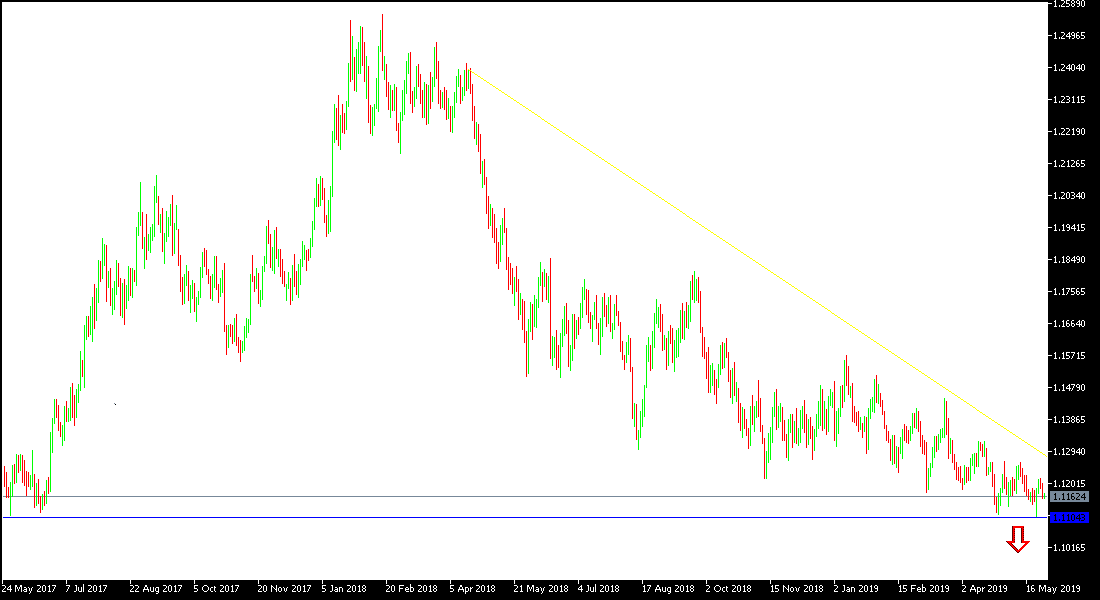

The US Dollar is still the strongest and strong US economy is still supporting US consumer confidence. The euro is still suffering and therefore the EUR/USD's bearish trend remains the most notable, especially with testing of the support level at 1.1106, the lowest level for two years, last week and stabilizing around 1.1165 at the time of writing. Pressure on the euro has increased after a pessimistic view of the European Union (EU) elections’ results, where anti-EU parties have won more seats than expected.

The results of the economic data still confirm the extent of suffering to the Eurozone economy led by Germany from continuing global trade wars. The minutes of the last Federal Reserve meeting showed the desire of some bank members to raise the US interest rate, which supported more gains for the US dollar and contributed to the continuation of the downward pressure.

The bearish stability supports investors' question of the most appropriate timing for buying: this will depend on the return of confidence in the Euro and optimism about the imminent resolution of the US-China trade dispute, which increases the pressure on the Eurozone economy that depends on manufacturing and exports. Technical indicators are still confirming oversold areas and the pair is ready for a bullish correction.

The US dollar increased gains as it became more attractive to investors as a safe haven after Trump's latest threat to impose more tariffs on Chinese products worth 200 billion. China has responded by imposing tariffs on $60 billion of US imports. The Euro did not benefit from the high inflation in the Eurozone, as the factors for the rise are still temporary. The dollar gained stronger momentum with positive US job numbers, adding jobs more than expectations and a drop in unemployment to a 49-year low.

The Federal Reserve Board kept the interest rate unchanged as expected, pointing out that it is unlikely to raise or lower interest rates in the coming months amid signs of renewed economic health while at the same time inflation is still unusually low.

As we mentioned earlier, we now emphasize that the divergence of the economic situation and the monetary policy between the US and the Eurozone will remain a strong influence on any chances for the pair to achieve upward correction.

Technically: We had expected and recommended in the previous analysis for a long time to sell the pair from every ascending level. The EUR/USD is now bearish and the nearest support levels for the pair are currently 1.1165, 1.1050 and 1.0975, respectively. On the upside side, the German-led Eurozone's negative economy weakened the correction opportunity further. The pair's current resistance levels are 1.1220, 1.1300 and 1.1380, respectively.

On the economic data front: There are no important data expected today from the Eurozone or from the US.