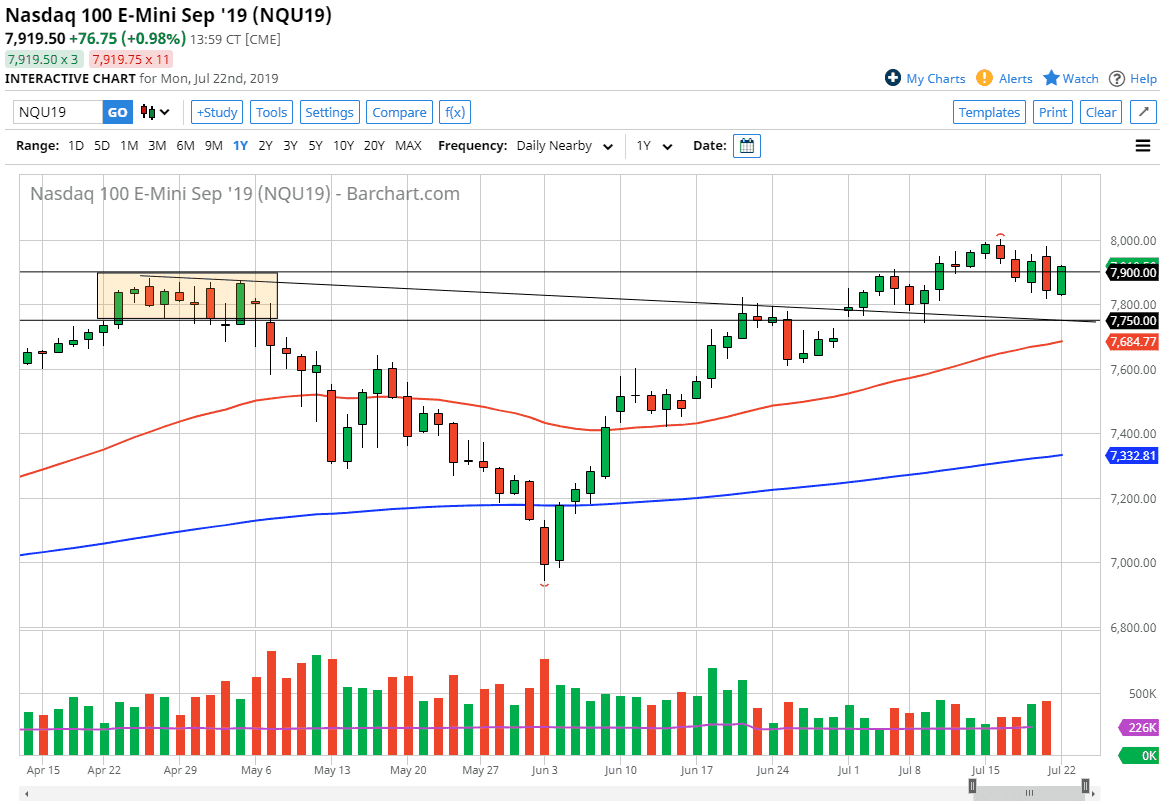

The NASDAQ 100 rallied a bit during the trading session on Monday, breaking above the 7900 level. By doing so, the show signs of strength in of course resiliency. After all, the markets have been relatively quiet as of late, and it looks as if we are trying to figure out where to go next. I like the idea of going long NASDAQ 100 contracts, simply because the market has pulled back from a major level, which is something that you would expect before we eventually break to the upside.

The importance of the 8000 handle

The importance of the 8000 handle is something that I cannot stress enough. The large, round, psychologically significant figure of course attracts a lot of attention, as there would have been a significant amount of profit taking in that region. Ultimately, this is a market that should continue to test that level, and eventually when we break the 8000 handle, that should be the next leg up. With the Federal Reserve likely to cut interest rates, I think it’s only a matter time before the NASDAQ 100 rallies, right along with many other stock markets and indices.

Massive support underneath

The 7750 level is massive support, as it is the scene of a gap, and of course an area where we had formed a nice-looking hammer a couple of weeks ago. Beyond that, we also have the downtrend line that I have drawn on the chart that intersects that area, just as the 50 day EMA is going to. With all of these supportive indications in the same region, it makes sense that it’s only a matter time before the buyers would return on any revisit to this level.

What I plan on doing

At this point I believe that the trade is relatively simple, we simply go along every time it offers value. I believe that’s what happened with most traders on Monday, and I think that will continue to be the case. The 7750 level is massive support, and I think it’s only a matter of time before we get a buyer in that area as well. Beyond that, if we can break above the 8000 handle, we could go much higher and then reached towards the 8100 level.

With the Federal Reserve cutting interest rates and the possibility of the President possibly looking to calm down trade tensions between the Americans and the Chinese in an election year rather soon, that could also drive the NASDAQ 100 to the upside. All things being equal though, it’s likely that the choppiness will continue to cause issues, but I think that the buyers will continue to support the NASDAQ 100 going forward. I believe that once we get past the 8000 handle it should attract fresh new money, as it will clear a major barrier that people are worried about.

However, if we get a daily close below the 50 day EMA I believe that the market will reach towards the 7600 level, and then eventually the 7500 level after that.