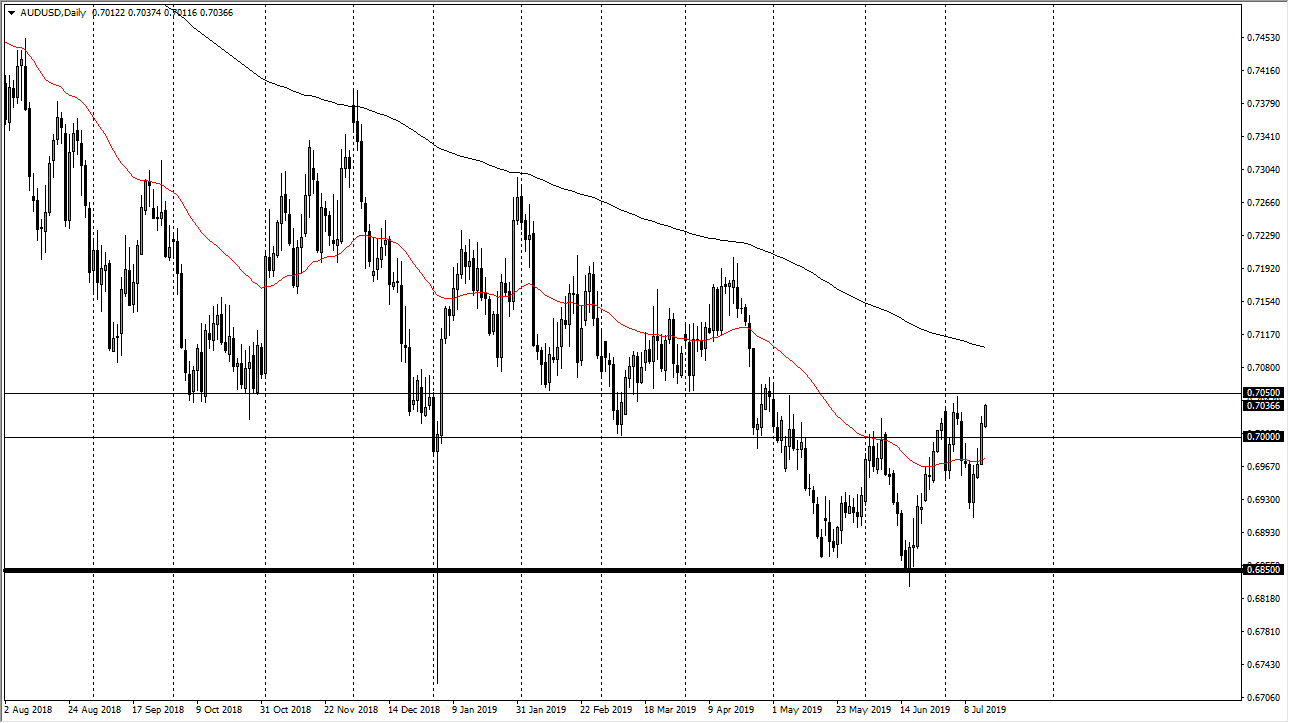

The Australian dollar has rallied a bit during the trading session on Monday as we have returned from the weekend. This is a market that has been strong for some time, and it is starting to try to break out to the upside. That being the case, if we can break above the 0.7050 level, then it’s very likely that the market will continue to go higher, perhaps reaching towards the 200 day EMA. Ultimately, the Australian dollar is trying to turn things around and at this point it looks very likely that the bottoming pattern could continue.

The Australian dollar is very highly linked to the Chinese economy, so if the Chinese economic numbers can continue to surprise like they did on Monday, that could also help the Aussie. The Australian dollar of course is highly levered to the Australian economy which provides so much of the hard materials for the Chinese. Another thing that helps this pair go higher is the fact that the Federal Reserve is looking to cut interest rates, so that bounce off of the US dollar in general.

Of further interest will be the Gold markets, so at this point if we can continue to see Gold rally, then the Aussie could get a bit of a boost due to the fact that the Australian’s export so much gold. Short-term pullbacks at this point should be buying opportunities, and I do think that the 50 day EMA will come into play underneath offer support. That being said, I think that we are trying to turn things around and so at this point it’s very likely that the market should continue to find buyers.

We have made “higher lows” which of course is a sign that we are starting to enter an uptrend. The 50 day EMA is starting to turn up a little bit higher, so at this point we are starting to see at least a significant attempt to turn things around. These are slow moves though, especially considering how negative the Australian dollar has been and for how long it has been that negative. The 0.6850 level has offered a hard floor recently, and now the question is whether or not we can break above the 0.7050 level. If we do, that’s the beginning of something rather special from what I see but it will also be very noisy, choppy, and difficult.