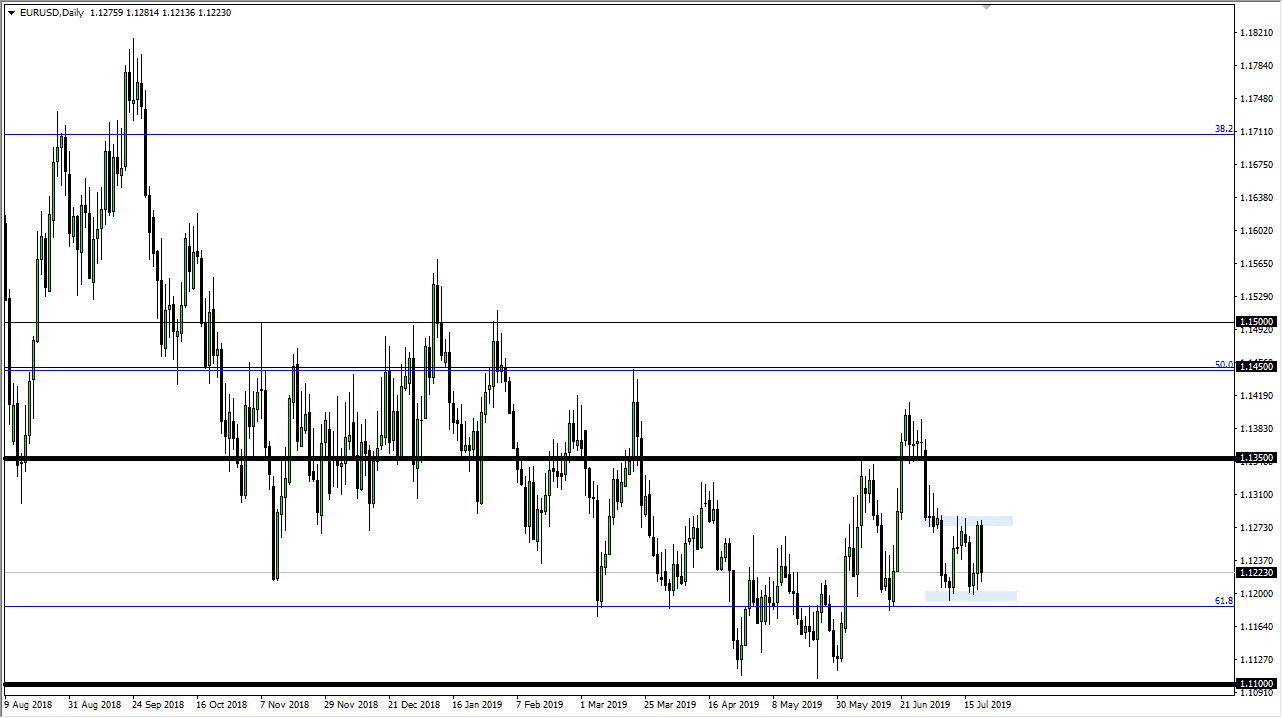

The Euro fell during the trading session on Friday, perhaps carving out a significant trading ranges again. We have seen a lot of resistance at the 1.13 level, but we have also seen the lot of support down to the 1.12 handle. At this point, there’s really nowhere to go as we are simply shopping around. That being the case though, it’s very likely that the central banks are starting to come back into the fray. With that being the case, it’s very likely that the market will continue to pay attention to the noise.

The European Central Bank continues to talk about easing its policy, and beyond that they are buying everything that even looks like a bond in the European Union. This is adding liquidity to the markets, perhaps trying to support a very weak economy. At the same time, you have the Federal Reserve looking to cut interest rates, which is supposed to be an “insurance cut”, which sounds like a lot of nonsense to me. If we are currently in a strong economy there should be no need for interest rate cuts, but never mind that. What this market is focusing on is the fact that neither one of these currencies look to be particularly strong, so having said that it’s likely that the market doesn’t have a lot of conviction one way or the other.

Looking at the longer-term charts though it does appear that we are trying to form some type of rounded bottom, so that could send this market to the upside. This would be a longer-term move though, so unless you are an investor, you really can’t do much with that information. In the short term I think you are probably better off to go back and forth between these two levels on a short-term range bound type of system, and with smaller positions. I would not risk a ton of money in this market because eventually we will get a breakout and it could be rather impressive. To the upside, the 1.1350 level is resistance, just as the 1.11 level underneath is massive support. However, we have to get there first, and that is difficult to do. In the short term I think we simply go back and forth as we can see where we have had one bullish candle followed by another bearish candle and so on.