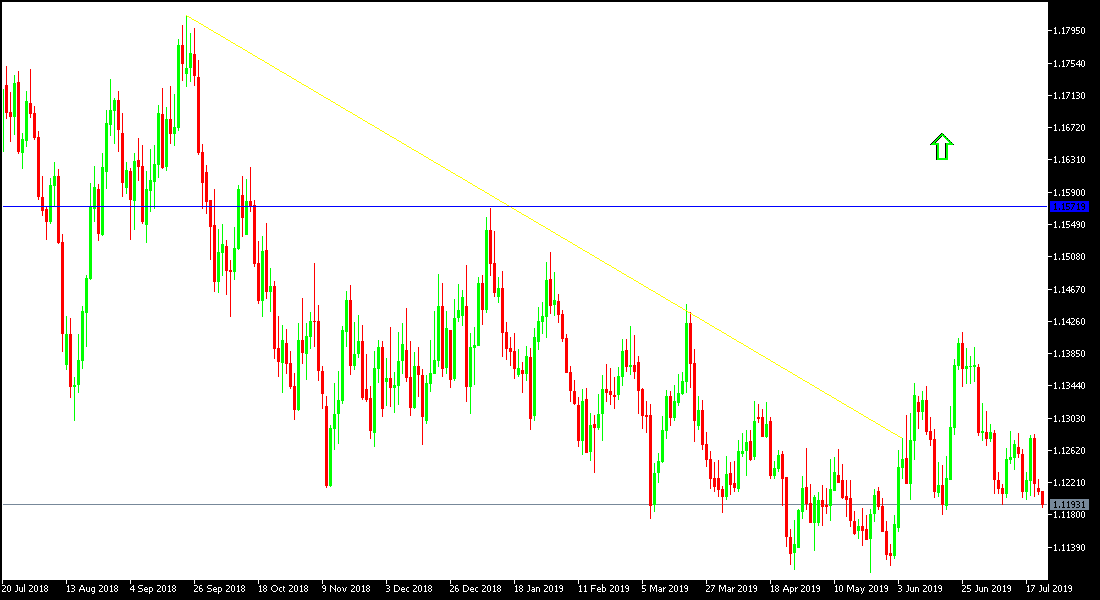

In the 20-point range, the movements of the EUR/USD pair during yesterday's trading, and we expected calm movements in narrow ranges in the absence of any important data affecting the performance of the pair. By the beginning of today's trading, the pair moved down to the 1.1190 support level, and in the latest technical analysis we expected the bearish pressure to continue and that the move below psychological 1.1200 support will increase momentum to test stronger support levels. The Euro has an important date this week with the announcement of the ECB's monetary policy, with expectations strongly suggest that the bank will keep interest rates unchanged around the zero level at this meeting. There will be cautious anticipation of the monetary policy statement following the interest rate decision, and then the tone of the bank’s governor, Mario Draghi's comments to predict the bank's plans to face the continued slowdown of the Eurozone, economy as the global trade war continues.

On the other hand, the US central bank very close to reducing US interest rates to counter the possibility of a slowdown in US economic growth, which recently witnessed its longest growth chain in the history of the United States. Investors will watch GDP growth figures by the end of this week amid expectations that the US economic slowdown will start. If results are less than expected, financial markets will immediately price the US interest rate cut, possibly at the Federal Reserve meeting by the end of next week. If that happens, US stock markets will continue to make record gains.

Technically: The general trend of the EUR / USD has continued to support the bearish move, as the Eurozone economy continues to slow. We still prefer to sell this pair from every ascending level, and the stability below 1.12 psychological support will support the performance to move towards the support 1.1170, 1.1060 and 1.0980 levels, respectively. On the upside, attempts to rebound may target the resistance levels at 1.1285, 1.1355 and 1.1445, respectively. Overall the price of the pair is holding onto the move within a stronger bearish channel.

On the economic data front: The economic calendar today will focus on the announcement of existing home sales in the United States, along with the Richmond industrial index. There are no significant data from the Eurozone.