The price of the pound is getting worse in the Forex market. In yesterday's analysis, we confirmed that the GBP/USD is preparing for stronger losses. The pair is stable around 1.2450 support at the time of writing. The UK's political administration is increasing pressure on the Pound, as until now, it is unknown who will succeed Teresa May as the prime minister and manage the Brexit, leaving financial markets and investors waiting and anticipating. The official Brexit date is approaching, so expectations are growing daily that Britain may eventually have to leave the EU without an agreement that would preserve its access to European markets. These concerns contributed to the discrepancy between the results of economic data from the United Kingdom, which confirms that the economy is suffering.

The US dollar will have an important date with the release of the US GDP figures by the end of the week. If the data are as expected or below expectations, the financial markets will confirm that the US central bank will be forced to cut US interest rates when it meets next week to determine its policy. Expectations indicate that the bank will cut interest rates by only a quarter of a point, and on the other hand, there are expectations of a half-point cut in interest rates, and all we can do is to wait.

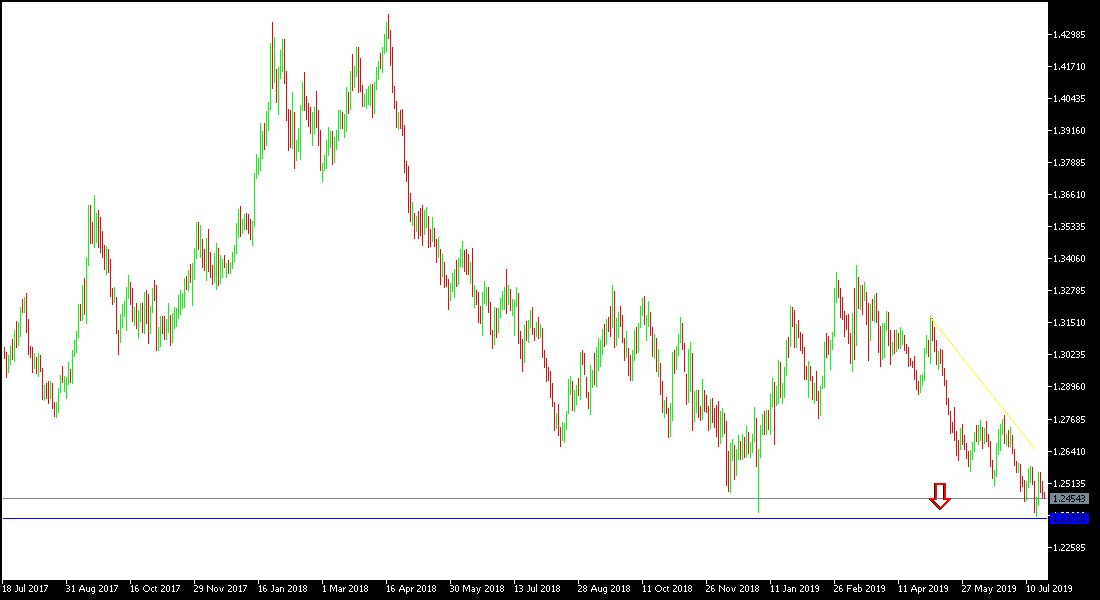

Technical Analysis: The general trend of the GBP / USD remains bearish, and after testing the first support stations that we expected, the nearest areas will be closer to 1.2380 and 1.2200 respectively. On the upside, any attempts by the pair to make gains will remain targets for investors to sell again. Currently, the resistance levels 1.2580, 1.2660 and 1.2720 will be the closest to any attempts for the pair bullish correction. We stick to recommend selling the pair from each ascending level. The pound is still under threat of any negative development for the future of the Brexit.

On the economic data front, the economic calendar today will focus on the US data on Existing Home Sales and the Richmond Industrial Index.