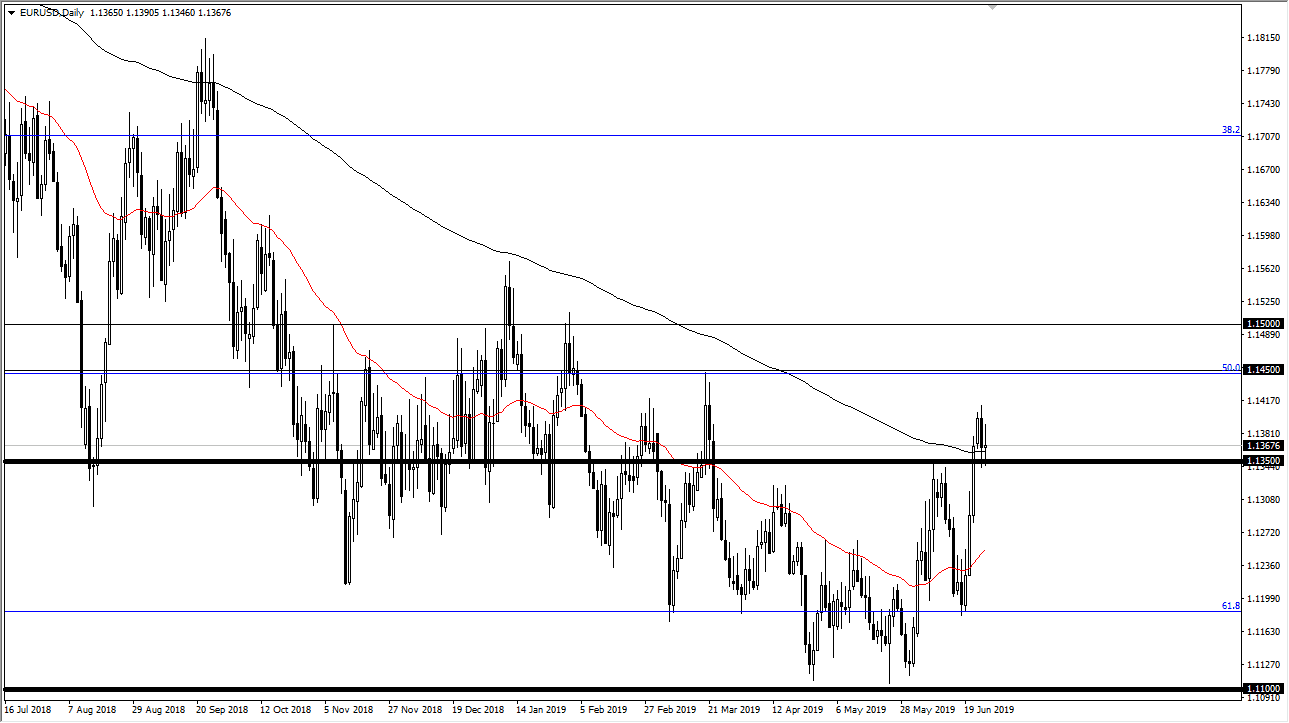

EUR/USD

The Euro has gone back and forth during the trading session on Wednesday as we continue to dance around the 200 day EMA. By forming a relatively neutral candle stick, it looks as if the market could rally but we obviously have already come so far in such a short amount of time. The market looks as if it is going to kill time at this area before we get another move to the upside based upon what I see. That being said, we could break down below the 1.1350 level and roll back a bit, but I think that the market is trying to build up the necessary momentum to turn the overall uptrend as we have seen so much in the way of change in the attitude of central bankers, especially the Federal Reserve.

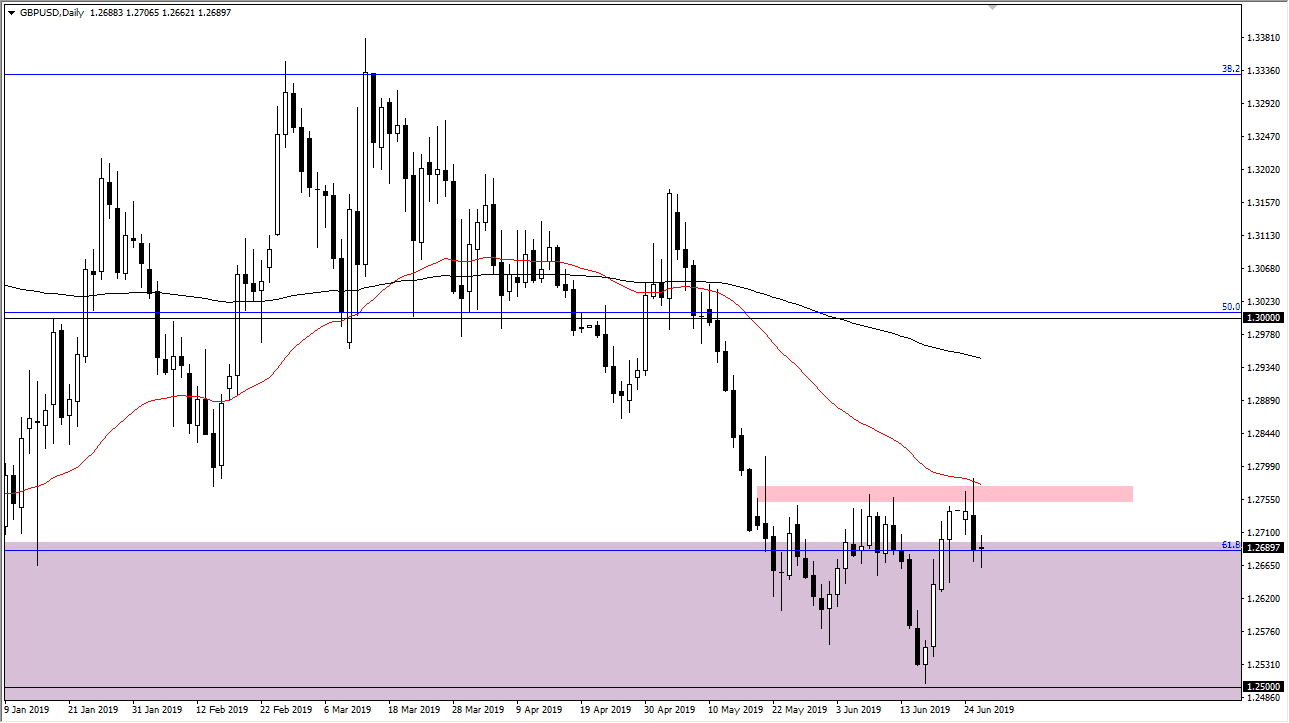

GBP/USD

The British pound has gone back and forth during the trading session on Wednesday, forming a relatively neutral candle as we broke down below the bottom of the negative candle stick from the previous session. At this point, it looks very likely that the market is going to continue to try to break down, but a short-term bounce could be coming. However, if we turn around and break above the top of the candle stick from the Tuesday session that would be extraordinarily bullish. That would clear the 1.28 level, and then perhaps reach towards 1.30 level.

Break down below the bottom of the candle stick for the Wednesday session could unleash selling pressure and send this market much lower. At this point, I think that the market is essentially going to treat the candle stick from the Wednesday session as a “binary event.” We will simply go whichever direction we break from.