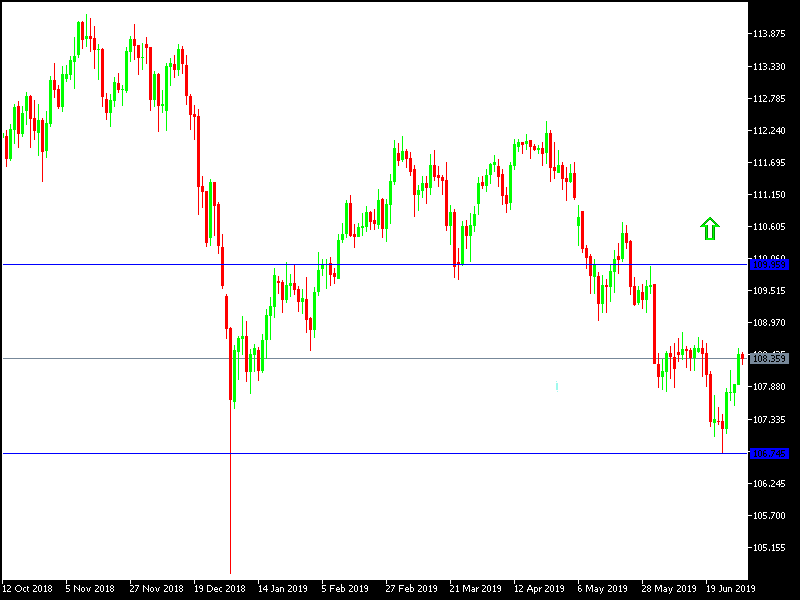

Weak US Economic Results stopped the USD / JPY recovery pushing it to 108.52 at the beginning of this week as investors were optimistic of the Trump and Xi agreement on the resumption of trade negotiations. The rebound was not strong as investors did not trust Trump and his policy, as they have negotiated many times, and then imposed more tariffs against each other. Technically, the pair will not be in the confirmation phase of the upside correction move without moving and stabling around and above the psychological resistance level of 110, otherwise the overall direction of the pair will remain bearish.

The pair's recent losses reached to the 106.77 support level, the lowest level in more than five months. Overall, the Japanese Yen will remain in the winning position continuously. The series of negative results of the US economic data continues to confirm the slowdown of the US economy and thus increase the expectations of the near date of the US interest rate cut.

The US Federal Reserve recently confirmed the possibility of a US interest rate cut if the US economy continues to slow down and does not specify a date and economic developments that will support the earliest date. Thus, the US dollar has fallen sharply against major currencies. The Central Bank of Japan continues to hold its monetary policy at its negative rate and expects no change in its policy as long as the global trade war is in place, which has strongly affected the Japanese economy.

The weakness of inflation levels and recent US job numbers have added pressure on the US dollar as it supports expectations of US interest rate cut by the US Federal Reserve to face a slowdown in the US economy. Japanese yen gains are still stronger against other major currencies as one of the safest safe havens with no strong signs of a near-end to the US-China trade dispute which threatens the future of the global economy.

Technically: As we had previously predicted, the stability of the USD / JPY below the 110.00 level will increase the bearish momentum of the pair, and the pair has reached the levels we expected in the previous technical analysis which is closest to the next psychological support at 107.00 and then the following support levels will be 106.45 and 105.80 respectively. These levels confirm the strength of the downward trend. On the upside, the nearest resistance levels are 108.70 and 109.55, respectively. We still prefer to buy the pair from every bearish bounce.

In today's economic data, the economic calendar today does not have any important data from the U.S or Japan. The pair will monitor with caution and interest the renewed global geopolitical concerns, and all about Trump's internal and external policy.