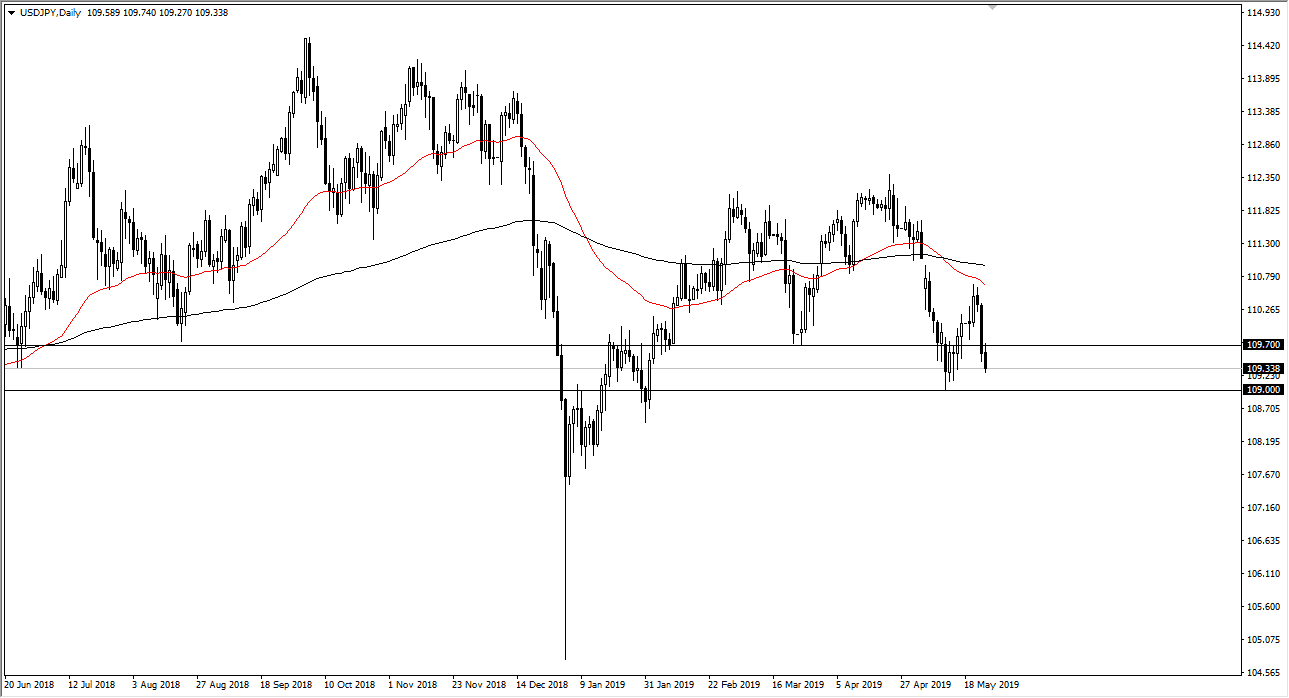

USD/JPY

The US dollar initially tried to rally during the trading session on Friday, but then fell towards the ¥109.30 level before it was all said and done. This is a market that is sensitive to risk appetite, and of course there’s a lot of that concern around the world to continue to push money into the Japanese yen. If we break down below the ¥109 level, the market could go down to the ¥108 level.

Alternately, if we turn around and break above the top of the candle stick for Friday, then I think we will go higher to go looking towards the gap at the ¥111.15 level. A lot of back and forth trading is more likely than not, but if we get a sudden mount down in the stock markets, that will probably send this pair much lower as people head back into the yen for safety.

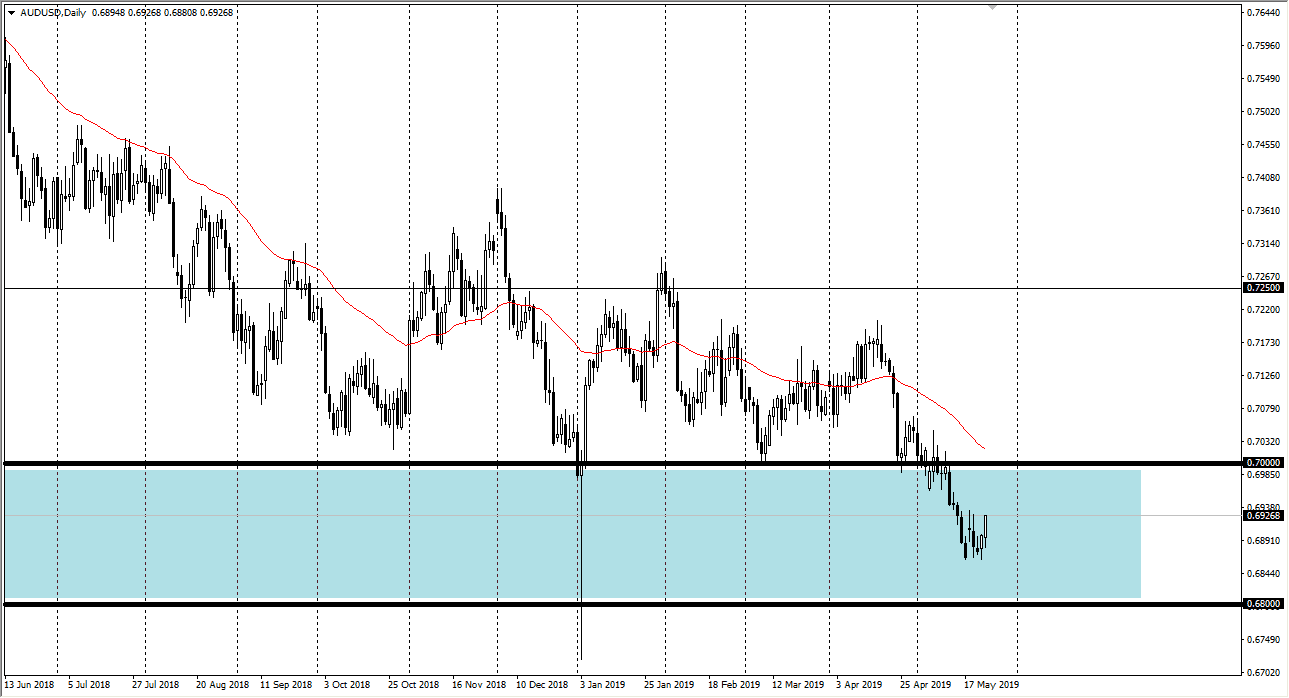

AUD/USD

The Australian dollar has shown signs of life during the trading session on Friday, perhaps in a bid to take risk off for the weekend. We are still in the middle of the larger consolidation area that is roughly 200 pips wide, so I wouldn’t put too much into it quite yet. However, this is a good sign and it does appear that the Australian dollar is getting a bit of a relief rally. I’m not sure if it’s short covering heading into the weekend for fear of some type of positive US/China trade news, and of course the fact that Memorial Day in America is Monday. With that, I think that this is still a market that you’ve got to stay away from until we get out of the blue box that I have drawn on the chart. If we get below the 0.68 handle, it could send the market down to the 0.65 level, just as a break above the 0.70 level could send the market towards the 0.70 level.