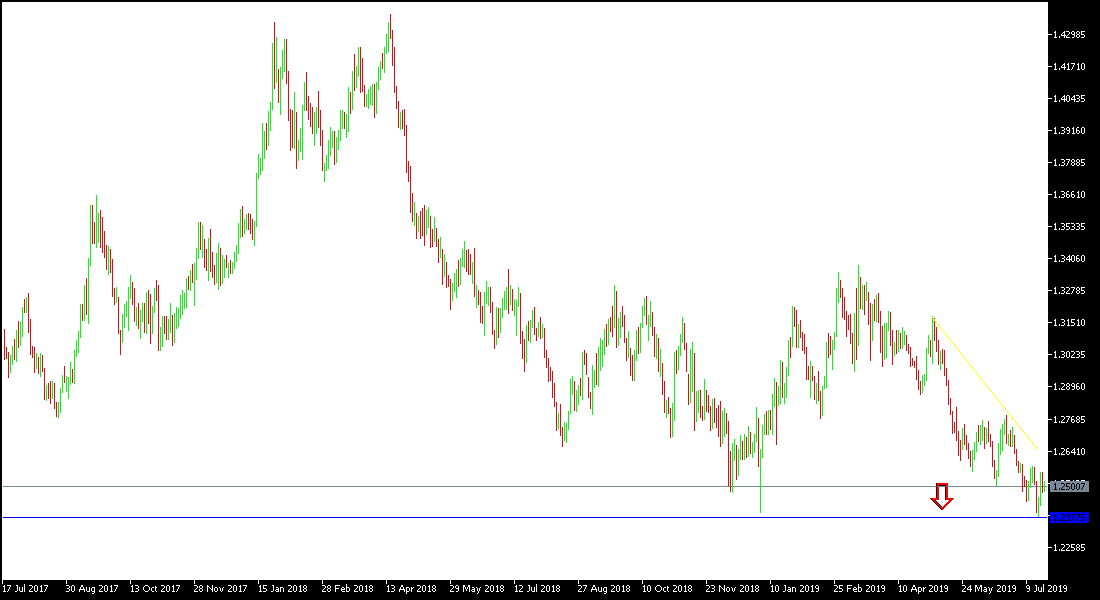

The British finance minister threatened to resign this week because there are no updates to the future of the Brexit, as the situation is in stalemate. The EU is waiting for the new British prime minister as the time is running towards the official Brexit deadline on Oct. 31, and expectations are growing that the country is on its way to leave without a deal with the Union, which would hurt Britain more than the rest of the Union, as what the British offer the EU can be compensated, while what the Union offers to Britain cannot, and will negatively affect the British economy and the pound sterling. GBP / USD's rebound attempts over the past week have reached 1.2556 and settled at the beginning of this week around the 1.2485 support level at the time of writing.

The pair will have an important date this week with the release of the US GDP figures. If data were as expected or below expectations, the financial markets will confirm that the Federal Reserve will cut US interest rates when it meets next week to determine its monetary policy. But expectations among economists about the extent and duration of the cut are variant, with ones that support the possibility of a quarter-point cut and monitoring economic developments, while others suggest a half-point rate cut to meet the strongest risks to the US economy, especially as the trade dispute with China continues. .

Investors do not care about the pound testing of historic buying levels, as the future of Brexit continues to uncertain, despite expectations that the Federal Reserve will cut interest rates.

Technical Analysis: The general trend of the GBP / USD is still more bearish and testing stronger support levels could push it towards 1.2455, 1.2380 and 1.2200, respectively. Any attempts by the pair to make gains will remain targets for investors to sell the pair again. There are no signs of a reversal of the bearish trend. At the same time, the 1.2580, 1.2660 and 1.2720 resistance levels will remain closest to any attempts of an upward correction. We still prefer to sell the pair from every ascending level. The pound is still under threat of any negative development for the future of the Brexit.

On the economic data front: Today's economic agenda has no important economic data either from Britain or from the United States of America.