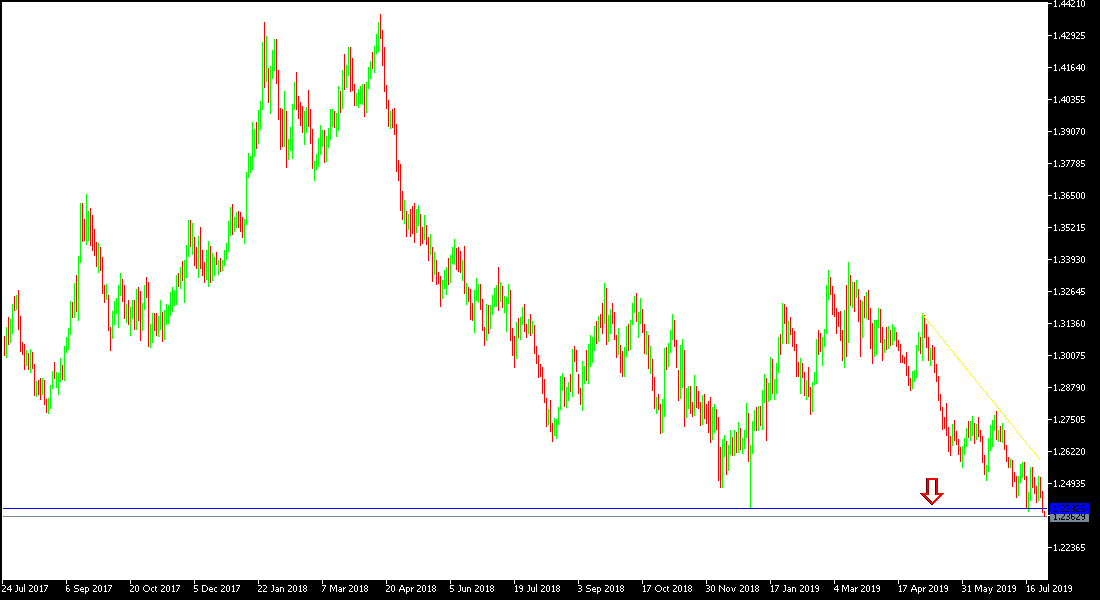

As we have consistently predicted, the pound will remain under pressure due to the fears of the future of the Brexit. This is after the victory of Boris Johnson, the British prime minister, replacing Teresa May, who believes that his country is ready to leave the EU without a deal, and does not care about global warnings of doing so. In light of this concern, the GBP / USD has been subjected to more pressure, and moved towards the 1.2360 support level at the time of writing, the lowest in 28 months. Losses will not stop as long as the future of the Brexit is ambiguous and may test stronger record and historical support levels if there is no hope of an agreement between the EU and Britain that ensures trade relations that will revive the economies of both sides.

Johnson stresses that he will make every effort to get Britain out on time, October 31, whatever the events and procedures, even if leaving the EU without a deal, and he is ready to renegotiate with the EU on the terms of the agreement with Theresa May, which was rejected by the British parliament and was the reason why May resigned from her post. In contrast, the US dollar gained strong support with the announcement that the country's GDP growth slowed to 2.1% against expectations for a 1.8% slowdown from 3.1% in the previous issue. The USD will have an important date this week as the Federal Reserve announces its monetary policy amid expectations that they will cut interest rate by a quarter point to meet the risks facing the world's largest economy, and then the market will focus on official US employment figures.

Technical analysis: GBP / USD will remain within the range of its standard bearish channel and will remain ready to test record support levels that may reach 1.2290 and 1.2200 areas, including the 1.2000 psychological support, respectively. On the upside, we did not see any signs of a near correction even though all the technical indicators and on all the time frames, have reached oversold areas. Overall we still prefer to sell the pair from every ascending level. The pound remains under threat of any negative development for the future of the Brexit.

On the economic data front: the economic calendar today have UK data including mortgage approvals, net lending to individuals and cash supply. There are no significant US data today.