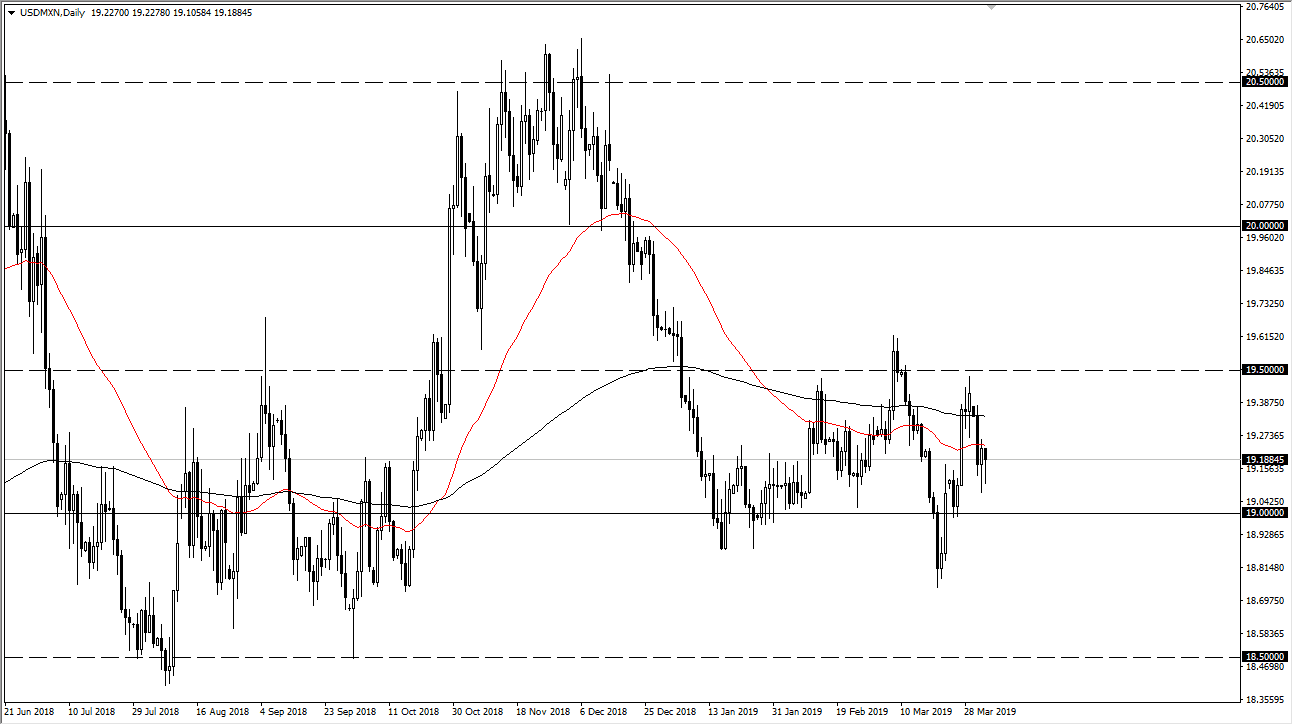

The US dollar initially fell against the Mexican peso during trading on Wednesday, but just as we had seen during the Tuesday session, the buyers came back in to push higher and form a hammer. Now that we have a couple of hammers on the daily chart, it makes sense that perhaps we get a bit of a bounce. The US dollar has of course strengthened against most currencies, but with the Mexican peso it’s been a lot less clear than it had been against some of the other currencies.

All things being equal, it’s likely that we will bounce above the 50 day EMA, pictured in red on the chart, and reach towards the black 200 day EMA. Once we clear that area, we probably go looking towards the 19.50 pesos level which has been resistance more than once. That won’t necessarily be the quickest move, but it certainly looks as if the buyers are being very tenacious at this point.

Just below, there is a significant amount of support at the 19 pesos level, as we can’t even reach down to that area. I believe that buying dips will continue to work, but obviously we are in a relatively tough consolidation phase between the 19 peso and the 19.50 pesos level. Expect a lot of volatility, but at this point I don’t see a break out as something that’s necessarily a minute. That being said, when we do wind up acting like this, it quite frequently will be a precursor to a larger move. With that in the back of our minds, we can trade this pair recognizing that the most recent high being broken, somewhere near the 19.65 pesos level, we could see this market reach towards the 20 pesos handle. To the downside, if we break down below the recent low at roughly 18.70 pesos, then it opens the door to 18.50 pesos and perhaps even the 18 pesos level based upon longer-term charts.