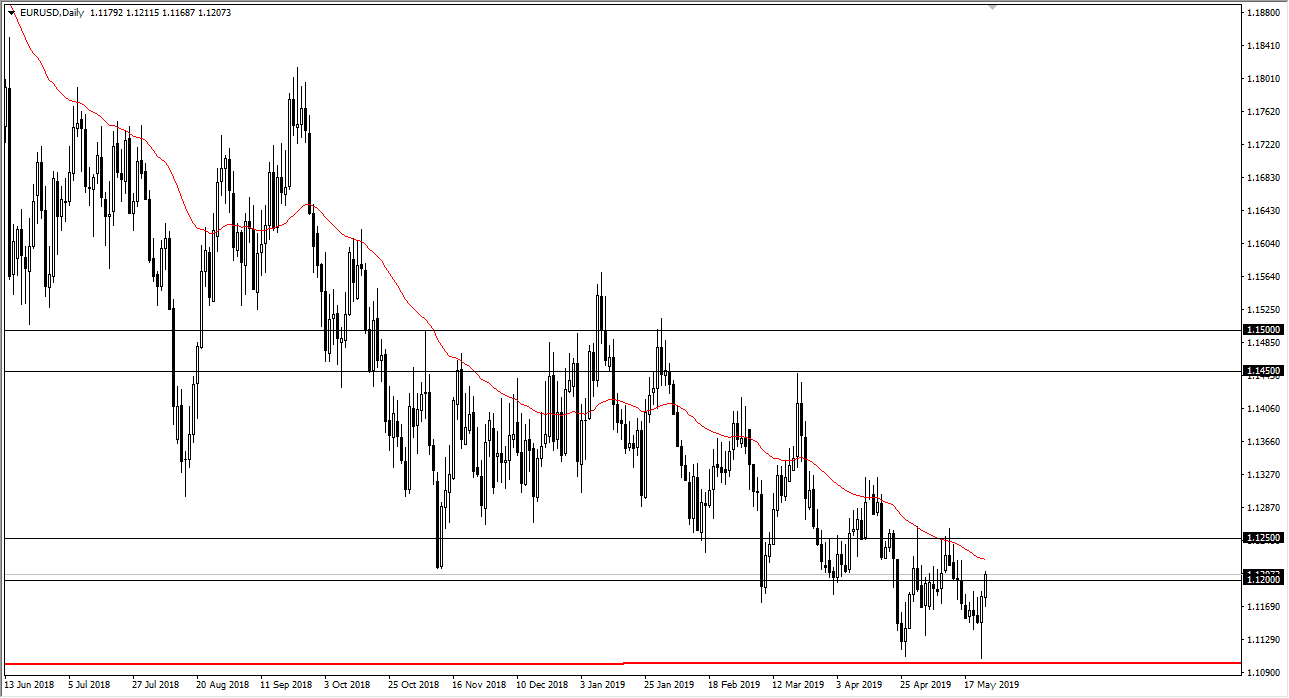

EUR/USD

The Euro rallied a bit during the trading session on Friday, breaking above the 1.12 handle. By doing so, it does suggest that we could go higher but we are on the precipice of dealing with a major resistance barrier extending all the way to the 1.1250 level. Signs of exhaustion could get the sellers back involved, but if we were to break above that level, we could go much higher, reaching towards the 1.1450 level.

Alternately, if we turn around and fall below the 1.12 level, then we will probably start drifting down to the 1.1150 level, possibly even the 1.11 level after that. For what it’s worth, the weekly candle stick is a hammer so that of course is a bullish sign and it looks as if we are at least starting to attempt to build some type of bottoming this market. Lots of back and forth trading continues to be the mainstay of this market, which is typical in what I believe is the choppy list major pair you can be trading.

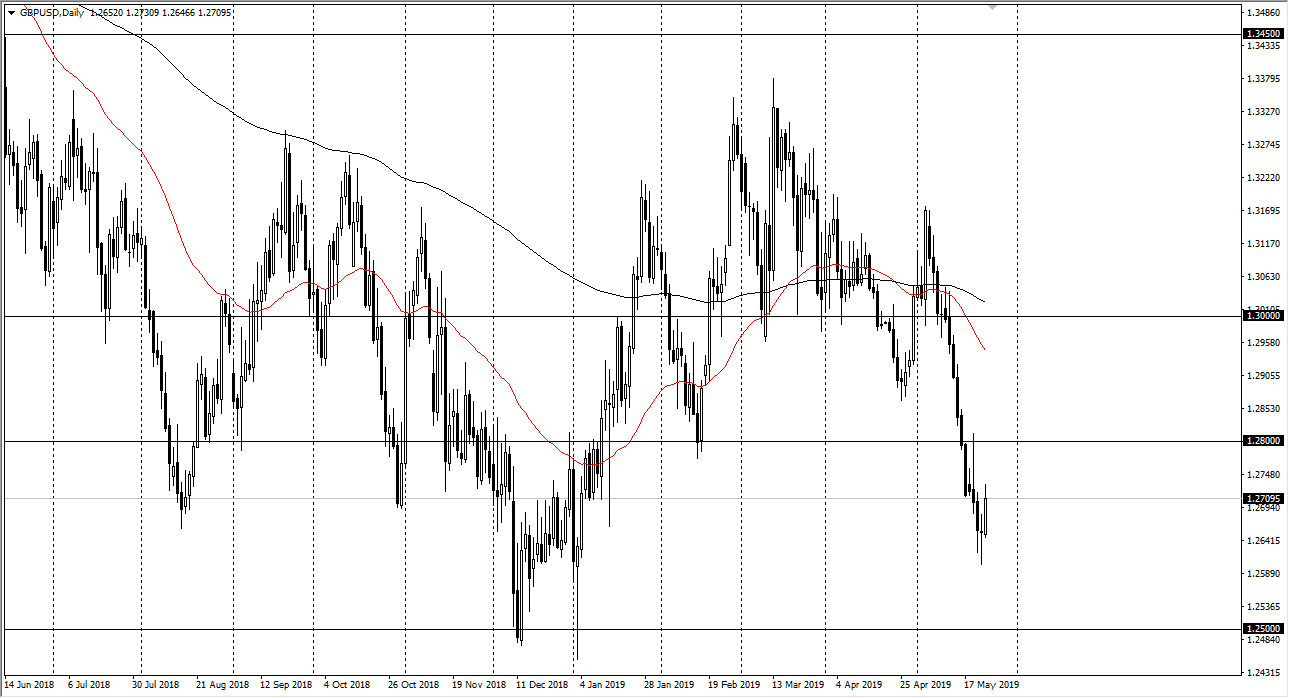

GBP/USD

The British pound rallied a bit during the trading session on Friday, breaking above the top of the hammer that formed on Thursday. This is a standard buying signal, but I think part of this was probably more to do with short covering heading into the weekend. After all, there aren’t that many people left to short the British pound so it’s very likely that the bounce should be coming. However, there’s even more support at the 1.25 level and I suspect that it’s only a matter of time before we test that major area. To the upside, we have the 1.28 level, and a break above there sends this market towards 1.30 level.

Looking at this chart, I believe that we will bounce around between the 1.28 and the 1.26 level in the short term, trying to find some type of equilibrium. Expect erratic trading, but I would necessarily be getting long of this market right here, at least not for more than a short-term trade.