At the beginning of this week's trading, the EUR / USD pair is settling around the 1.1100 support level, the lowest for two years. The US dollar gained additional momentum from last weekend's data on GDP figures, which slowed by 2.1%, as oppose to expectations of a stronger 1.8% slowdown, than 3.1% growth in the previous quarter. The US economic slowdown has not been strong, and therefore, the dollar has not suffered a major shock, rather continued to make gains against other major currencies. But gains in the dollar could be under threat this week, as financial markets cautiously await the Federal Reserve's announcement of its monetary policy amid expectations that it will cut US interest rates by a quarter point to counter the US economic slowdown. At the end of trading, the pair will be on another important date, which are the US official employment numbers.

The divergence of economic performance and monetary policy of both the Eurozone and the US will be in favor of the US dollar. Last week, the ECB kept the interest rate unchanged at 0.00%, but the monetary policy statement, according to Mario Draghi, indicated that the bank is determined to provide more stimulus plans for the Eurozone economy, which is suffering from a slowdown due to the continuation of the global trade war. Economists explained this trend as to indicate that the bank may think in the future of the negative interest in addition to the plans to buy bonds again, which had been abandoned in the past.

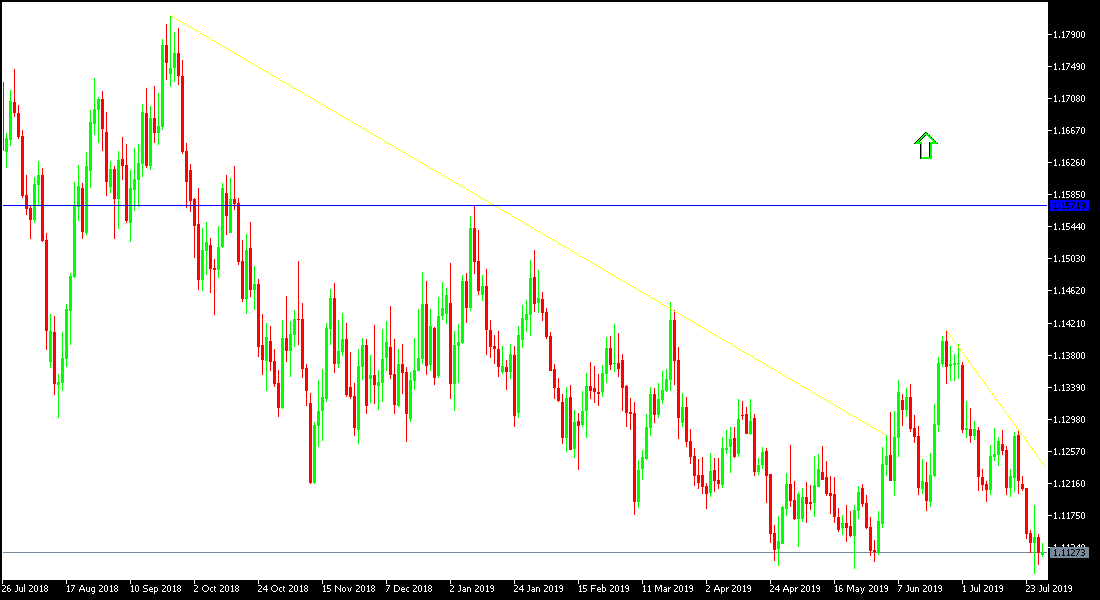

Technically: EUR/USD is holding to the move within its strongest bearish channel around 1.11 psychological support, the last for two years, supporting the strength of this trend. Moving below it will support the trend towards the support levels 1.1045, 1.0980 and 1.0900, respectively. On the upside side in the event of a correction, resistance levels may target 1.1200, 1.1285 and 1.1345, respectively. The pair is still bearish and it is still the best to sell from every ascending level.

On the economic data front: The economic calendar today is free of any important data either from the Eurozone or from the United States of America.