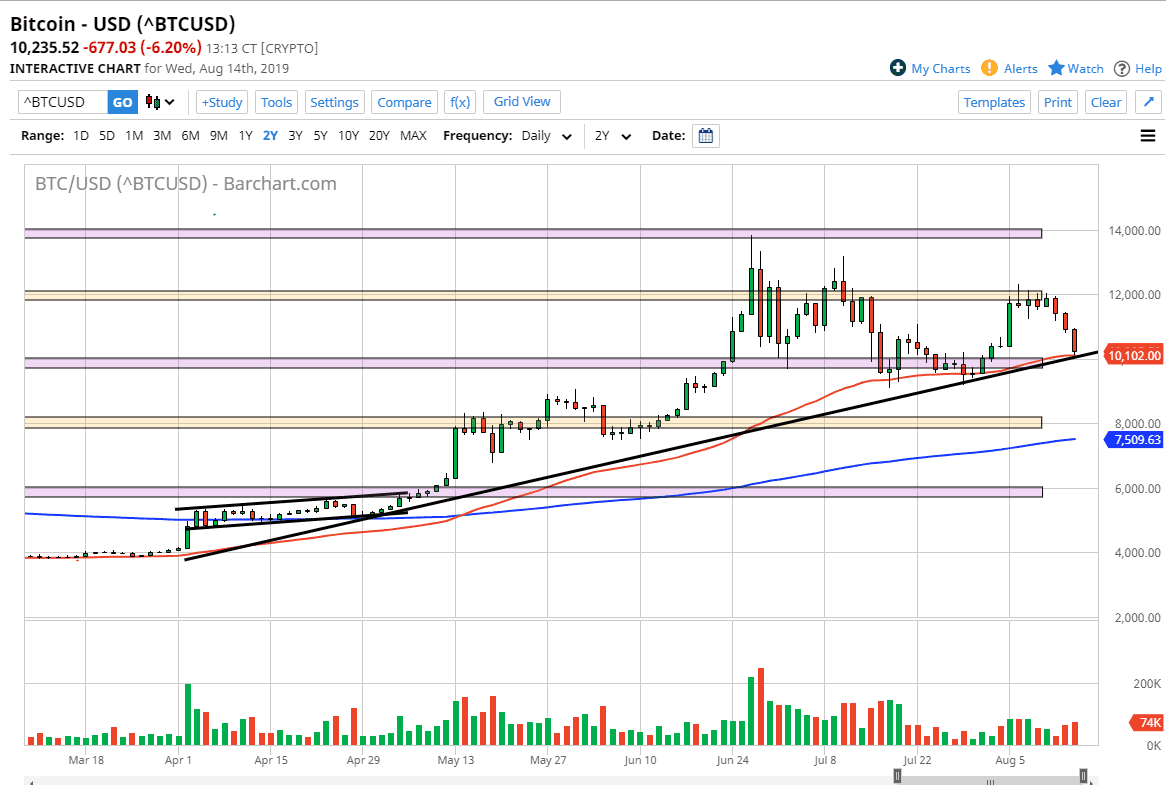

The Bitcoin markets broke down significantly during the trading session on Wednesday as we have reached down towards a pretty significant support level. The $10,000 level of course will attract a certain amount of attention, as the number is such a large, round, psychologically significant figure. At this point, we also have a confluence of other things coming into play, not the least of which of course is the uptrend line that we have marked on the chart right now.

We also have the 50 day EMA testing this area, so I think it’s only a matter of time before the buyers would come back in general. Looking at this chart, with those two major influences on the market at a large, round, psychologically significant figure, it makes sense that the market has stopped right here. The question is whether or not it will hold here, and there is certainly a lot of noise here just waiting to happen.

The candlestick of course isn’t that positive, as we are close to the bottom of the range, and it’s likely that we will continue to see a bit of softness. However, if the buyers are going to step in and pick up Bitcoin, it’s probably going to be right here. Ultimately, I think that the market will find a bit of a bit, especially considering there’s so much uncertainty out there. One of the major factors could be that the US treasuries are getting a massive bid during the trading session as we are continuing to find a lot of “risk off” trading. At this point, the market could act as a conduit of wealth protection, as we had seen recently. However, I’m also the first person to recognize that there does come a point in time where we break down.

As far as selling is concerned, if we were to break down below the $9750 level, then the market probably unwinds down to the $8000 level. That is an area that would also be supportive as well. Ultimately, any bounce at this time should attract a certain amount of capital into the market, sending the market towards the highs again. The market continues to find plenty of interest, and now that we are at this confluence, I think it’s only a matter of time before we make our move for the next $2000.