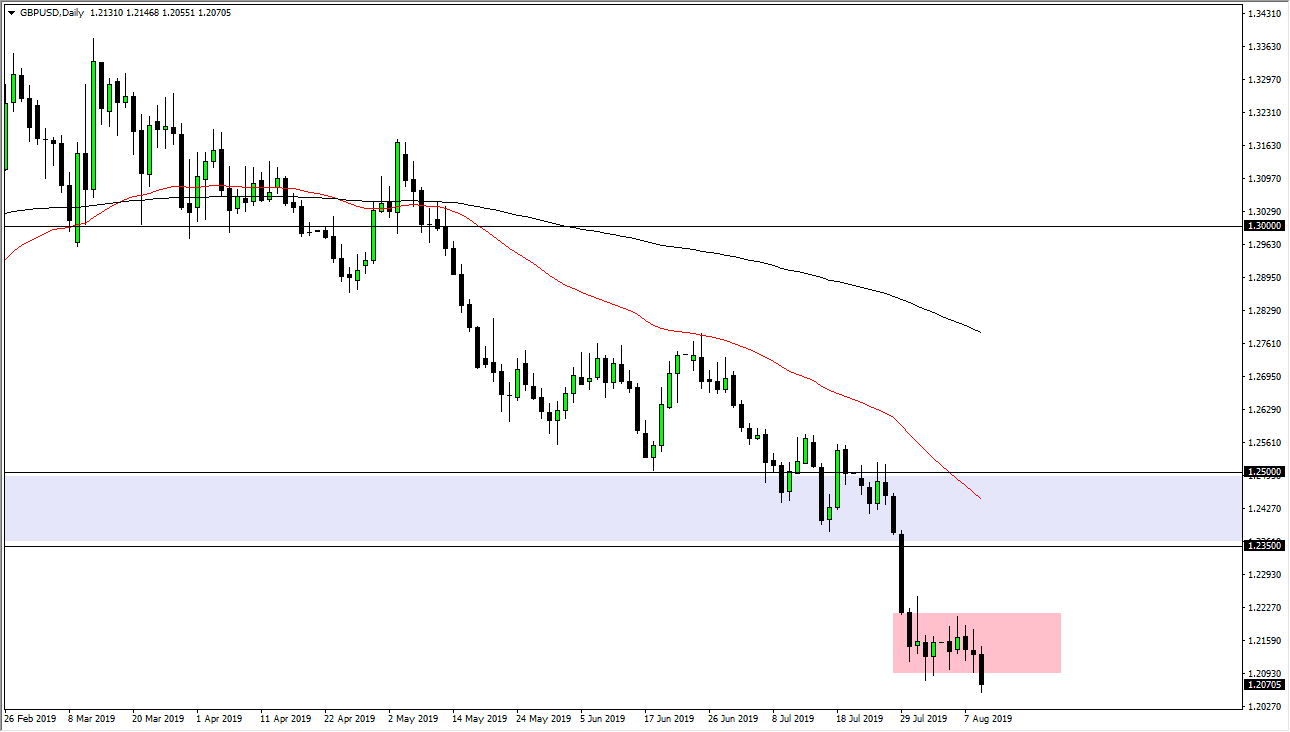

The British pound broke down a bit during the trading session on Friday, slicing through the 1.21 level, an area that has been offering a bit of support in the recent couple of weeks. The fact that we have broken down and are closing towards the bottom of the candle stick does in fact suggest that we are going to go lower. I think at this point the British pound is hell-bent on testing the 1.20 level underneath. Should that level be broken, and quite frankly I don’t see why it won’t, we should continue to go much lower, perhaps opening up the door to another 500 PIP loss.

In the short term, I suspect that any short-term rally will offer a selling opportunity and as soon as we can see some type of exhaustion we should jump on it. The US dollar is favored over many other currencies right now, and the British pound of course has the specter of the Brexit ahead of it. In other words, there’s too much uncertainty when it comes to the UK to think that we will continue to see British pound strength anytime soon.

As we are getting closer to the end of the timeline to extend the Brexit, it looks very unlikely that we are going to suddenly see the attitude of the British pound reverse. Ultimately, I think that the market will continue to see a lot of negativity, as the idea of a “no deal Brexit” becomes much more likely. The market participants will continue to favor the greenback over the British pound and once we break down below the 1.0 level I feel that a large amount of money will come back into this market.

To the upside, even if we were to break out I believe that there is enough resistance at the 1.2350 level and extending to the 1.25 level that we will see sellers at the first signs of trouble. After all, the US dollar is a bit of a safety currency, so it makes sense that the British pound suffers quite drastically against it through this very tough time. Eventually we will get a major “flush lower”, and that will be the beginning of the end. At that point, careers will be made by going long the British pound. We are not there yet, not even close.