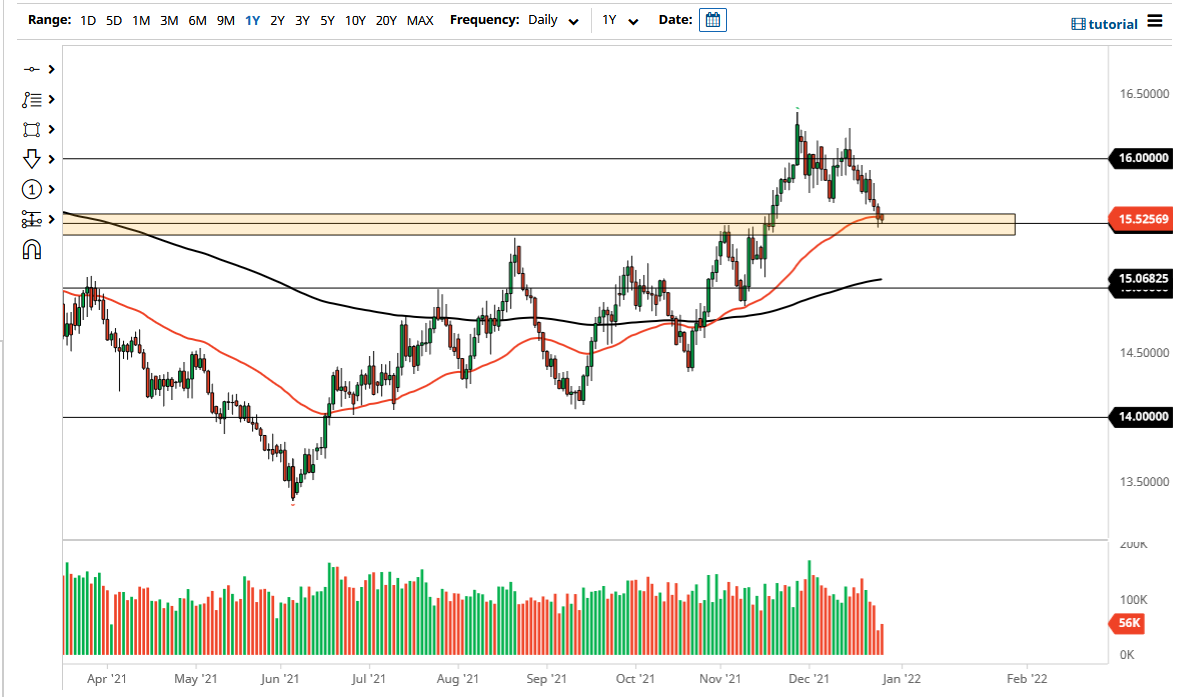

The US dollar fell during trading on Friday after the jobs number came out, as there was more of a “risk on” attitude initially. This of course have its influence in the South African Rand, as we reach down towards the vital 14 handle. This is not only a large, round, psychologically significant figure, but it is also an area that features the 200 day EMA. That obviously will attract a lot of attention, so longer-term traders have gotten quite interested as of late.

The fact that we ended up forming a hammer at the end of the day also suggests that we are going to bounce from here, which of course makes quite a bit of sense as we have been bouncing around between the 14 and the 14.50 Rand levels. There is a gap above that hasn’t been filled yet, closer to the 14.50 Rand level, so it makes sense that we are going to continue to see quite a bit of consolidation, as the area is the scene of recent trading.

If we do break down below the 14 Rand level, and by extension the 200 day EMA, then I think the market probably goes to the 13.80 Rand level, and then eventually the 13.50 Rand level. That being said, we have made a series of “higher highs” in the US dollar against the South African Rand, and of course there are a lot of political concerns when it comes to South Africa right now so I do believe that the market will continue to find buyers on these dips as it offers value in what has been a nice trend over the last several months. However, if we get a sudden rush to risk appetite, that could be the catalyst for this market to continue falling.