The New Zealand dollar has seen a bit of a resurgence after the central bank meeting, which is a bit ironic considering that the Royal Bank of New Zealand suggested interest rate cuts are coming. Ultimately, this is a pair that is probably going to react to overall risk appetite around the world. In other words, it’s very likely that this pair will be very sensitive to the US/China trade talks during the G 20 meetings.

The New Zealand dollar of course is very sensitive to China itself, just as the Japanese yen will be. In other words, it makes sense that the New Zealand dollar would rally against the Japanese yen if we are feeling like we are ready to take on a little bit of risk. After all, the Japanese yen is considered to be one of the ultimate safety currencies out there.

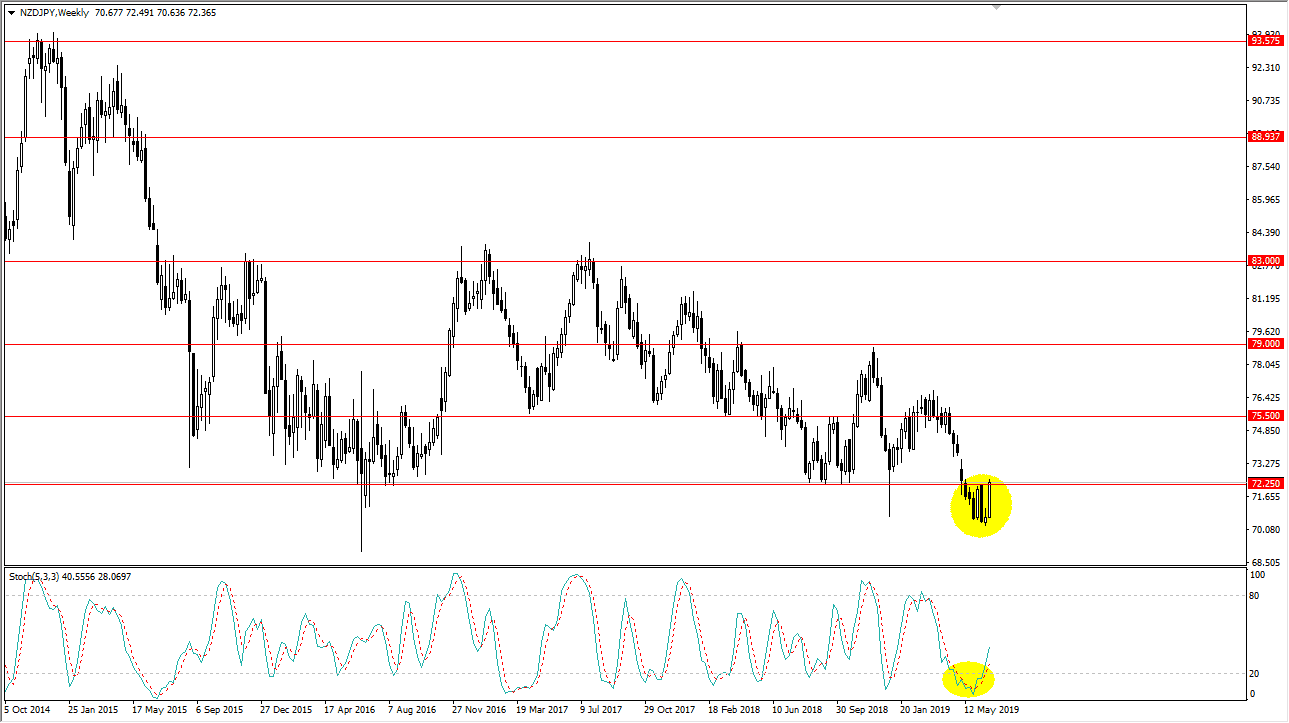

From a technical standpoint, the ¥72.25 level is an area that has offered resistance, so it’s likely that a break above there signifies that we are ready to go higher. We will more than likely go looking towards the ¥73.50 level which is the gap above. I also believe that we could go above there if we get some type of good news out of the US/China talks. Beyond that, you can see that the Stochastic Oscillator crossed in the oversold situation area just as we are starting to turn back around. This suggests that perhaps we are going to have a bit of a bounce and then possibly even a return to the top of the consolidation area over the last couple of years. That could mean a potential move to the ¥83 level. Obviously, that takes a long time to get to, but I do think that we are more likely to see upward pressure in the month of July than downward.