The US dollar rallied significantly against the South African Rand as you would expect, as the global markets sold off rather drastically. Because of this, the market favors the greenback as far as safety is concerned, so it’s very likely that emerging market currencies such as the Rand will continue to suffer. That being said, the entire global situation is a bit skittish to say the least, and the occasional headline will come across that can throw the greenback and most certainly these emerging market currencies around. With that in mind, we will need to look to the larger picture in order to do any serious trading.

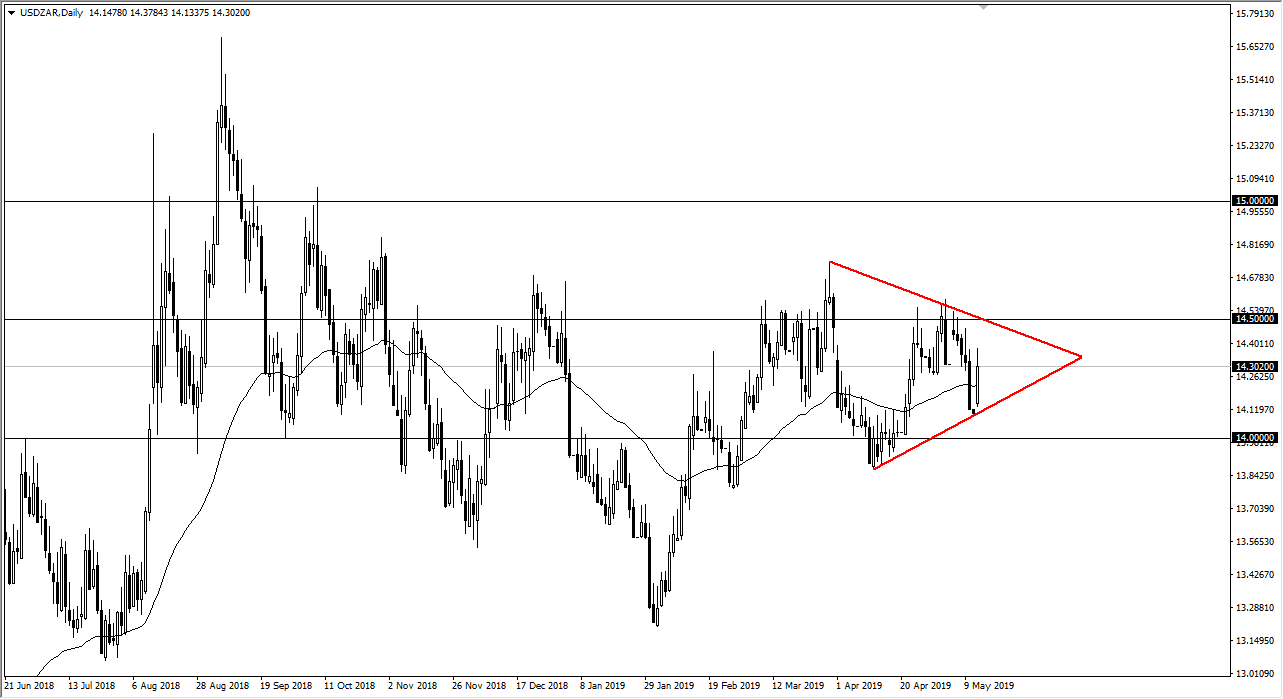

As you can see on the chart, I have a symmetrical triangle drone, and that should serve as a bit of a measuring stick as to what we should be doing. As this triangle is symmetrical and not ascending or descending, it suggests that we are going to get a move but nobody really knows which direction. This shows the tenuous situation that we find ourselves in, as the US/China trade war rages on. Beyond that, we have a lot of global growth concerned, so in situation like we find ourselves in right now, it’s a lot to ask for investors to start putting money into places like South Africa when they can simply by US treasuries.

If we do break down below the bottom of the symmetrical triangle, then I believe we will go looking towards the 13.50 Rand level, just as if we can break above the top of the symmetrical triangle, my target at that point would be the 15 Rand level. In the meantime, one would have to assume that we go back and forth so if you are more of a short-term minded trader you could use the triangle as your area to trade back and forth then, but being an exotic currency makes out a bit more difficult than with something along the lines of the USD/CHF, USD/JPY, or other major pair.