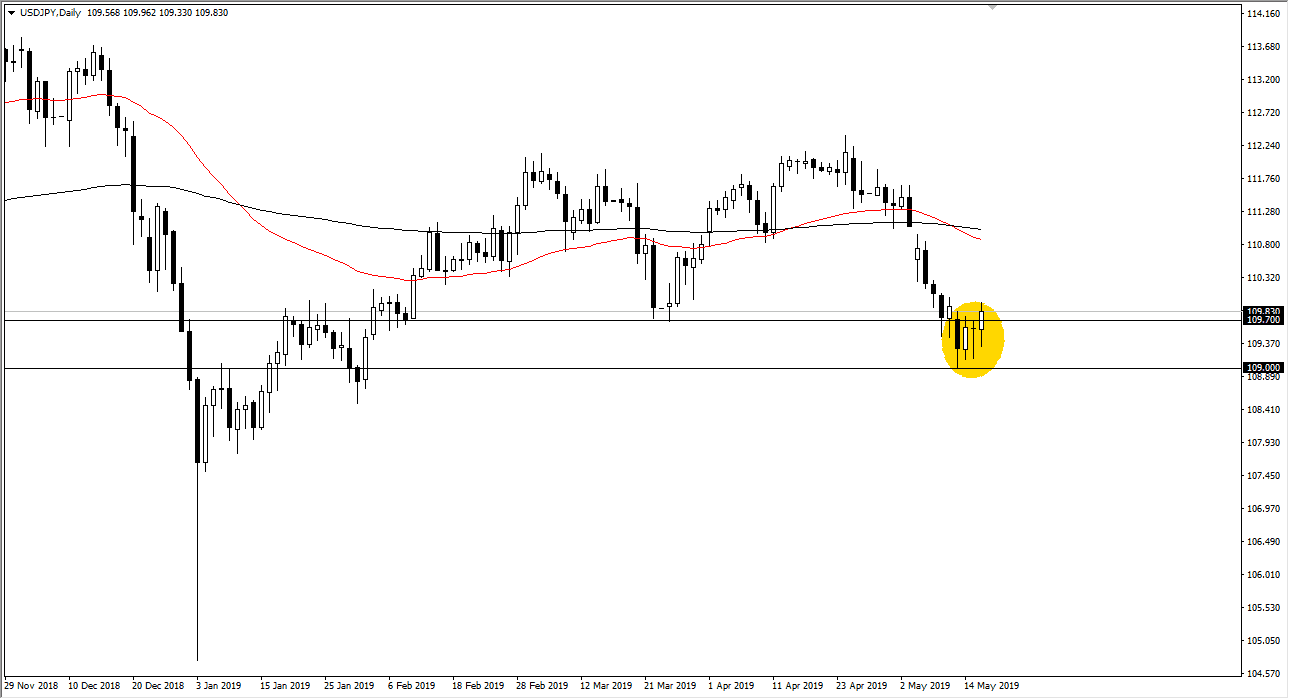

USD/JPY

The US dollar has initially fallen during trading on Thursday but found enough support underneath the turn things around and form a bit of a hammer. In fact, we even tested the ¥110 level at one point during the day. The fact that we continue to form higher lows tells me that there is a lot of interest in this market, and therefore we could see a bit of a pop. This makes complete sense, considering that we had yet to fill the gap above which is near the ¥111 level. My best case scenario is that we do in fact rally from here, especially if the stock markets continue to behave with strength. Remember, this is a market that is highly sensitive to risk appetite, so the S&P 500 is an excellent proxy as to where we could go. If we do see a major risk off scenario, we could see this market break below the ¥109 level, which could open up the door to ¥108 below.

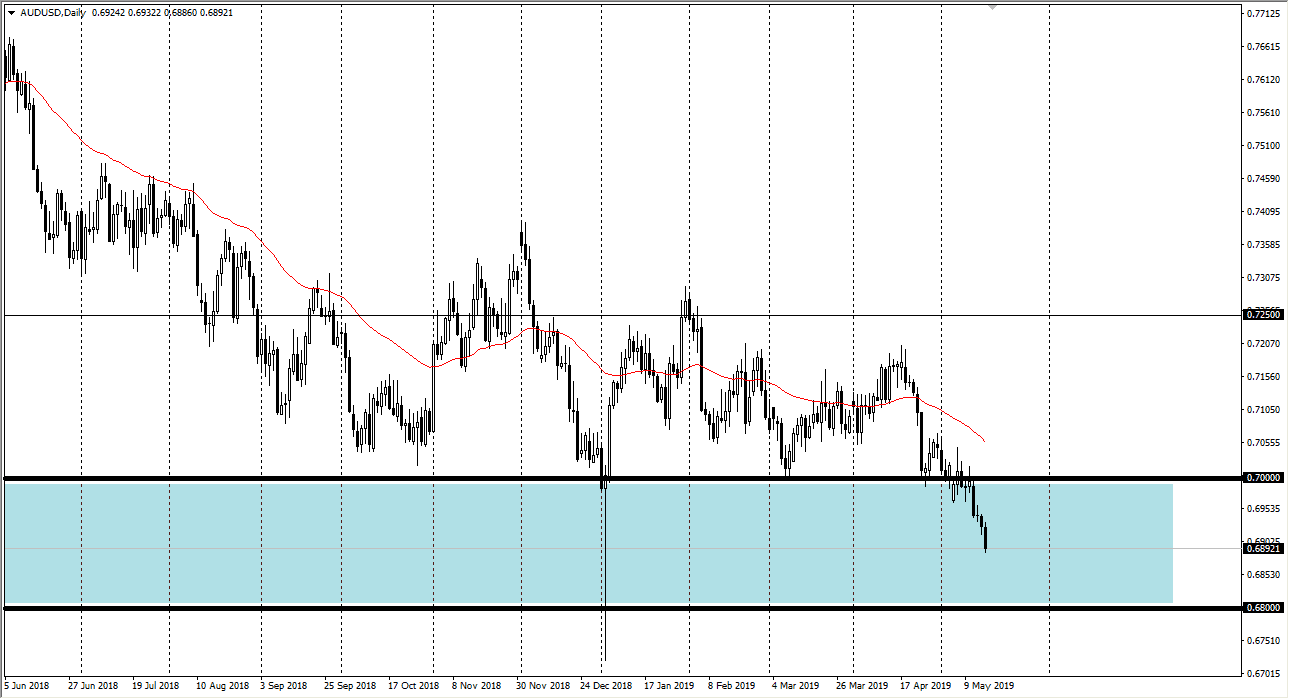

AUD/USD

The Australian dollar continues to show weakness, and I think at this point we could very well end up down at the 0.68 handle. That’s an area that is the bottom of the larger support range, extending 200 pips up to the 0.70 level. This is a major area on longer-term charts and should not be diminished. At this point, if we can stay above the 0.68 level there’s chance that the Australian dollar will rally. That being said, keep in mind that this pair is going to be extraordinarily sensitive to the US/China trade war, which of course doesn’t seem to be getting any better. Beyond that, we need to pay attention to overall risk appetite, as it will probably rise and fall right along with that as well. Until we break below the 0.68 level though, I’m not interested in selling.