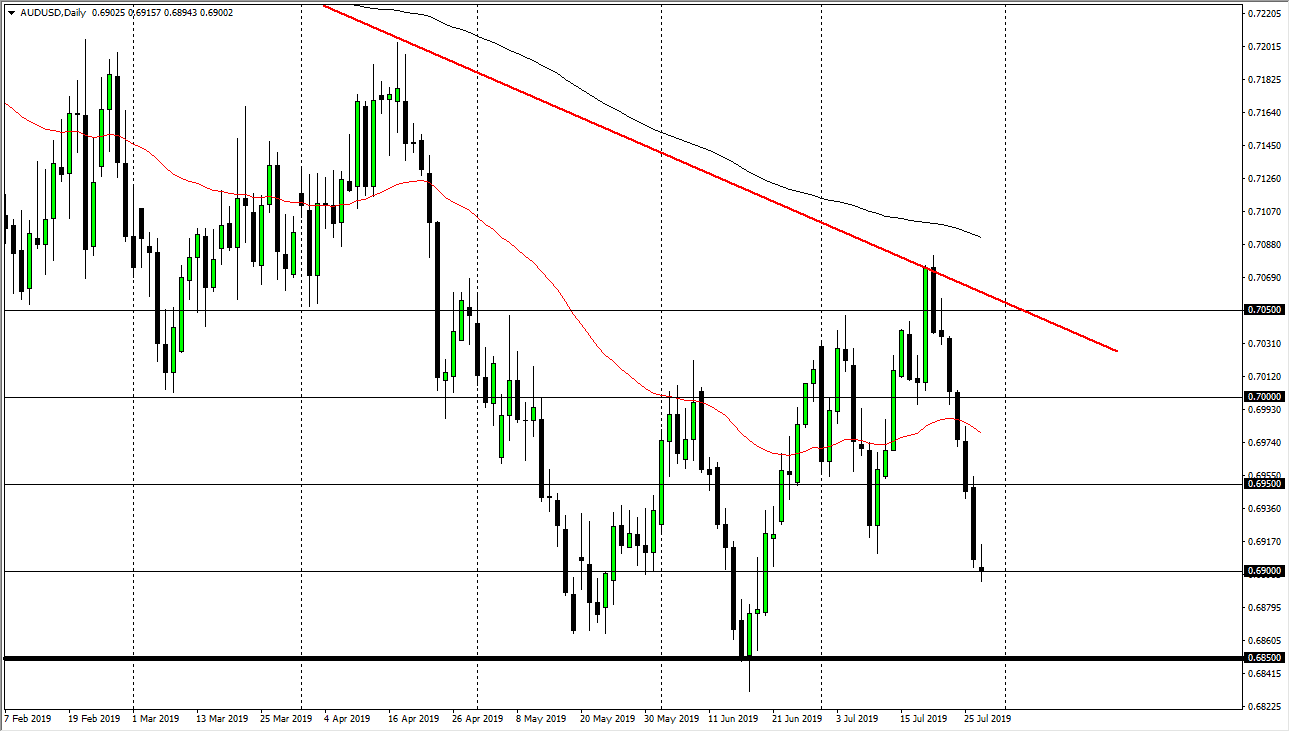

The Australian dollar gapped lower on Monday, turned around to rally during the day, but gave back those gains to form a very bearish looking candle stick. By the time the Americans were closing out the trading session it looked as if we were going to form something akin to an inverted hammer, which of course is a bearish candlestick. If we can break down below the bottom of that it is a sell signal but at this point I think it’s very likely that the 0.6850 level should offer a bit of support.

Looking at this chart, if we were to break above the top of the candle stick it would be very bullish, perhaps reaching towards the 0.6950 level. In fact, this looks as if we are going to continue to be attracted to 50 pip increments as we did in the past. The Australian dollar has been getting hammered by the USD/China trade situation and of course the global slowdown. Beyond that, we have the Federal Reserve meeting this week, that of course will determine the direction of the US dollar in general. I think at this point, the US dollar is likely to get a little bit of a head due to the fact that we are going to get an interest rate cut, but the reality is that the statement is going to have a lot to do with where the USD goes, and at this point I think that if they are going to signal further rate cuts, that could help the Australian dollar. That being the case though, we have a couple of days of waiting between now and then, so I would expect a lot of choppiness and very little but negative moves as we await the next trade.

I suspect that it’s going to be a scenario where the next big trade will present itself Wednesday afternoon in the United States, as we need to wait and see what the Federal Reserve says in the statement more than anything else. That being said, if for some reason the Federal Reserve doesn’t cut rates, this market will slice rate through the bottom and go screaming towards the 0.68 support barrier. With a lack of economic drivers between now and then, is very likely there isn’t much to do rather than look for the reaction in a couple of days.